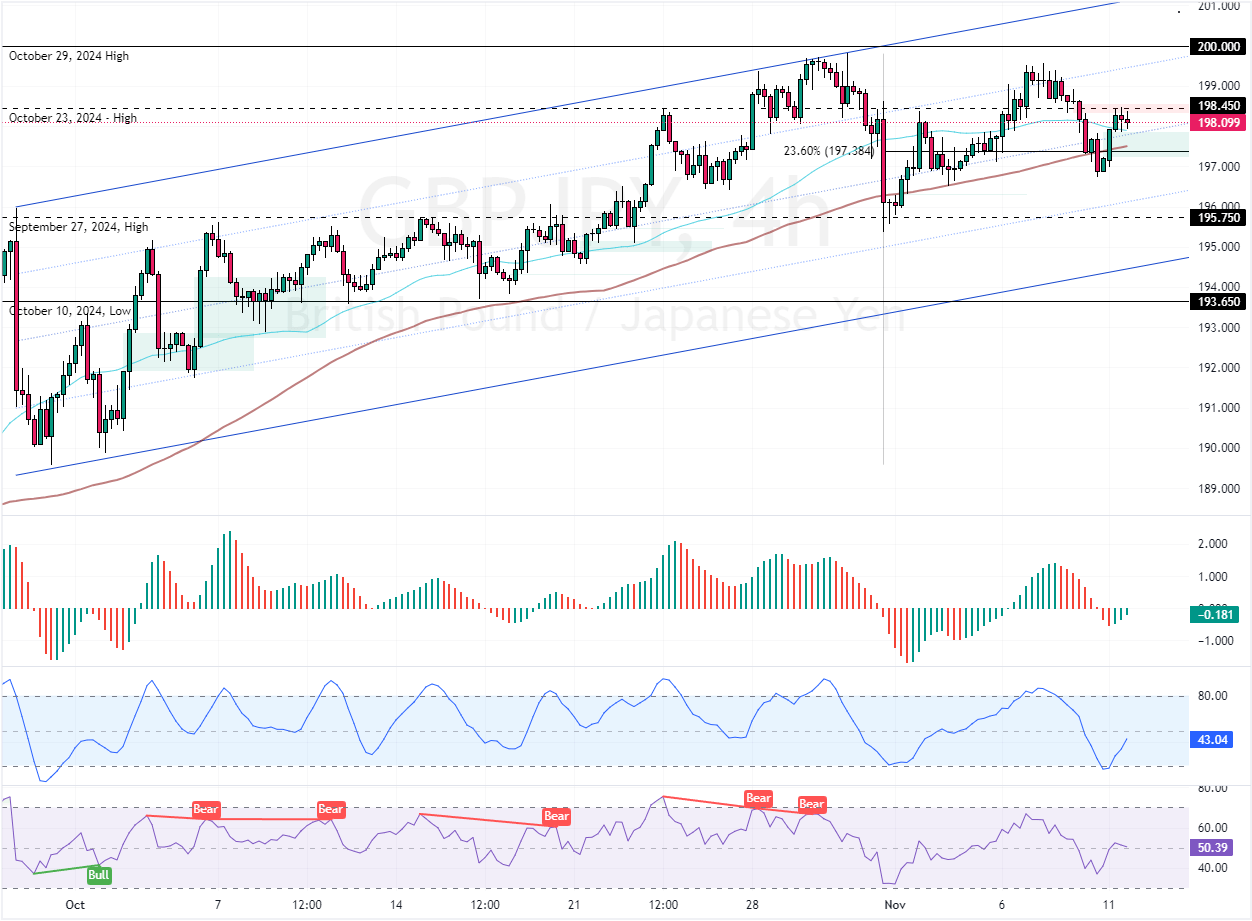

FxNews—The GBP/JPY currency pair returned above the 100-period simple moving average, testing the bearish Fair Value Gap at 198.4, a resistance level that neighbors the October 23 high.

GBPJPY Technical Analysis – 11-November-2024

As for the technical indicators, the Awesome Oscillator histogram turned green, approaching the zero line from below, meaning the bear market weakens. Furthermore, the Stochastic and RSI are rising, depicting 42 and 49 in the description, respectively, indicating bulls are adding new bids to GBP.

Overall, the technical indicators suggest the primary trend should be considered bullish because GBP/JPY flipped above the 100-period SMA.

GBPJPY Forecast – 11-November-2024

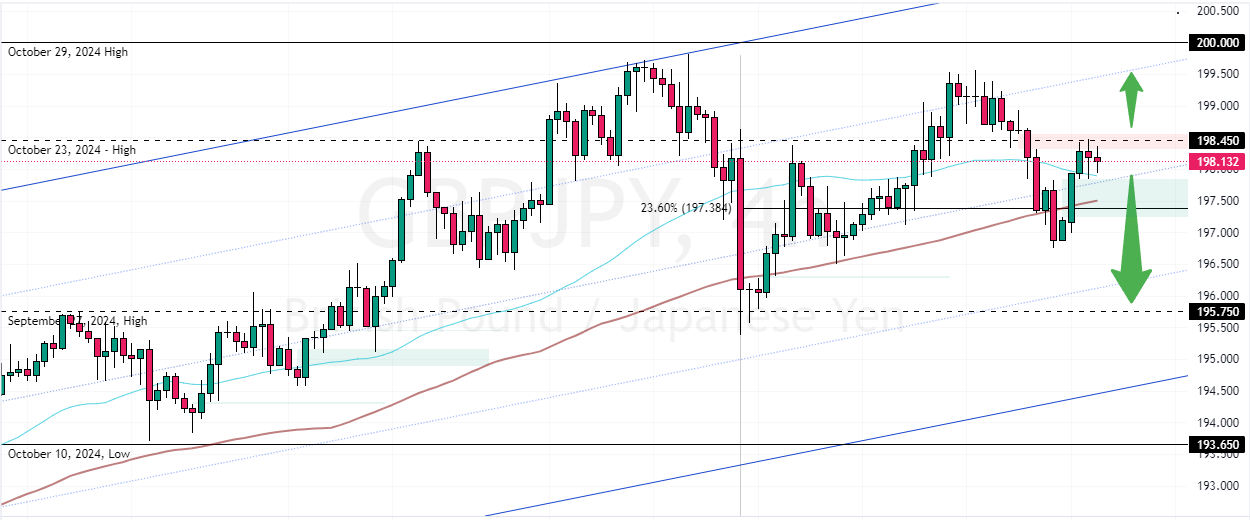

The immediate resistance rests at 198.45. The current bullish momentum can potentially resume if the GBP/JPY price exceeds 198.25. In this scenario, the bulls’ path to revisiting the October 29 high at 200.0 will likely be paved.

Please note that if buyers fail to close and stabilize the GBP/JPY price above the immediate resistance, a new bearish wave could form. If this scenario unfolds, the downtrend from last week could extend to 195.75.

Furthermore, if the selling pressure exceeds 195.75, the next bearish target could be the October 10 low at 193.65.

- Support: 197.38 / 193.65

- Resistance: 198.45 / 200.0