FxNews—Japan’s 10-year government bond yield hit about 1%, its highest in three months. This happened because Japan’s weak currency made investors think the central bank (BoJ) might increase interest rates to help the yen. This increase is similar to what happened in the U.S. when bond yields increased after Donald Trump won the presidential election and the Republicans took control of Congress.

Bank of Japan Signals More Rate Hikes Ahead

The head of Japan’s central bank, Kazuo Ueda, said last week that prices and wages are behaving as expected. This could mean more rate hikes are coming. At the bank’s recent meeting, everyone agreed they should keep raising rates if prices and the economy keep growing as they hope.

Also, new reports show that real wages in Japan dropped slightly by 0.1% in September, while prices increased by 2.9%, overtaking the 2.8% wage increase.

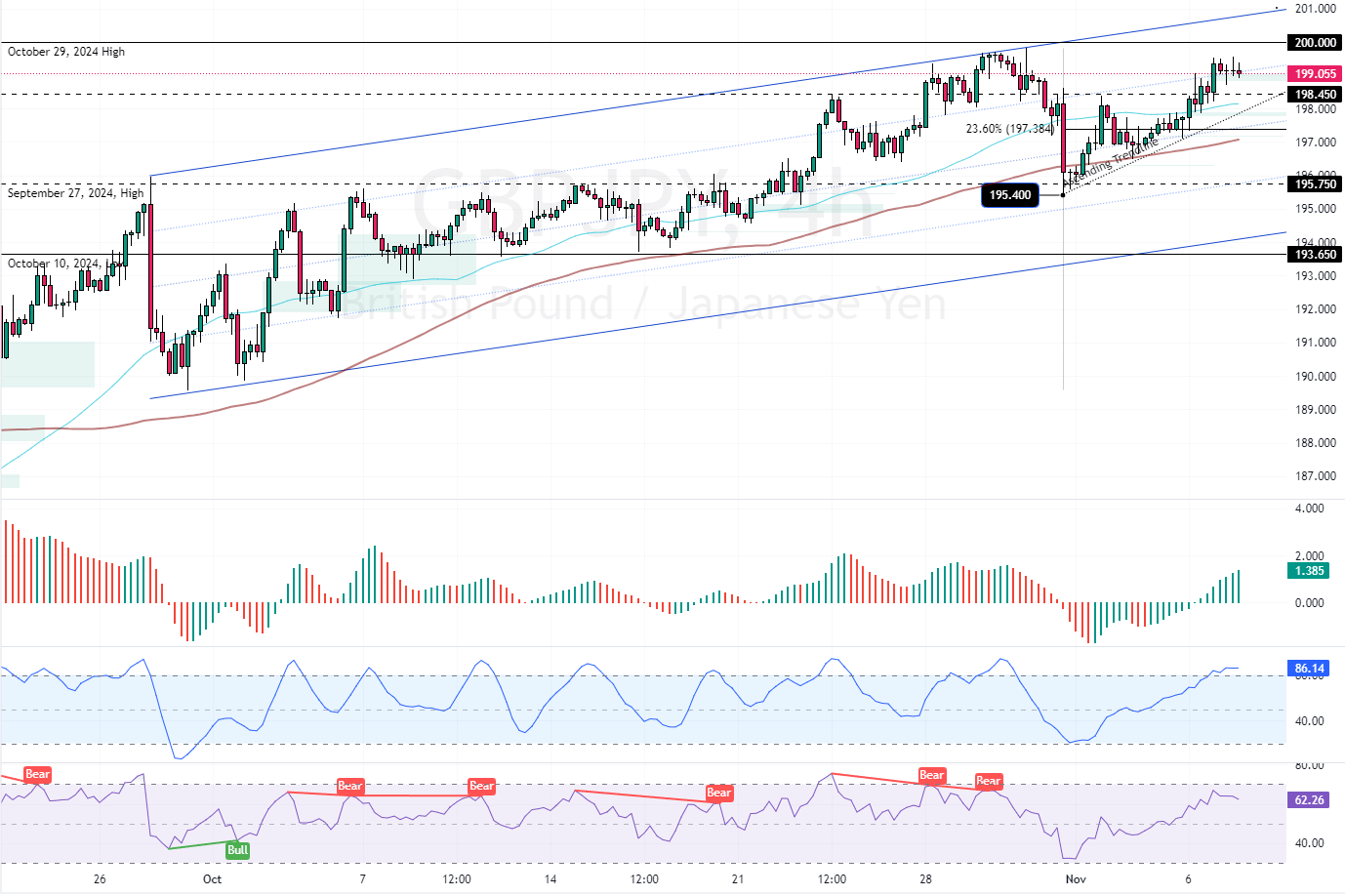

GBPJPY Technical Analysis – 7-November-2024

GBP/JPY is in an uptrend above the 50-period simple moving average, trading at approximately 199.0 as of this writing. Furthermore, the British pound seems overpriced due to Stochastic’s overbought signal. Therefore, the market has the potential to consolidate or dip to lower support levels.

The immediate support is at 198.45. If GBP/JPY closes below 198.45, a new consolidation phase can potentially form. If this scenario unfolds, the price could dip to the 23.6% Fibonacci retracement level at 197.3, backed by the 100-period simple moving average. Furthermore, if the selling pressure exceeds 197.38, the consolidation phase could extend to the September 27 high at 195.7.

Conversely, if GBP/JPY bulls drive the price above the 200.0 physiological resistance level, their path to 202.0 (the daily 78.6% Fibonacci retracement level) will likely be paved.

- Support: 198.45 / 197.38 / 195.75 / 193.65

- Resistance: 200.0 / 202.1