FxNews—The NZD/USD trades bearishly. In today’s trading session, it tested the August 5 low ($0.585). As of this writing, the currency pair bounced off the support, trading at approximately $0.587.

This strength in the U.S. dollar is due to “Trump trades,” where investors act on expected policies from President-elect Trump’s future administration. After Trump’s election victory, many anticipated that his administration might introduce tariffs and other measures that could increase inflation. This possibility makes it tougher for the U.S. Federal Reserve to lower interest rates.

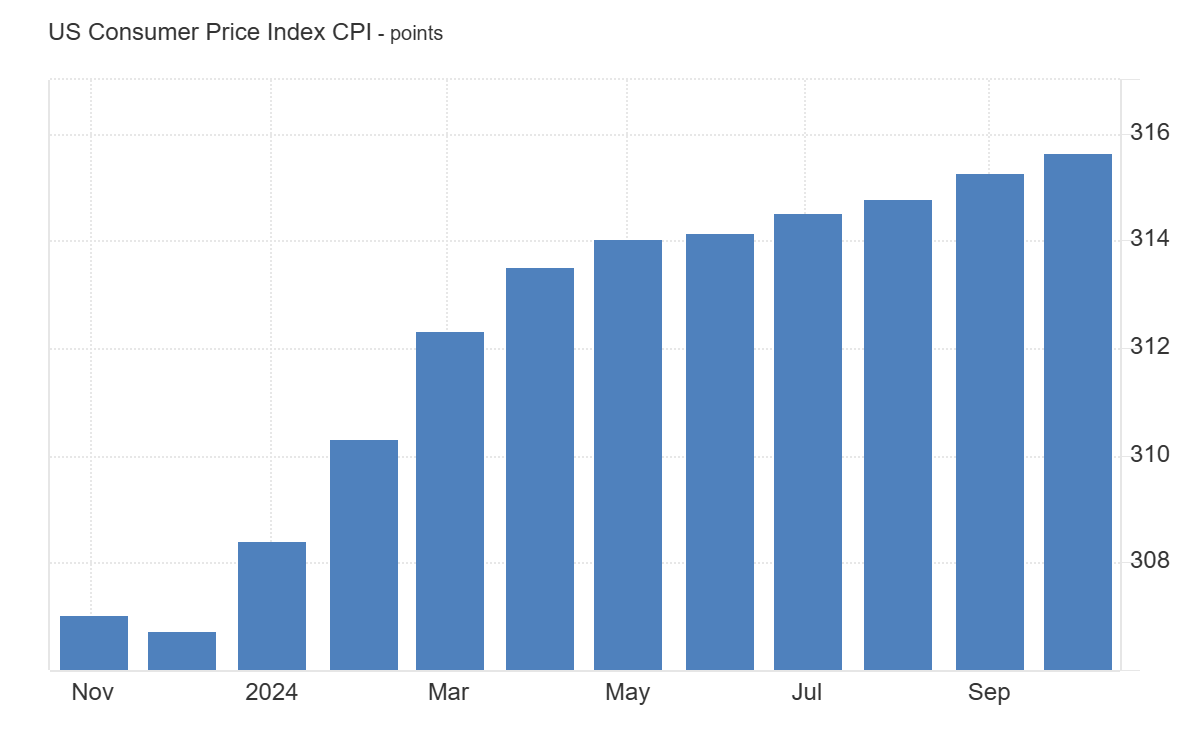

Fed Rate Cut Still Possible as U.S. Inflation Climbs

However, data released on Wednesday showed that U.S. consumer inflation rose as expected, which keeps the chance of a Fed rate cut alive.

Meanwhile, in New Zealand, food prices dropped by 0.9% in October compared to the previous month. This decrease supports the Reserve Bank of New Zealand’s belief that inflation is under control. The central bank is set to meet later this month and is expected to announce a 50 basis point cut in interest rates.

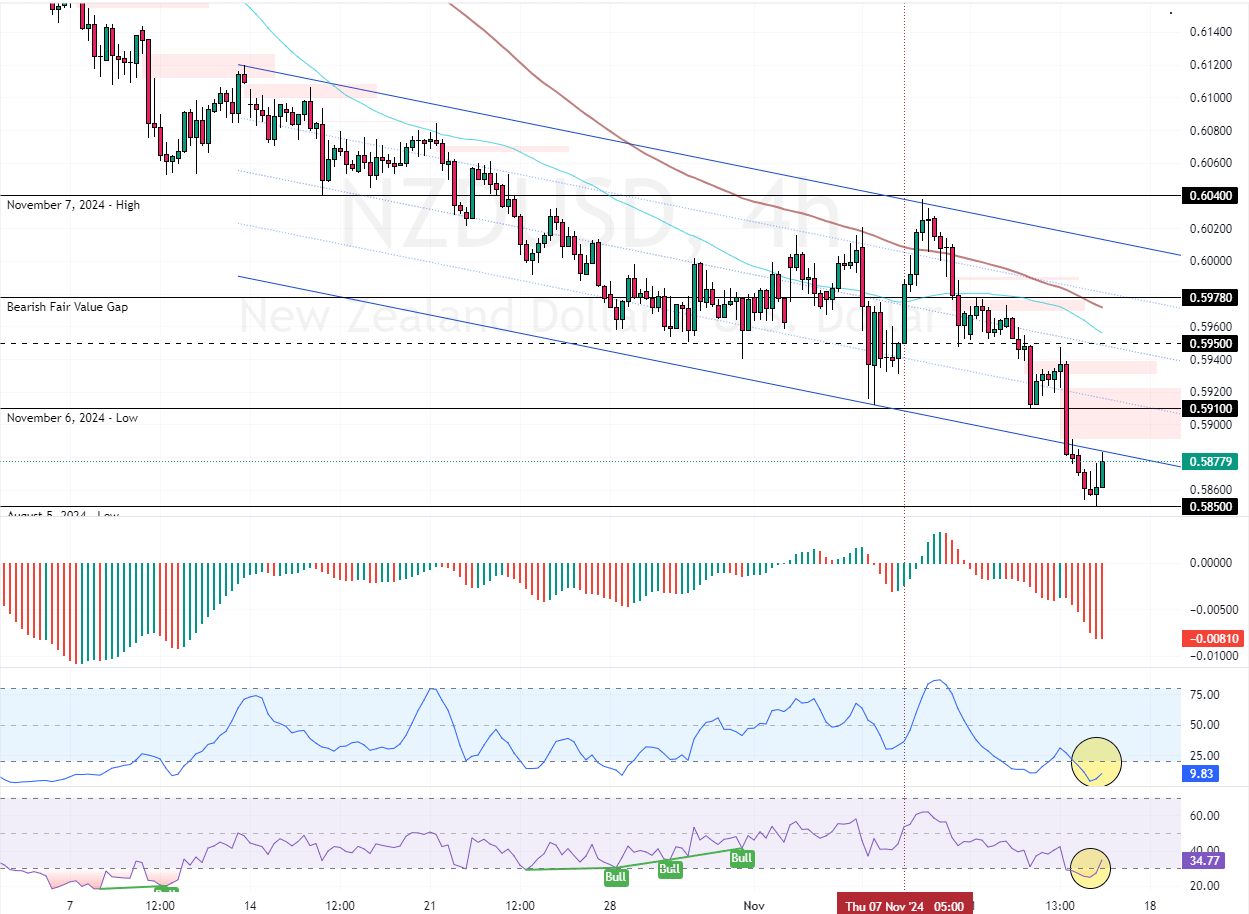

NZDUSD Technical Analysis – 14-November-2024

The NZD/USD primary trend is bearish because the prices are below the 50- and 100-period simple moving averages. However, the robust selling pressure pushed the Stochastic Oscillator into oversold territory, recording 9 in the description. This indicates that the U.S. dollar is overpriced against the Kiwi.

Interestingly, the sellers have tested the broken descending trendline as support ($0.585). From a technical perspective, we expect the NZD/USD pair to consolidate near the upper resistance areas starting with the November 6 low at $0.591, backed by the bearish fair value gap.

In this scenario, traders and investors should closely monitor $0.591 for bearish signals, such as candlestick patterns. Becuse this level can provide a decent bid to join the bear market.

On the other hand, the bearish outlook should be paused if NZD/USD exceeds $0.591. If this scenario unfolds, the consolidation phase can potentially extend to $0.595, a robust resistance backed by the 100-SMA.