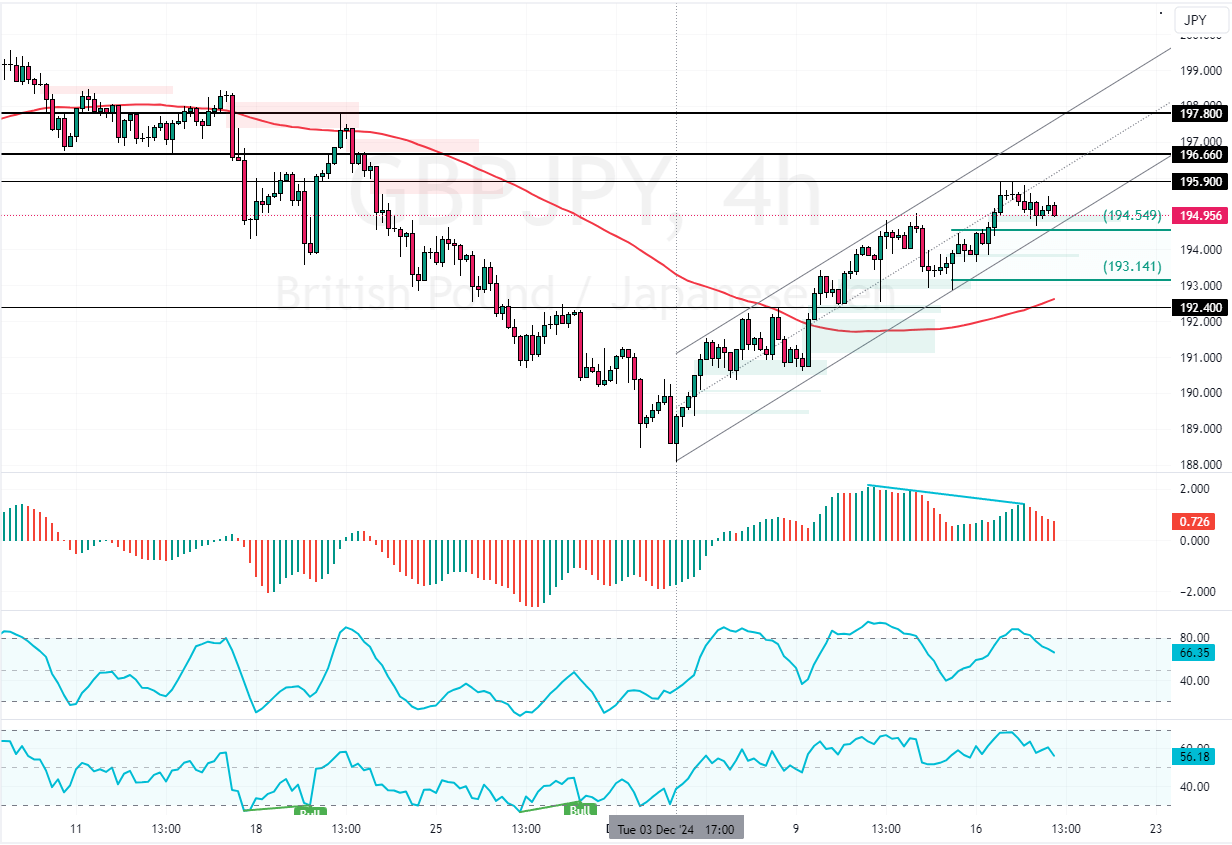

GBP/JPY is in a bull market, but technical indicators signal a bearish divergence. A dip to 193.1 is possible if bears push the prices below the 194.5 immediate support.

GBPJPY Forecast – 18-December-2024

The British pound is in an uptrend against the Japanese Yen, above the 75-period simple moving average. As of this writing, the currency pair trades at approximately 195.0, slightly above the immediate support.

As for the technical indicators, the Awesome Oscillator hints at a bearish divergence, with red bars declining toward zero. This is interpreted as a consolidation phase, or a possible downtrend could be on the horizon. Additionally, Stochastic and RSI 14 records show 66 and 56, respectively, decreasing.

Overall, the technical indicators suggest while the primary trend is bullish, GBP/JPY could step into a consolidation phase that might push the prices toward lower support levels.

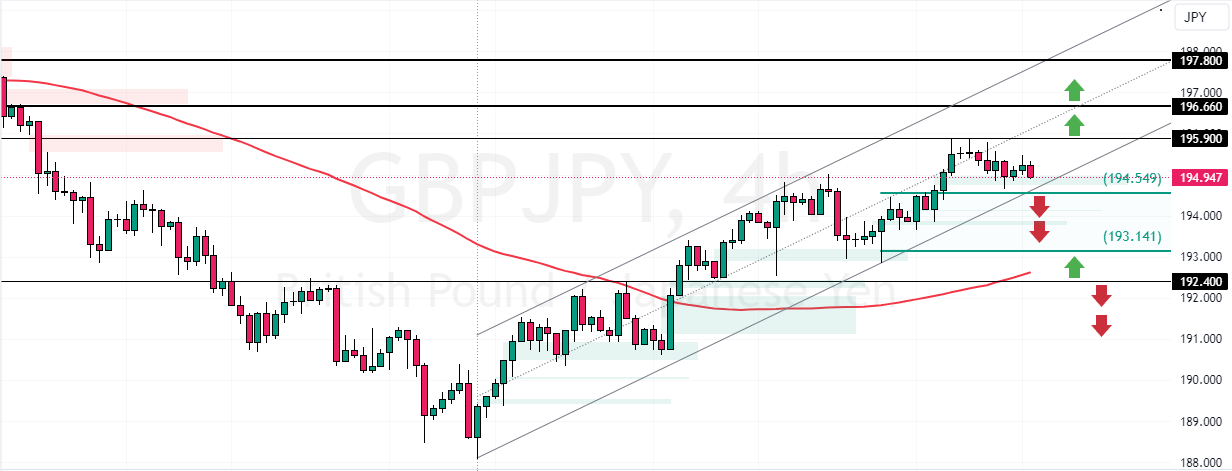

Potential GBPJPY Decline Past 194.5 Support

The immediate support is at 194.5. From a technical perspective, GBP/JPY could dip if bears push the prices below this level.

In this scenario, the next support level will be the 193.1 mark, followed by the 192.4 mark, backed by the 75-period SMA.

The Bullish Scenario

Please note that the bearish outlook should be invalidated if GBP/JPY exceeds 195.9. If this scenario unfolds, the uptrend will likely resume, targeting 196.6.