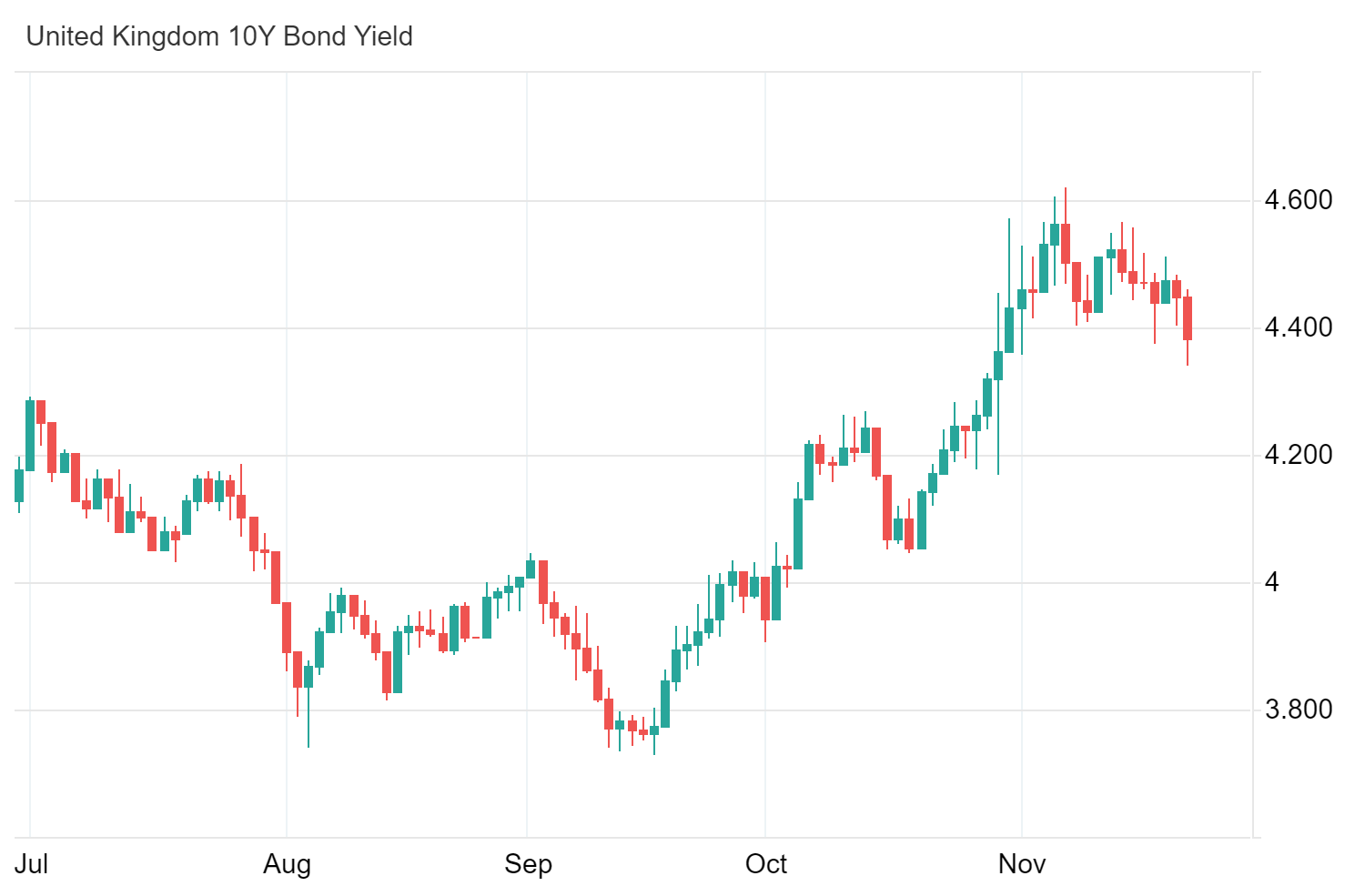

The yield on the UK’s 10-year government bonds has dropped below 4.4%, hitting its lowest level in nearly a month. This decline follows the release of economic data that fell short of expectations. In October, retail sales decreased by 0.7%, a larger drop than analysts had predicted.

Preliminary figures for November’s Purchasing Managers’ Index (PMI) also missed forecasts, indicating a slight reduction in overall business activity. This downturn is mainly due to a significant slowdown in the services sector and a continued contraction in manufacturing.

UK Inflation Surges to 6-Month High of 2.3%

At the same time, the UK’s annual inflation rate rose to 2.3% in October, the highest in six months. This is up from 1.7% in September, surpassing the Bank of England’s target and market expectations of 2.2%. Inflation in the services sector—which the central bank views as a key indicator of domestic price pressures—increased to 5% from 4.9%.

Most experts anticipate that the Bank of England will keep interest rates unchanged in December. The likelihood of a quarter-percentage-point rate cut is currently estimated at around 14%.

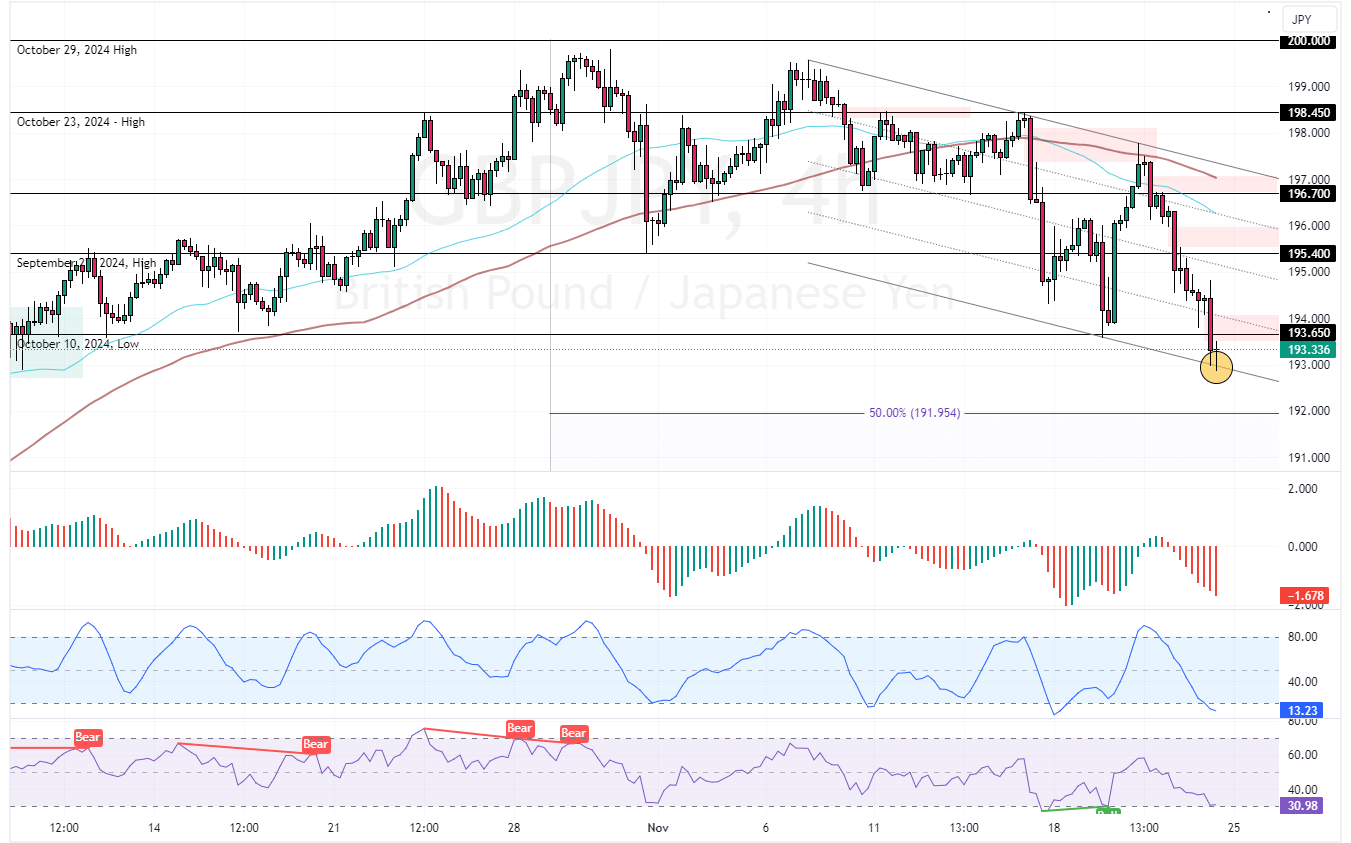

GBPJPY Technical Analysis

The British Pound trades in a downtrend against the Japanese yen flipped below the October 10 low of 193.6 in today’s trading session. Robust selling pressure that began earlier this week resulted in the Stochastic stepping into oversold territory, hinting that the yen is overpriced in the short term.

Therefore, the market expects the GBP/JPY pair to consolidate before the downtrend resumes.

GBPJPY Bearish Below 195.4 Watch for 191.9 Target

The outlook for the GBP/JPY remains bearish, with prices below 195.4. Furthermore, immediate support is at 193.0.

From a technical perspective, the bearish trend will likely resume if GBP/JPY dips below the 193.0 mark. In this scenario, the next bearish target could be the 50% Fibonacci retracement level at 191.9.

- Good reads: EURJPY Slips as ECB Warns of Economic Shocks

Please note that the selling strategy should be invalidated if GBP/JPY exceeds the 195.4 critical resistance.

- Support: 193.0 / 191.9

- Resistance: 195.4 / 196.7