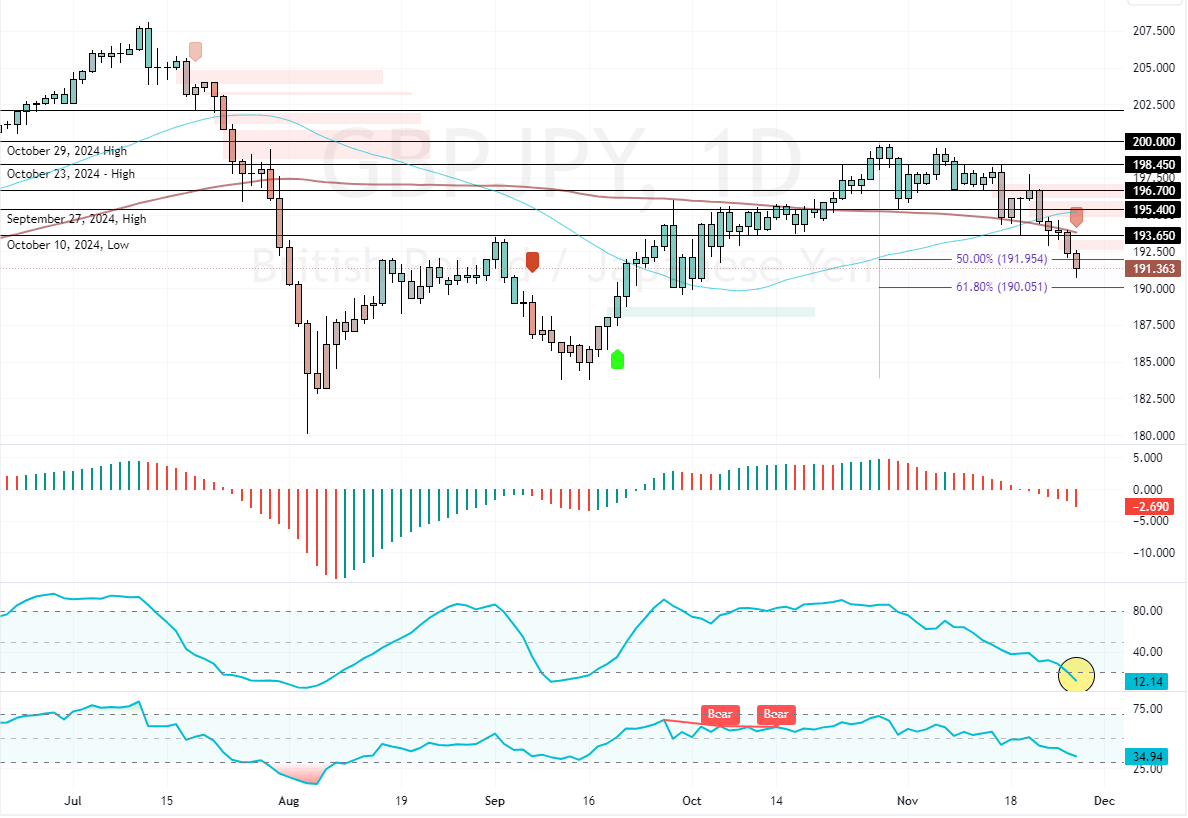

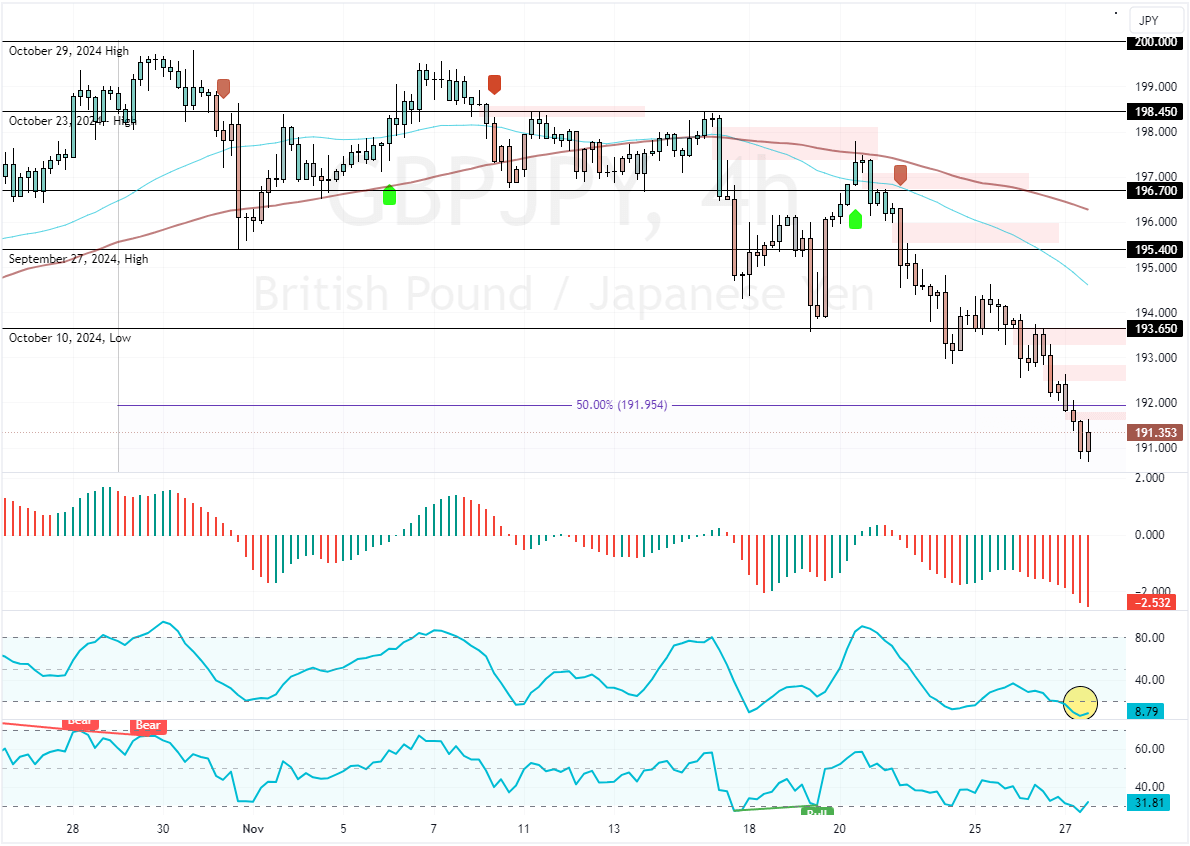

FxNews—The GBP/JPY resumed its bearish trajectory below the %50 Fibonacci retracement level. The sellers have ignored the oversold signals on daily and 4-hour charts, adding pressure to the prices.

Stochastic Oscillator Suggests Overpriced Yen

As of this writing, the currency pair is experiencing a pullback from today’s low, testing the broken support at 192.0 as resistance. Meanwhile, the Stochastic Oscillator hints that the Japanese Yen could be overpriced in the short term.

Therefore, joining the downtrend at the current price, which is 191.3, is not advisable, mostly because the market could consolidate near the upper resistance level soon.

GBPJPY Outlook Bearish Under 195.4

The critical resistance level that divides the bull market from the bear market rests at 195.4. As long as prices hold below this level, the outlook for the GBP/JPY trend remains bearish. The next bearish target in this scenario could be the 61.8% Fibonacci at 190.0.

Please note that the bearish outlook should be invalidated if GBP/JPY exceeds 195.4, which is active resistance.