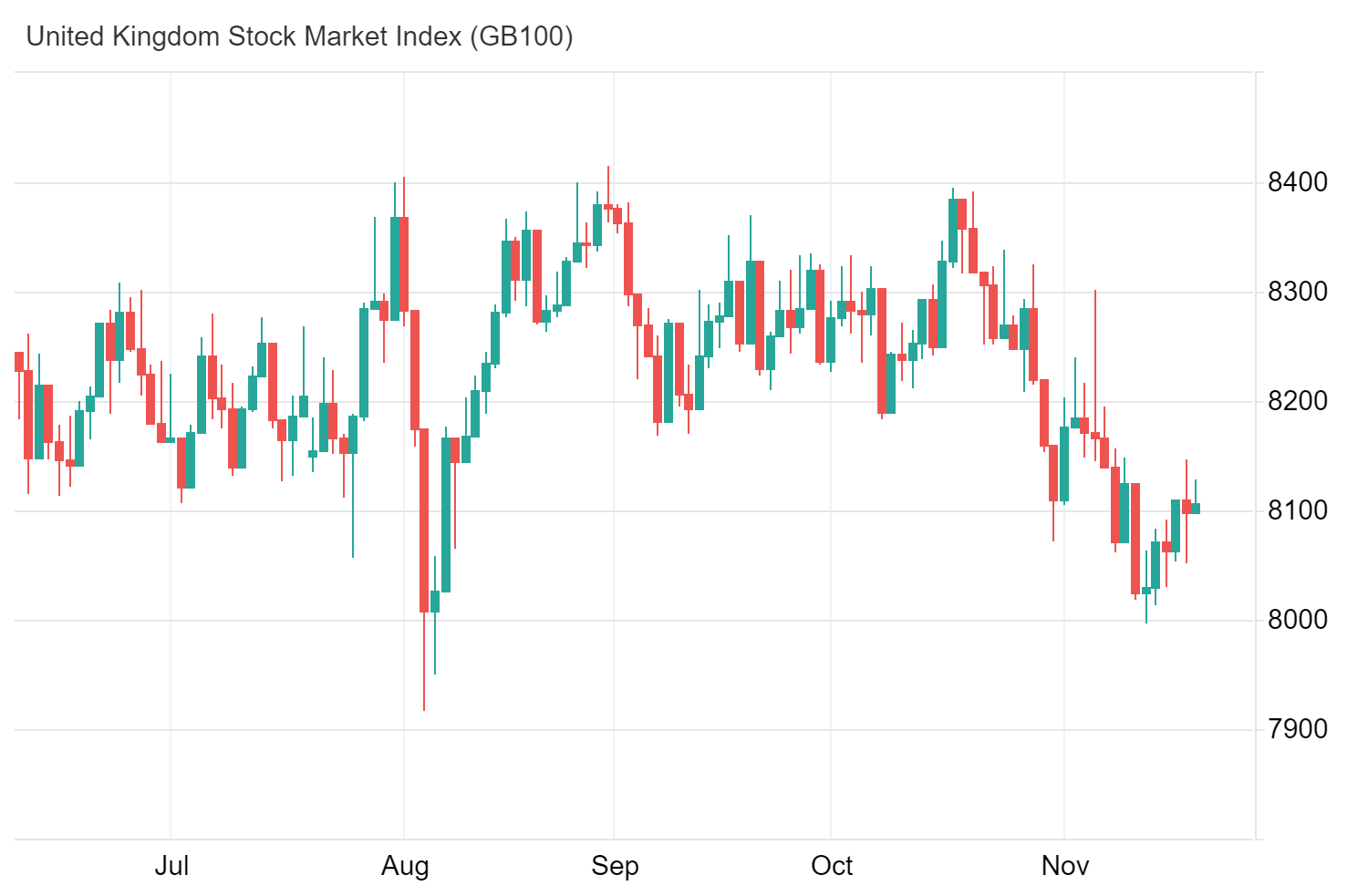

The FTSE 100 index bounced back, trading above 8,100 points. This recovery mirrored gains in other European markets as worries about a potential escalation in the Russia-Ukraine conflict eased. Traders were also looking ahead to Nvidia’s upcoming quarterly earnings report.

Sage Group Shares Soar 16% on Stellar Annual Results

In the stock market, Sage Group’s shares surged over 16%. This jump came after the company announced strong annual results and introduced a new share buyback program. Severn Trent’s shares rose nearly 3% as the company reported a significant improvement in interim profits. However, it acknowledged that it would miss some water-safety performance targets this fiscal year.

Conversely, Vistry Group led the losses with a 3.3% drop in its share price. British Land Company followed, declining by 2.2% after revealing that its portfolio value remained mostly unchanged in the year’s first half.

In economic news, UK inflation climbed to 2.3% year-on-year in October. This rate was higher than the expected 2.2% and showed a notable increase from September’s 1.7%.

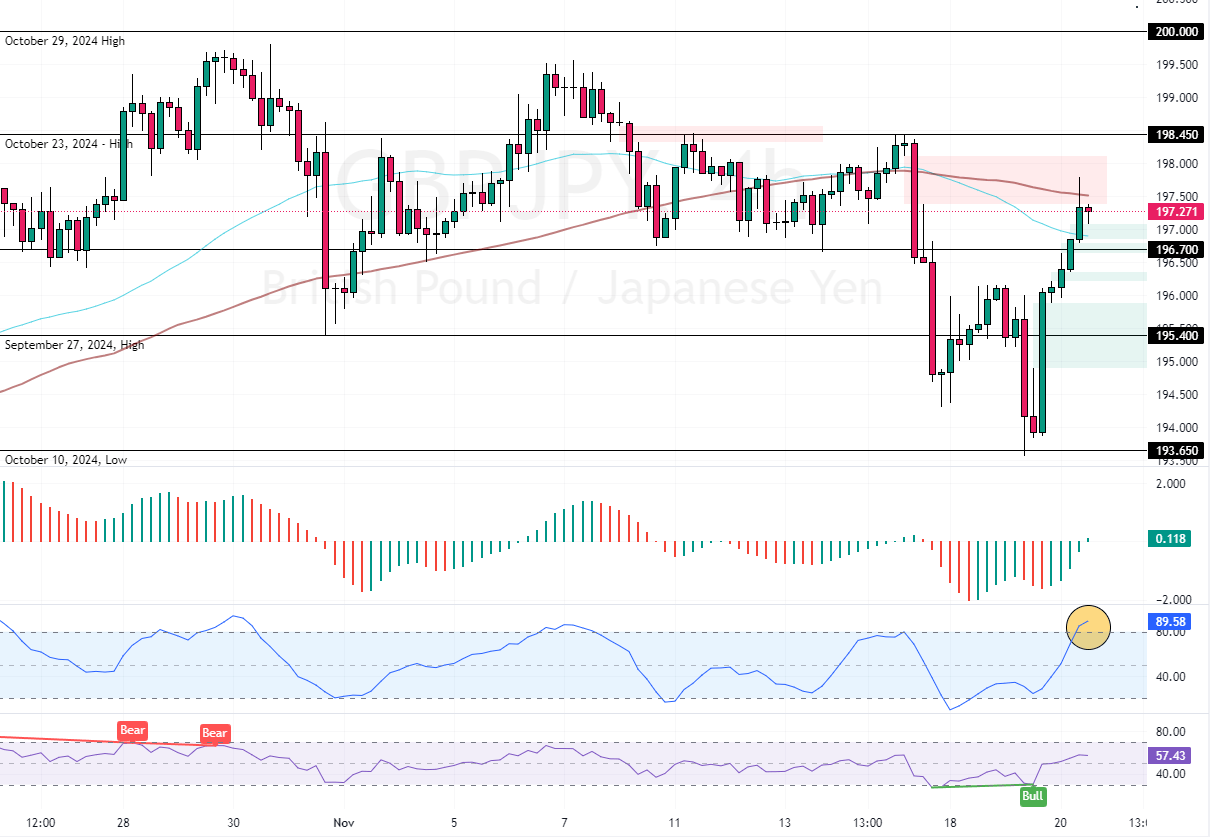

GBPJPY Technical Analysis

As of this writing, the GBP/JPY pair trades at approximately 197.2, while Stochastic records show 89, meaning the British pound is overpriced against the Japanese Yen. Furthermore, the currency pair is facing the 100-period simple moving average as resistance, backed by the bearish fair value gap formed on November 15.

GBPJPY Price Forecast

From a technical perspective, the outlook for the GBP/JPY currency pair remains bearish as long as the prices are below the October 23 low at 198.4. That said, the bear market will likely be triggered again if sellers push the prices below the immediate support (196.7).

If this scenario unfolds, the next bearish target could be revisiting the September 27 low at 195.4.

Bullish Scenario

Please note that the downtrend strategy should be invalidated if GBP/JPY bulls pull the prices above the immediate resistance (198.45).

GBPJPY Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 196.7 / 195.4

- Resistance: 198.45 / 200.0