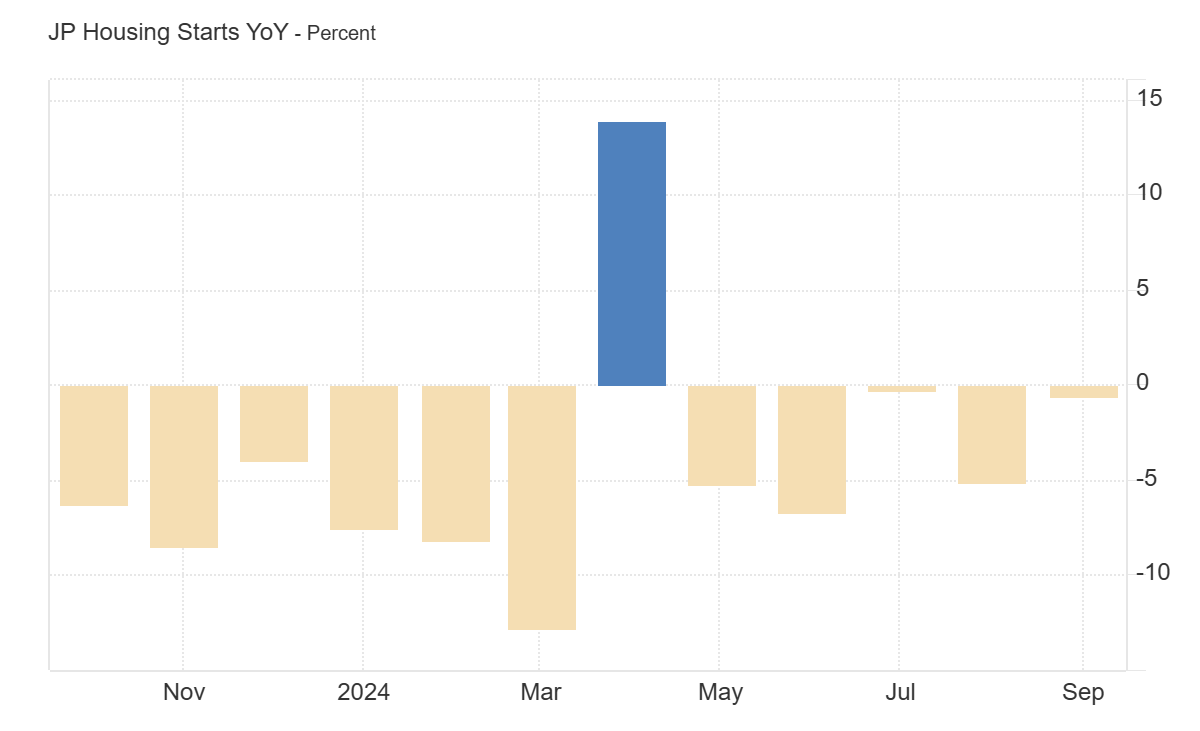

FxNews—In September 2024, Japan saw a minor 0.6% annual decrease in housing starts, a significant improvement compared to the 5.1% drop recorded in August. This decrease was also less severe than the anticipated 4.1% drop forecasted by experts.

Housing Market Dips as New Builds Decrease

The decline in new housing was evident across various types, with owned homes falling by 0.9%—a milder drop compared to August’s 6.6%. Homes built for sale saw a 7.0% decrease, showing some recovery from a 12.0% fall in the previous month. There was a dramatic reduction in issued housing, down 40.9%, following a surge of 129.7% in August. Pre-fabricated homes also decreased by 12.5%, slowing down from an 8.6% drop.

Conversely, the number of starts for rental buildings rose by 4.4%, reversing a 1.4% decrease, and two-by-four constructions modestly increased by 0.8%, down from a 4.3% rise.

- Also read: EUR/USD Nears Breakpoint as ECB Meets Goals

GBPJPY Technical Analysis – 31-October-2024

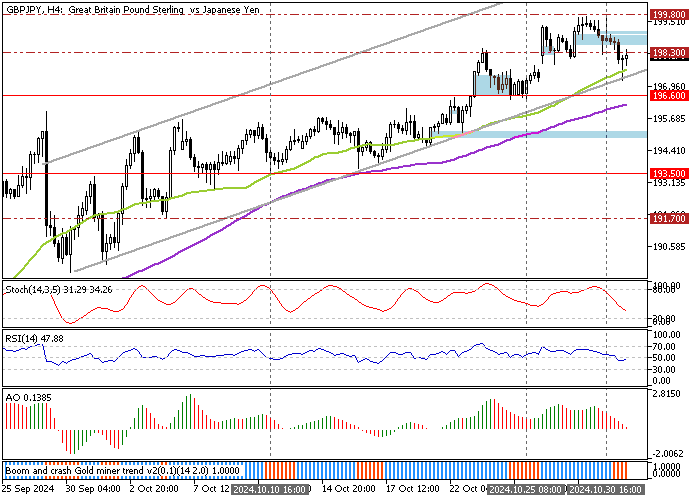

The British pound trades bullish against the Japanese Yen because its price floats above the 50- and 100-period simple moving averages. Today, the GBP/JPY price bounced off the 50-period SMA, active support in conjunction with the ascending trendline, as the 4-hour chart above shows.

Despite the primary bullish trend, the other technical indicators give mixed signals.

- The Awesome Oscillator bars are red and about to flip below the signal line.

- The Relative Strength Index, or RSI 14, is below the median line.

- The Stochastic Oscillator declined but was not oversold, meaning the downtrend from 199.8 could extend lower.

Overall, the technical indicators suggest the primary trend is bullish, but the current downtick momentum should be considered.

Bullish GBPJPY Stays Above Key 196.6 Level

The October 25 low at 196.6 is the immediate support. The GBP/JPY trend outlook should be considered bullish as long as it trades above the 196.6 mark, backed by the 100-period simple moving average.

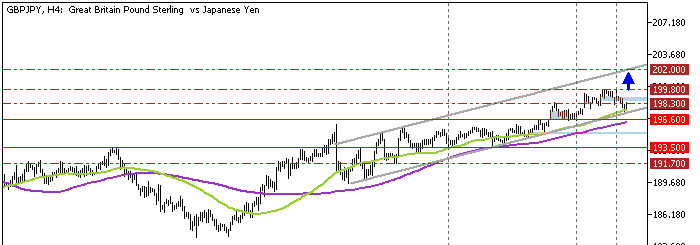

From a technical standpoint, the uptrend will likely resume if GBP/JPY exceeds the immediate resistance at 199.8, the October 30 high. If this scenario unfolds, the bulls’ path to 202.0 (July 18 Low) will likely be paved.

Please note that the bullish outlook should be invalidated if GBP/JPY falls below the 196.6 critical support.

Bearish Scenario

The downtrend from 199.8 extends to 193.5 (October 10 low) if bears close and stabilize the GBP/JPY price below the critical support of 196.6. If this scenario unfolds, the 100-period simple moving average will serve as the primary ceiling for the downtrend.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 196.6 / 193.5 / 191.7

- Resistance: 199.8 / 202.0