FxNews—Gasoline prices in the US have climbed back over $2.00 per gallon due to worries about potential supply disruptions. This concern has grown as tensions increase between Israel and Iran. The fear is that the conflict could expand regionally and affect oil and fuel availability.

Israel-Hezbollah Conflict Shakes Global Oil Prices

Recent fights, such as Israel’s actions against Hezbollah and its promises of retaliation against Iran, are causing price fluctuations.

Moreover, economic initiatives from China, like reductions in borrowing rates, are affecting global demand. In the US, a drop of 2.2 million barrels in gasoline inventories for the week ending October 11 is pushing prices higher due to reduced supply within the country.

Gasoline Analysis – 23-October-2024

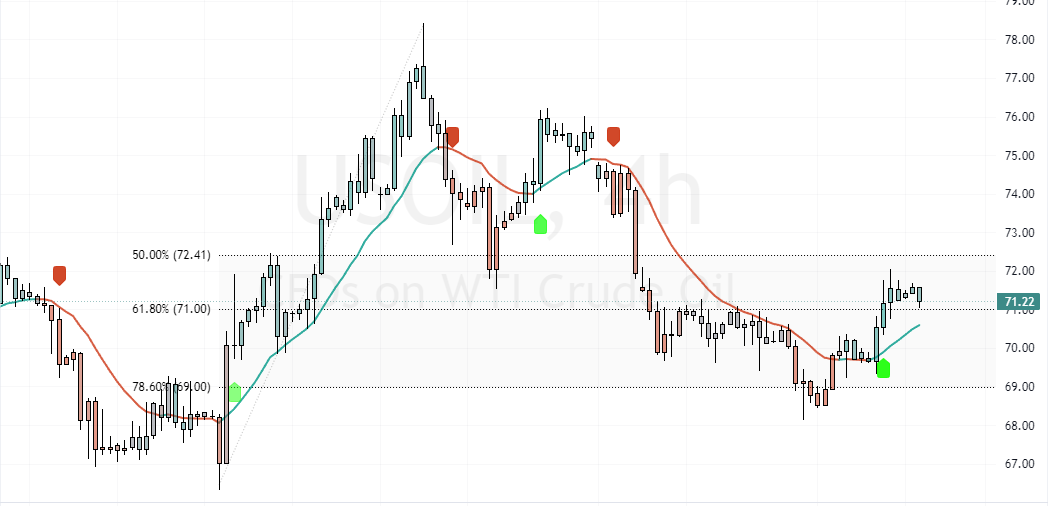

In today’s trading session, gasoline flipped below the October 17 high, the $2.04 resistance level. As of this writing, Gasoline trades at approximately $2.030, while the Awesome Oscillator histogram is green and above the signal line, which interprets that the bull market should prevail.

On the other hand, the Relative Strength Index Indicator (RSI 14) is above the median line but declining.

Overall, the technical indicators give mixed signals, but the market is mildly bullish.

Gasoline Price Forecast – 23-October-2024

From a technical perspective, if Bulls (buyers) close and cross above the $2.04 critical resistance, the uptick momentum from $1.96 will likely extend to $2.066, the October 6 low.

If the Gasoline price fails to break above the $2.04 resistance, it could revisit the October 17 low of $1.99.