GBPJPY consolidates at 192.2, having gained 1.2% since January 13. If the immediate support at 191.8 holds, the uptick in momentum could extend to 193.5, followed by 195.3.

GBPJPY Technical Analysis – 14-January-2025

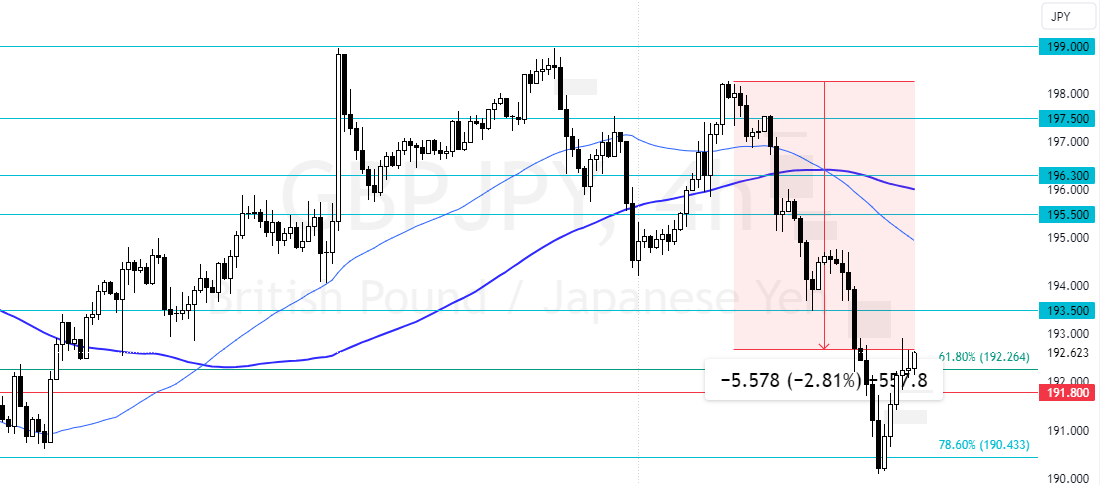

FxNews—The British Pound has been in a downtrend market against the Japanese Yen, below the 50- and 100-period simple moving average, and has lost 2.9% of its value since January 7. However, the selling pressure eased at the 78.6% Fibonacci retracement level at 190.4.

As of this writing, the currency pair trades at approximately 192.4, stabilizing above the 61.8% Fibonacci retracement level.

What Do Technical Indicators Reveal?

- The RSI 14 value is 43.0 and rising, meaning the bull market is strengthening.

- The Stochastic Oscillator value is 44.0 and growing, supporting the RSI’s signal.

- The Awesome Oscillator histogram is green, below zero, interpreted as the bear market weakens.

Overall, the technical indicators suggest that while the primary trend is Bearish, GBP/JPY and has the potential to rise toward upper resistance levels.

GBPJPY consolidates at 192.2: The Forecast

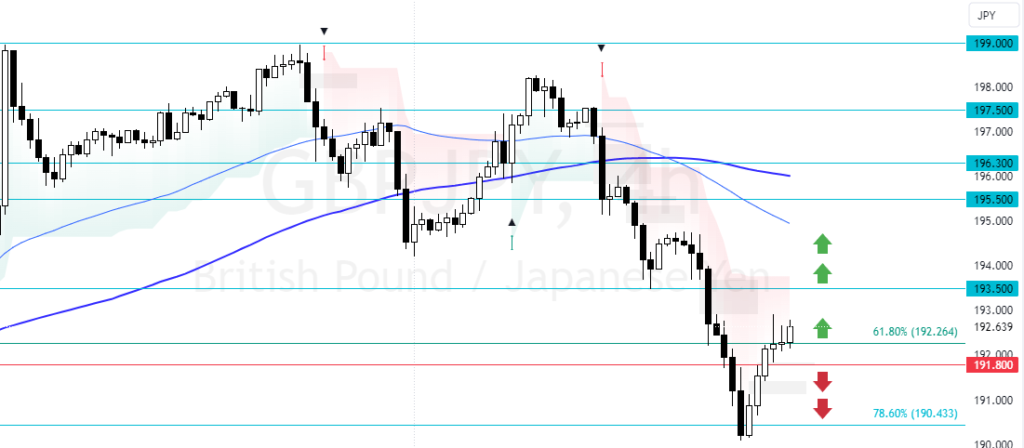

The immediate support is at 191.8. From a technical perspective, the bullish wave from 190.4 could extend to higher resistance levels if the prices hold above 191.8. In this scenario, the next bullish target could be the 193.5.

Furthermore, if the buying pressure exceeds 193.5, the bulls’ path to the 195.5 mark could be paved. Please note that the bullish outlook should be invalidated if GBP/JPY falls below 191.8.

The Scenario

The immediate support is at 191.8. From a technical standpoint, the downtrend will likely resume if the value of GBP/JPY declines and stabilizes below 191.8. If this scenario unfolds, bears could revisit the 78.6% Fibonacci support area at 190.4.

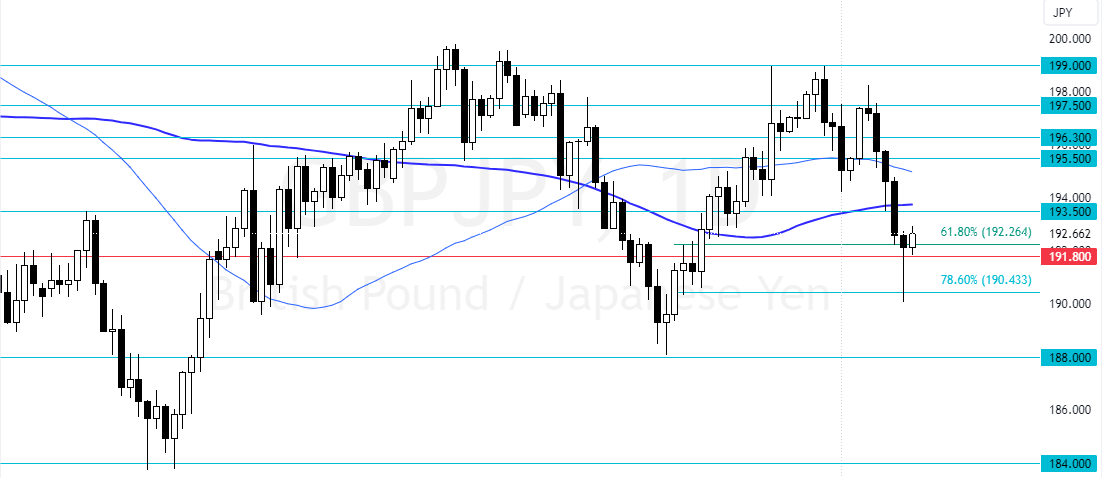

GBPJPY Support and Resistance Levels – 14-January-2025

Traders and investors should closely monitor the GBP/JPY key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

| Support | 191.8 | 190.4 | 188.0 |

| Resistance | 193.5 | 195.5 | 197.5 |