FxNews—The GBP/USD pair resumed its bearish trajectory after the prices neared the 50-period simple moving average, which is active resistance. This morning’s rise was due to higher-than-expected UK inflation numbers, which have made the Bank of England more cautious about cutting interest rates in the future.

UK Inflation Hits Six-Month High at 2.3%

In October, the UK’s annual inflation rate increased to 2.3%, the highest in six months. This is up from 1.7% in September and is above the Bank of England’s target and market expectations of 2.2%. Additionally, services inflation—which the central bank views as a key indicator of domestic price pressure—increased to 5% from 4.9%.

As a result, markets now see only a 14% chance of another quarter-point interest rate cut this year and anticipate just two cuts in 2025. However, the British pound is still under pressure due to the strong US dollar. This strength comes from expectations that Donald Trump’s policies could boost US inflation, potentially limiting the Federal Reserve’s ability to reduce interest rates.

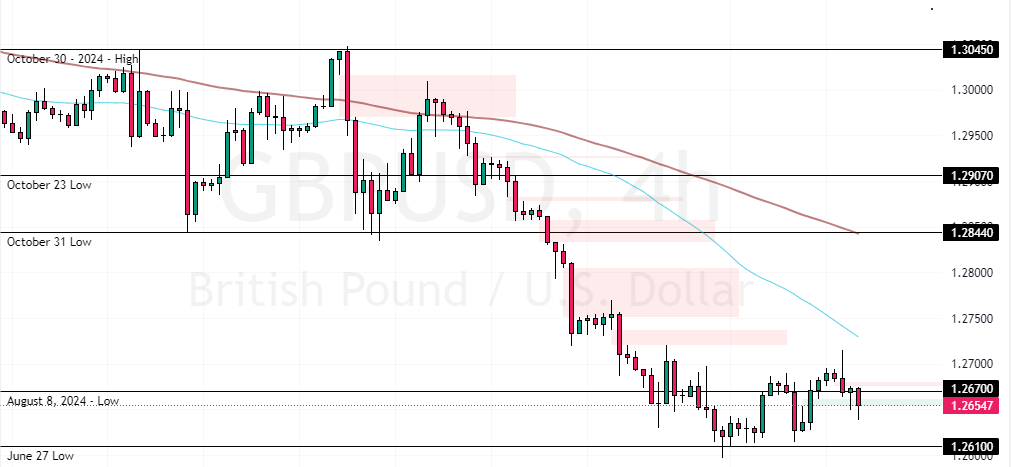

GBPUSD Technical Analysis

The primary trend is bearish because the currency pair in discussion is below the 50- and 100-period simple moving average. That said, the immediate support is at June 27 low, the 1.261 mark.

From a technical perspective the downtrend will likely resume if GBP/USD dips below the 1.261 mark. In this scenario, the downtrend can potentially extend to the May 9 low at 1.245.

- Good reads: Expect USDSGD Surge to 1.349 and Higher

Please note that the bearish outlook should be invalidated if the prices exceed 1.284 resistance, backed by the 100-period simple moving average.

GBPUSD Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.261 / 1.245

- Resistance: 1.273 / 1.284