In today’s comprehensive GBPNOK forecast, we will first examine Norway’s current economic conditions. Then, we will meticulously delve into the details of the technical analysis of the GBPNOK pair.

Manufacturing Slows Down in Norway

Bloomberg–In October 2023, Norway’s manufacturing landscape saw a noticeable retreat, with the DNB Manufacturing PMI dipping to 47.9 from September’s adjusted figure of 51.8. This shift signals a decrease in factory activity, with new orders and production both taking a hit—falling to 45 and 45.7, respectively, from their September readings.

The pace of hiring in factories also decelerated, easing down to a score of 52 from 53.5, hinting at a more cautious approach to staffing. Suppliers delivered quicker, as indicated by the shorter delivery times at 48.7.

Despite a slight increase in stock levels to 46.9, the rise points to a slackening in demand. Price trends also took a downward turn, with the index for the cost of purchased goods settling at 56.1, suggesting that while prices are still going up, the surge is not as steep as it has been historically.

GBPNOK Forecast: Technical Analysis

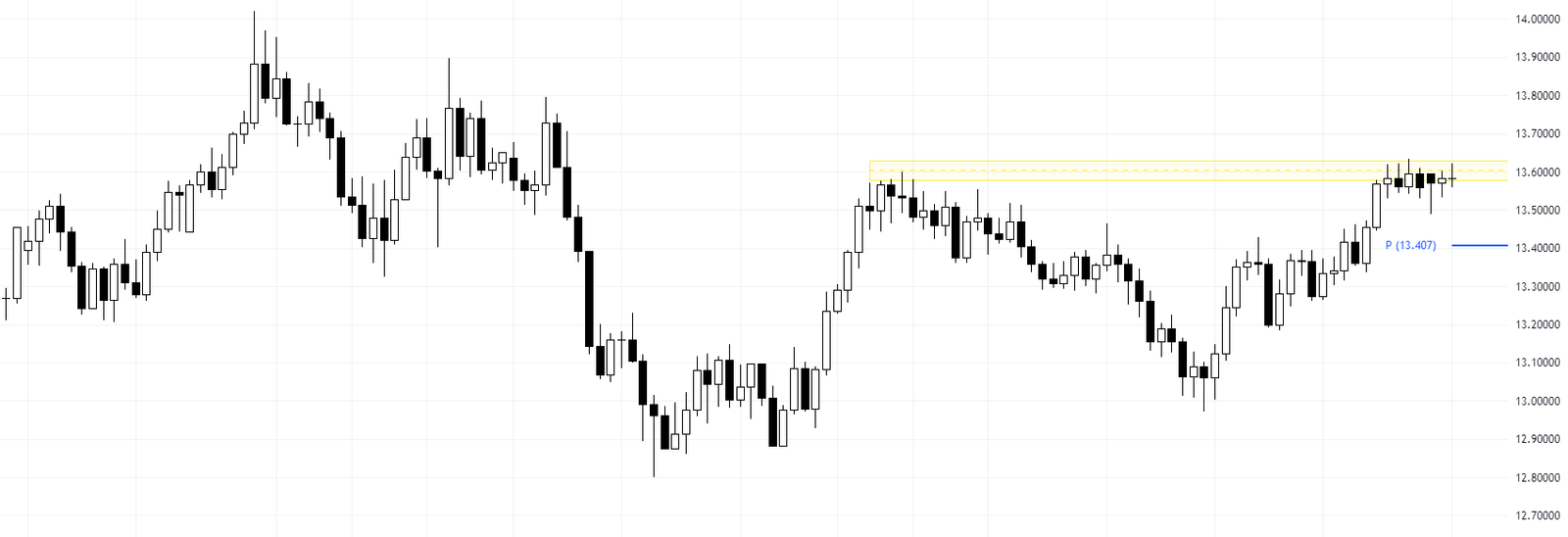

Since October 24, the GBPNOK has oscillated within a tight range of 13.6 and 13.5. Despite the formation of a hammer candlestick pattern on Monday, the bears have consistently thwarted the bulls’ attempts to breach this ceiling.

A closer look at the GBPNOK 4-hour chart provides a more detailed view of the price action. The Relative Strength Index (RSI) indicates divergence, which hasn’t reversed the trend but has indeed ranged the market and decelerated its momentum. The presence of a bearish channel lends support to the bullish bias. In this scenario, the GBPNOK’s targets could be Resistance 1 (R1), followed by Resistance 2 (R2) at 13.73.

However, if the bears manage to close below Support 1 (S1) at 13.45, the bullish scenario would be invalidated.