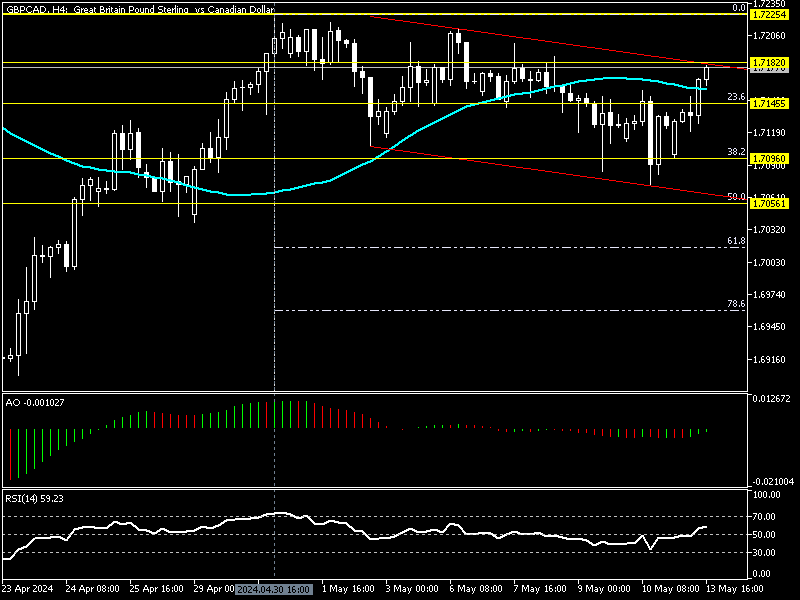

The Pound Sterling resumed its bullish momentum from 1.70 against the Canadian currency. The uptick in velocity escalated in today’s trading session after the bears failed to close the price below the %38.2 Fibonacci retracement level (1.709) on Friday.

As of writing, the GBPCAD pair trades at about 1.71, approaching the descending trendline, shown in blue in the daily chart below.

GBPCAD Technical Analysis

We zoomed into the 4-hour chart to dissect the technical indicators, trend direction, and price action on the GBPCHF currency pair. Analyzing the market in a lower time frame is essential for forecasting the next price move and marking potential entry and exit points in trading.

The technical indicators in the 4-hour chart support the current uptrend. The awesome oscillator bars green, approaching the signal line, and RSI hovers above the median line. Notably, the relative strength index value is 58, meaning there is room for the indicator to become oversold.

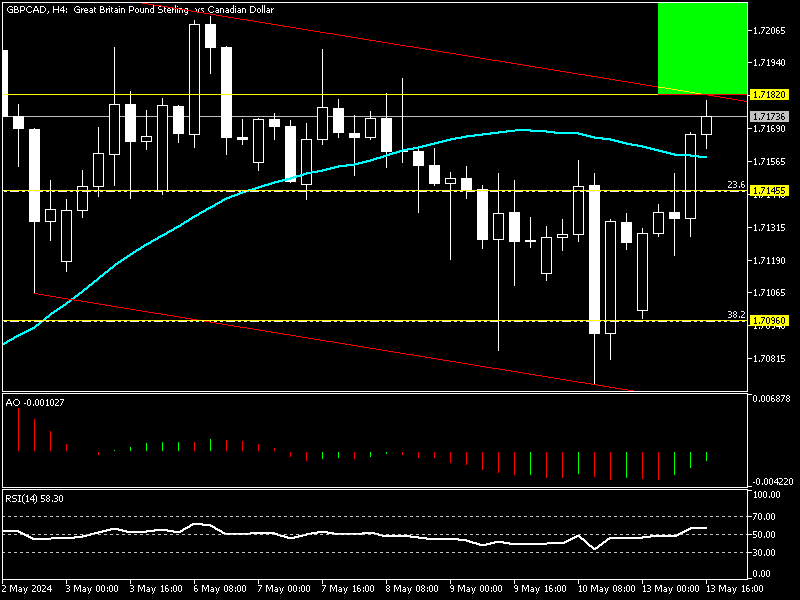

GBPCAD Forecast – Bull Market Opportunity Ahead

Analysts at FxNews are optimistic that the uptrend will break the descending trendline in red. From a technical standpoint, a firm cross above the trendline can provide a short-term opportunity to join the bull market, with 1.722 as the initial target.

The support level for the bullish scenario is the %23.6 Fibonacci retracement level (1.714). If the price is above 1.714, the bullish forecast stands correct. We suggest traders and investors closely monitor the 1.718 resistance for a breakout.

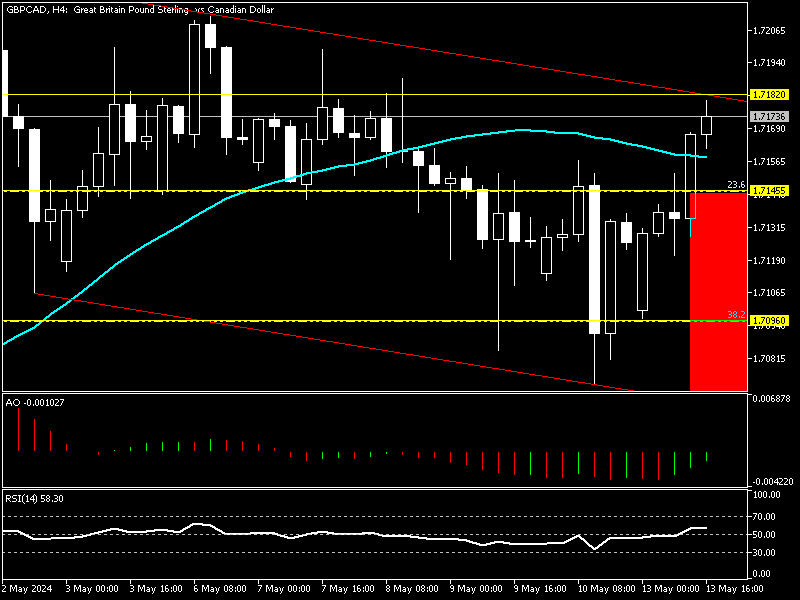

GBPCAD Bearish Scenario

Conversely, if the Pound sterling value becomes cheaper than 1.714 against the Canadian Dollar, the downtrend started on April 30 from 1.722 will likely retest %38.2 Fibonacci followed by the lower band of the bearish flag, the 1.705 mark.