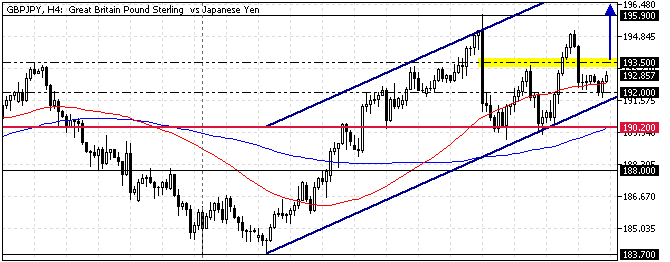

FxNews—The British pound traded in a bullish flag against the Japanese Yen at about 192.8 in today’s trading session. As of this writing, the GBP/JPY currency pair is testing the 50-period simple moving average as support.

The GBP/JPY 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

GBPJPY Technical Analysis – Bulls May Push Prices Up

The primary trend is bullish because the GBP/JPY price is above the 50- and 100-period moving averages. Meanwhile, the Awesome oscillator shifted above the signal line, which indicates that the bull market prevails.

Additionally, the relative strength index indicator flipped above the median line, meaning the GBP/JPY is not overbought, and the uptrend can potentially target upper resistance levels.

Overall, the technical indicators suggest the primary trend is bullish and should resume.

GBPJPY Forecast – 4-October-2024

The immediate resistance is the October 1 high, 193.6. If bulls (buyers) pull the GBP/JPY price above 193.6, the bull market will likely resume. In this scenario, the next target could be revisiting the September 9 high at 195.9.

Furthermore, suppose the buying pressure increases and the conversion rate surpasses the 195.9 resistance. In that case, the GBP/JPY path to the upper line of the bullish flag at approximately 199.5 will likely be paved.

Please note that the bull market should be invalidated if the GBP/JPY price falls below the 100-period SMA at 190.2.

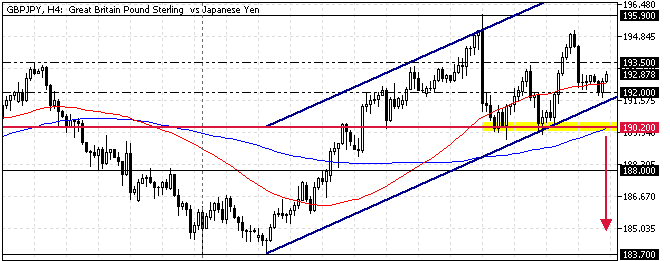

GBPJPY Bearish Scenario – 4-October-2024

The immediate support rests intact this month at 190.2. If bears (sellers) drive the GBP/JPY price below 190.2, not that the trend should be considered bearish, the pair’s value will likely fall to the September 19 low at 188.0.

Furthermore, if the GBP/JPY exchange rate closes below 188.0, the next supply zone will be 183.7, the September 9 low.

GBPJPY Support and Resistance Levels – 4-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 190.2 / 188.0 / 183.7

- Resistance: 193.5 / 195.9 / 199.5