FxNews—The interest rate on the UK’s 10-year government bonds decreased to below 4.10%, marking the lowest point in two weeks. This decline came after inflation figures were lower than anticipated, suggesting that the Bank of England might reduce interest rates further.

UK Inflation Falls to 1.7%, Below BoE’s Target

In September, the UK’s inflation rate fell to 1.7%, a decrease from August’s 2.2%, and was under the expected 1.9%. This is the first time inflation has dropped below the Bank of England’s target of 2% in over three years.

With the recent reduction in inflation and a slowdown in wage increases, Andrew Bailey, the Governor of the Bank of England, hinted at the possibility of more significant interest rate cuts soon. These developments suggest a rate reduction in early November and possibly another cut in December.

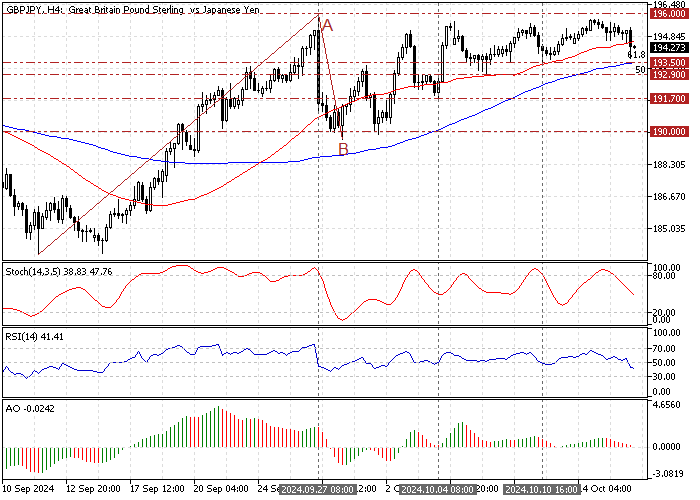

GBPJPY Technical Analysis – 16-October-2024

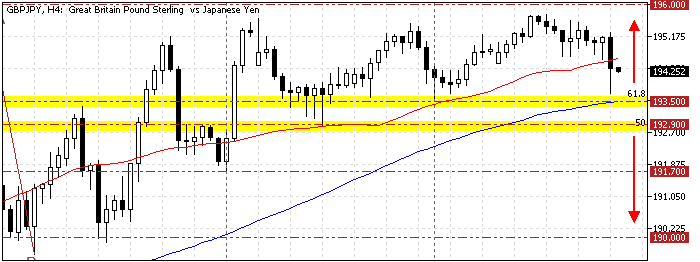

The GBP/JPY currency pair trades in a bull market above the 100-period simple moving average, testing the 61.8% Fibonacci retracement level of the AB leg at 193.5, backed by the 100-period SMA.

As for the technical indicators, the Stochastic Oscillator dips from overbought territory, recording 40 in the description. This indicates that the bear market is gaining momentum.

- The RSI 14 backs the Stochastic Oscillator. The indicator flipped below the median line, showing bearish momentum increases.

- Additionally, the Awesome Oscillator histogram is red and about to shift below the signal line, indicating that the current downtrend could resume.

Overall, the technical indicators suggest the primary trend is bullish. Still, GBP/JPY bears have the potential to make the market bearish.

GBPJPY Forecast – 16-October-2024

The immediate support is at 193.5 (October 10 Low). If the GBP/JPY price falls below 193.5, the bearish momentum from 196.0 will likely extend to the October 4 low at 191.7.

Furthermore, if selling pressure pushes the price below 191.7, the next bearish target could be the September 27 low at 190.0.

GBPJPY Bullish Scenario

As mentioned earlier in today’s technical analysis, immediate support is at 193.50. If this holds, the uptick momentum from 190.0 will likely extend. If this scenario unfolds, GBP/JPY will likely revisit the September 2024 high at 196.0.

GBPJPY Support and Resistance Levels – 16-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 193.5 / 192.9 / 191.7 / 190.0

- Resistance: 196.0