FxNews—The GBP/USD currency pair continued declining, nearing the June 27 low at approximately $1.261—the lowest level in three months. This downward movement was due to a stronger U.S. dollar overall, spurred by expectations that Donald Trump’s policies could boost inflation and limit the Federal Reserve’s ability to lower borrowing costs.

UK Wage Data Backs Central Bank’s Rate Cut Caution

In the United Kingdom, recent labor market data supported the central bank’s cautious approach to cutting interest rates. Regular wages, excluding bonuses, dipped slightly to 4.8% in the three months leading up to September, aligning with the central bank’s forecasts. When bonuses are included, total pay increases at a faster rate.

U.K. Unemployment Rises as Job Vacancies Hit Low

However, unemployment rose to 4.3%, and job vacancies dropped to their lowest point since May 2021. Last week, the Bank of England enacted its second 25 basis point rate cut of the year and remained cautious about further reductions.

Moreover, key U.K. economic data, including third-quarter GDP growth figures, is anticipated this week.

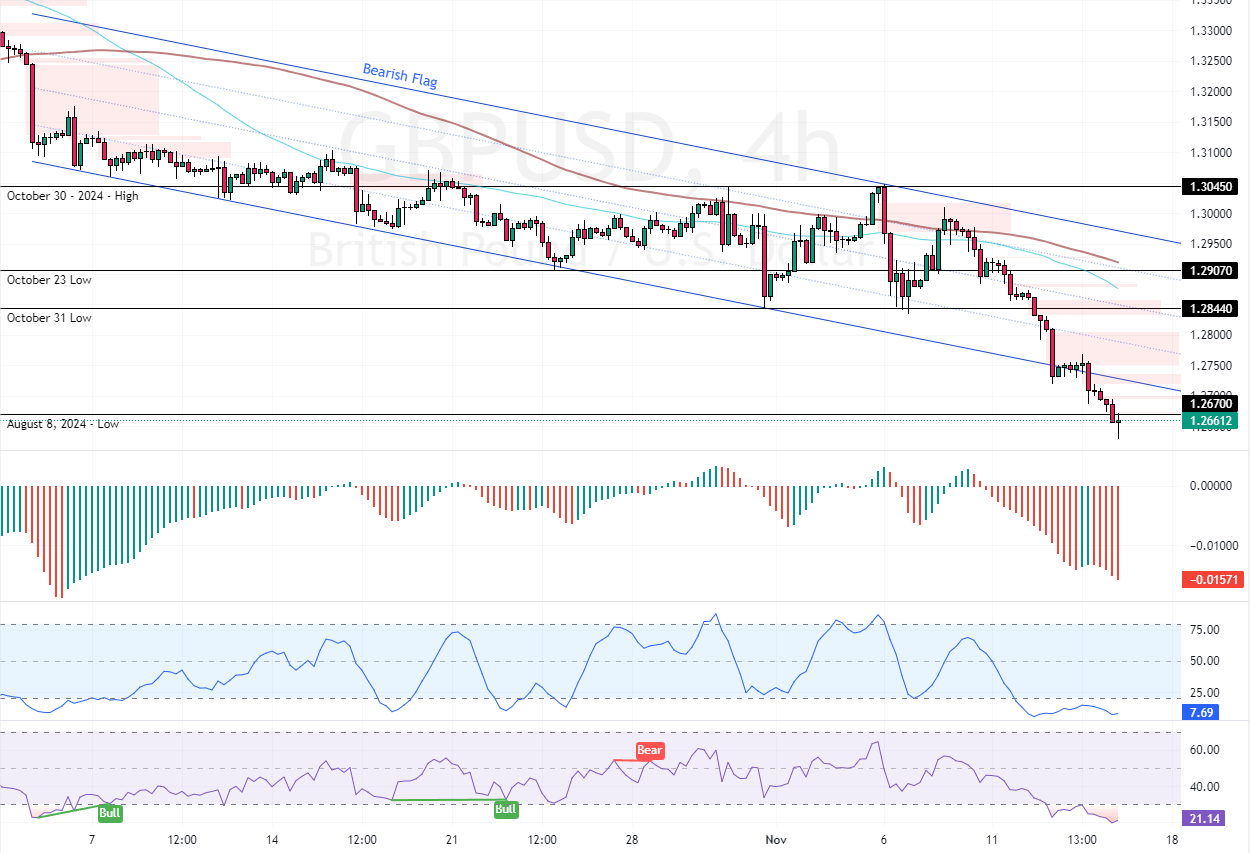

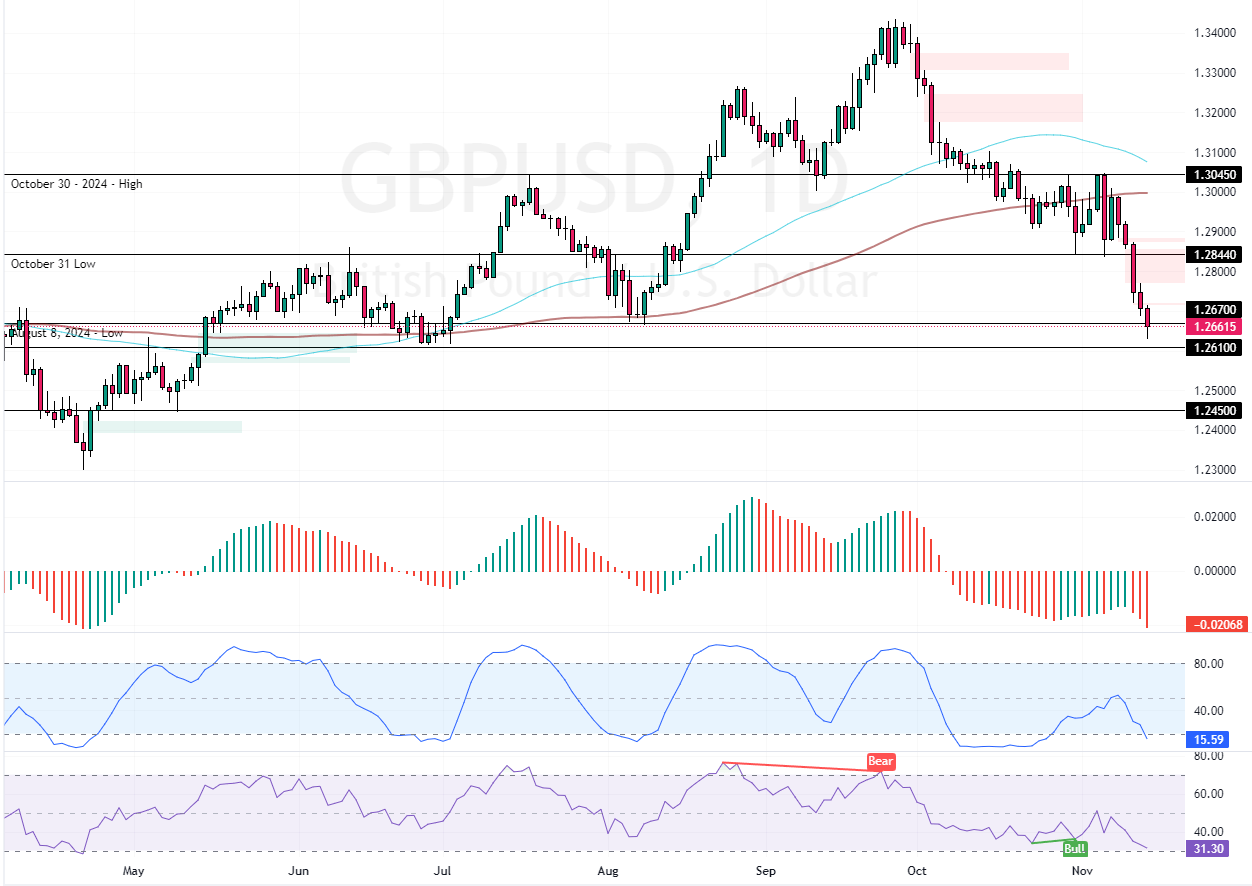

GBPUSD Technical Analysis – 14-November-2024

The British pound trades bearish against the U.S. Dollar below the 50-period simple moving average. On November 12, the Bears pushed the prices below $1.284, which was critical support for the current downtrend wave.

As of this writing, the currency pair trades at approximately $1.266, bouncing off the 1.261 resistance. Meanwhile, the momentum indicators suggest the market is oversold.

- RSI value is 22, hovering in the oversold territory.

- Stochastic records show 8 in the description, meaning the U.S. dollar is overpriced.

GBPUSD Expected to Correct Before Resuming Downtrend

We anticipate GBP/USD running for a consolidation phase before the downtrend resumes. That said, the outlook for the primary trend remains bearish as long as prices are below the 1.284 resistance. In this scenario, the next bearish target could be the May 9 low at $1.245.

Please note that the bearish strategy should be invalidated if the GBP/USD value exceeds 1.284.

- Support: 1.261 / 1.245

- Resistance: 1.284 / 1.304