FxNews—The British pound has fallen below $1.31, marking its lowest point in nearly a month. This decline is mainly due to the strong US dollar, which has been influenced by expectations that the Federal Reserve might not reduce borrowing costs as quickly as previously thought.

Bank of England’s Future Moves

In the UK, the financial market is bracing for the Bank of England to potentially adopt a tougher approach towards lowering interest rates. This follows comments from Governor Andrew Bailey, who hinted that rate cuts might be considered if inflation drops. Despite these speculations, the central bank maintained the interest rate at 5% in September, unchanged from a slight decrease in August.

Economic Growth in the UK

August saw the UK’s GDP grow by 0.2%, which met market forecasts and suggests the economy could continue to expand in the third quarter of the year. However, the pace of growth is expected to be more modest compared to earlier months.

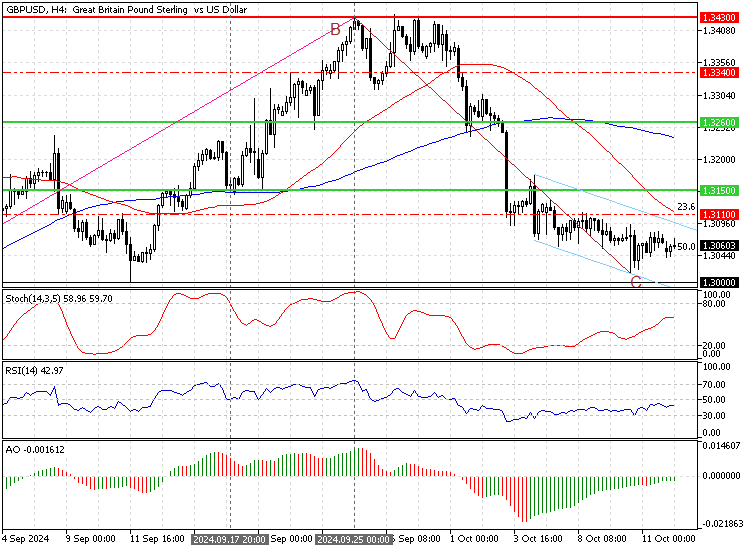

GBPUSD Technical Analysis – 14-October-2024

The British pound is in a robust bear market against the American currency. However, the downtrend eased when the GBP/USD price neared the September 11 low at $1.3, trading at approximately $1.305 as of this writing.

The technical indicators suggest the primary trend is bearish, but the market could consolidate near upper resistance levels.

- The Awesome Oscillator histogram is green, approaching the signal line from below, signaling the bull market strengthens.

- The Relative Strength Index indicator shows 42 in the description, hovering below the median line, which indicates that the bear market prevails.

- More importantly, the primary trend should be considered bearish because the GBP/USD price is below the 50- and 100-period simple moving averages.

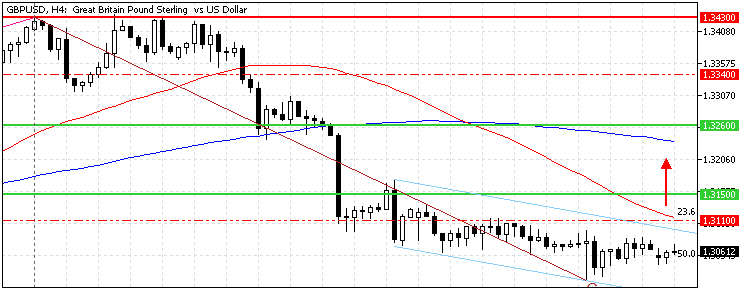

GBPUSD Price Forecast – 14-October-2024

The immediate resistance rests at $1.311, backed by the 50-period simple moving average and the %23.6 Fibonacci retracements level.

From a technical perspective, the uptick momentum from $1.3 can potentially target the $1.315 (September 17 Low) if bulls stabilize the price above the immediate resistance, the $1.311 mark.

It is worth mentioning that $1.315 provides a decent entry point into the bear market. Hence, retail traders and investors are advised to monitor this demand area closely for bearish signals, such as candlestick patterns.

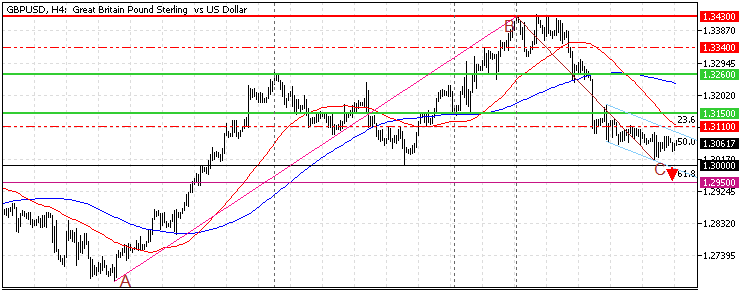

GBPUSD Bearish Scenario

The immediate support that kept the price from further decline is $1.30. If bears (sellers) close and stabilize the GBP/USD price below $1.30, a new bearish wave will likely emerge. If this scenario unfolds, the next bearish target could be $1.295, the AB wave’s %61.8 Fibonacci level.

GBPUSD Support and Resistance Levels – 14-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.03 / $1.295

- Resistance: $1.311 / $1.315