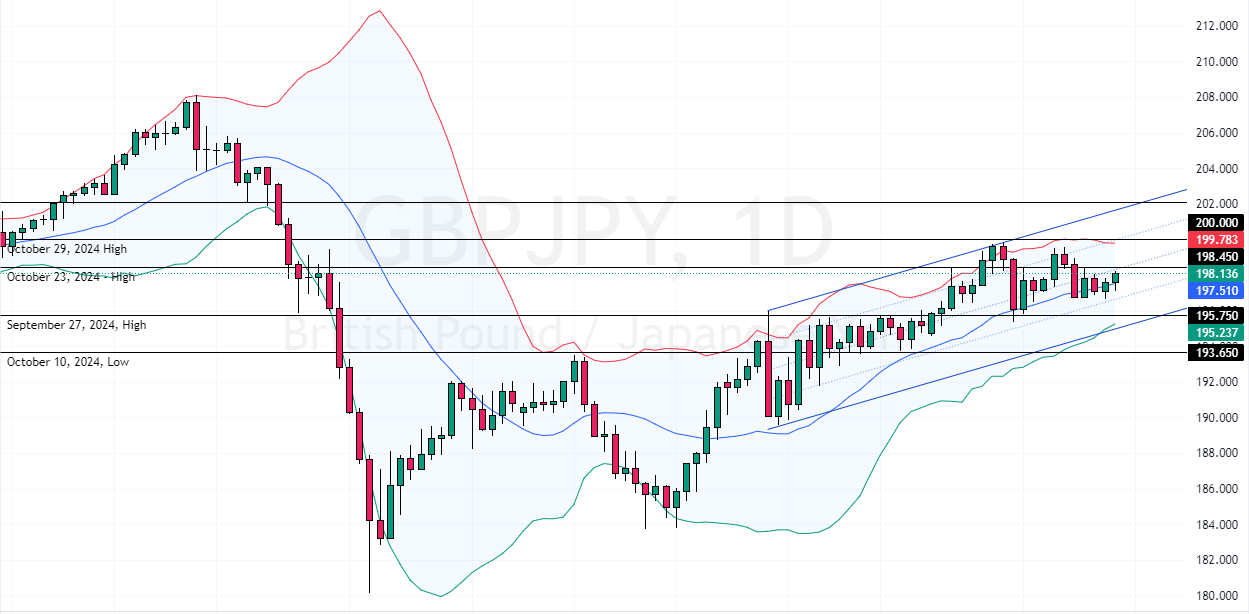

FxNews—The GBP/JPY currency pair has been moving sideways since November 8. It traded at approximately 198.0 in today’s trading session, slightly below the October 23 high. This depreciation of the Japanese yen is caused by the Nikkei shares, which dropped by 0.48%, and speculation on the United States’ new tariff policies, which could impact the Japanese economy.

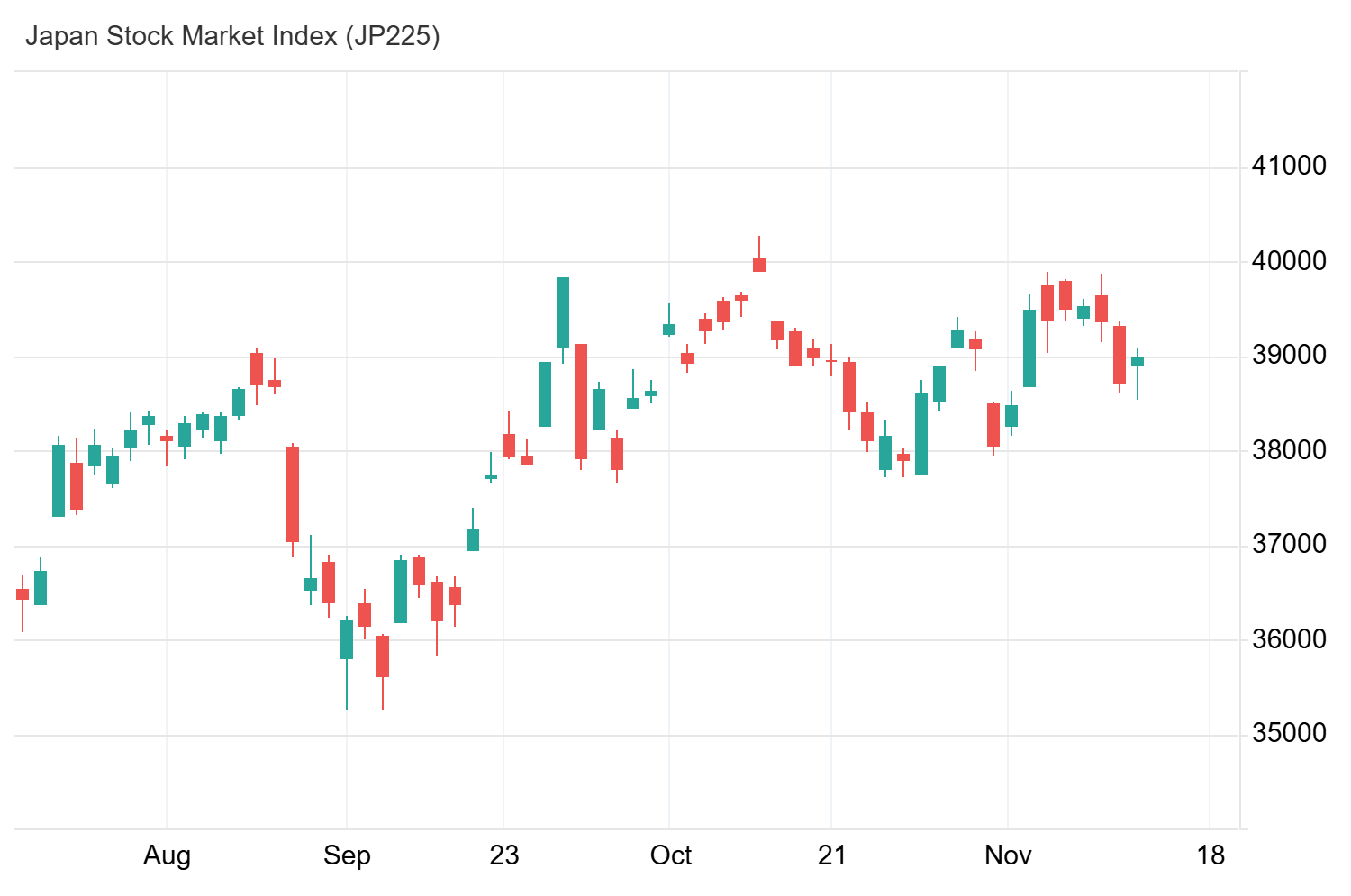

Nikkei 225 Slides 0.48% Amid Tech Sector Losses

The Nikkei 225 Index fell by 0.48%, closing at 38,536 points. Similarly, the broader Topix Index declined by 0.27% to finish at 2,701 points. These drops erased gains from earlier in the day, primarily due to losses in the technology sector that mirrored overnight declines on Wall Street.

How Trump’s Plans May Affect Japan’s Economy

Investors are assessing how U.S. President-elect Donald Trump’s proposed policies might impact Japan’s economy, especially export-focused industries. Meanwhile, traders are watching a sharp yen weakening, which could offer short-term support to local stock markets.

Tech Stocks Tumble as Disco Corp Leads 4.2% Drop

Technology companies led the downturn. Disco Corp’s shares dropped 4.2%, Lasertec fell 5%, Tokyo Electron decreased 3.5%, Advantest lost 2.8%, and SoftBank Group declined 3.2%.

Rakuten Group announced a strategic partnership with Mizuho Financial Group in corporate developments. Rakuten will transfer 14.99% of its Rakuten Card shares to Mizuho for about 165 billion yen as part of the deal.

GBPJPY Technical Analysis – 14-November-2024

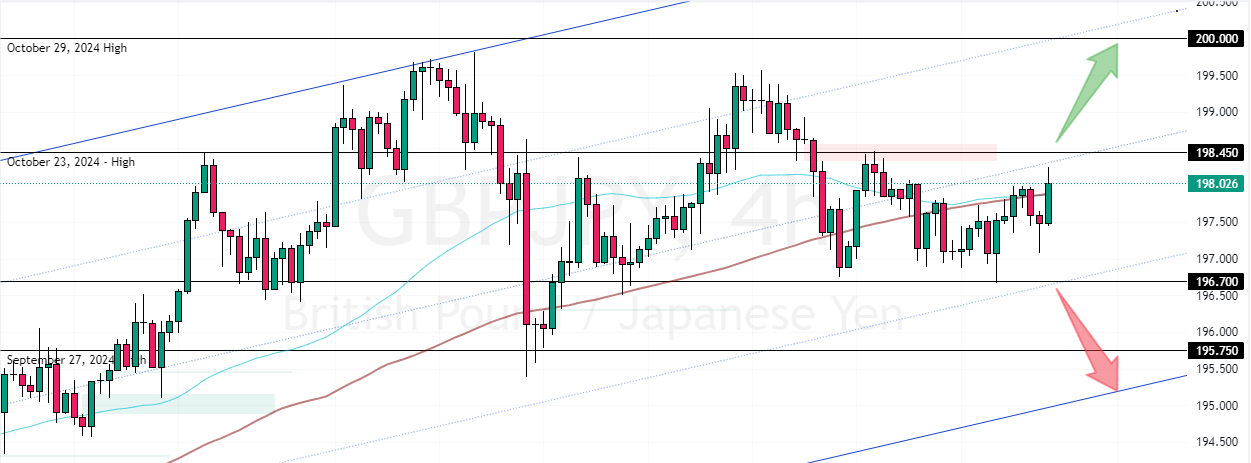

For a week, the currency pair has been trading in a narrow range between 196.7 and 198.4, signaling a low-momentum market.

As for the technical indicators, the Stochastic is about to step into the overbought territory, meaning the British Pound could become overpriced soon. However, the primary trend should be considered bullish because the prices are slightly above the 100-period simple moving average.

GBPJPY Forecast – 14-November

The immediate resistance is at 198.45. From a technical perspective, a new bullish wave will likely begin if bulls pull the GBP/JPY price above this resistance. In this scenario, the next bullish target could be revisiting the 200.0 mark, the October 29 high.

Conversely, the consolidation phase that began from the 200.0 physiological level could extend toward the lower line of the bullish flag at approximately 195.75 if bears (sellers) push the prices below the immediate support of 196.7.

- Support: 196.7 / 195.75 / 193.65

- Resistance: 198.45 / 200.0