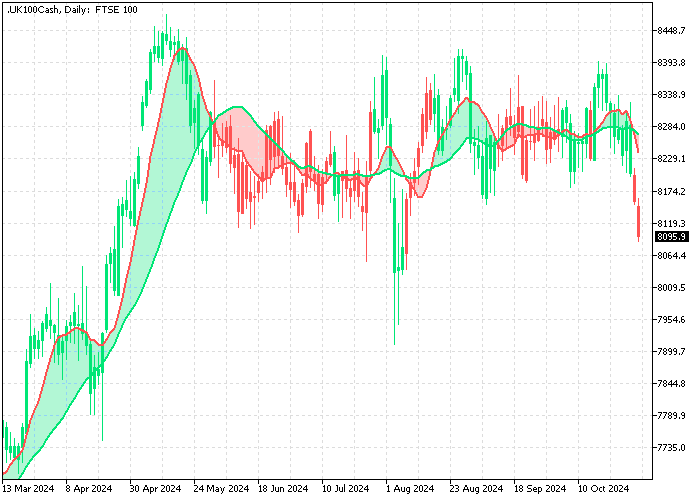

FxNews—On Thursday, the FTSE 100 dropped by more than 0.5%, reaching approximately 8,000, marking its lowest point since early August. This decrease marks the third consecutive day of losses. Investors are currently evaluating a new set of corporate reports and considering the effects of the recent Budget.

Smith & Nephew Down Coca-Cola HBC Up

Smith & Nephew saw a significant decline in stock market updates, dropping over 13% to the index‘s lowest position after reducing its yearly sales estimate due to weaker sales in China.

On the other hand, Coca-Cola HBC emerged as a strong performer, with its shares increasing by more than 2% after it raised its annual forecast following robust results in the first nine months. Additionally, Shell experienced a slight gain of 1.1%, even though its third-quarter profits fell due to declining oil prices. However, the decrease was less severe than anticipated.

GBPUSD Technical Analysis – 31-October-2024

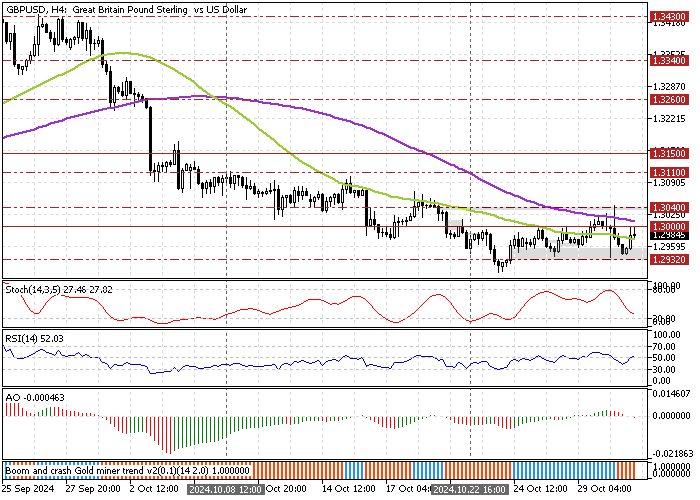

The British pound is in a bear market against the U.S. dollar, below the 100-period simple moving average. As of this writing, the currency pair trades at approximately $1.30, testing the 100-SMA as resistance.

The Awesome Oscillator histogram is red and flipped below the signal line, meaning the bear market gained momentum. Additionally, the Stochastic Oscillator declines but is not oversold, indicating the bear market should resume.

Overall, the technical indicators suggest the primary trend is bearish and should continue to lower support levels.

GBP/USD May Fall Below $1.293 Support

The immediate support is at $1.293. From a technical perspective, the downtrend will likely resume if bears push the price below the 1.293 mark. If this scenario unfolds, the next target could be the August 13 high at $1.287.

Please note that the bearish outlook should be invalidated if the GBP/USD price exceeds $1.304, backed by the 100-period simple moving average.

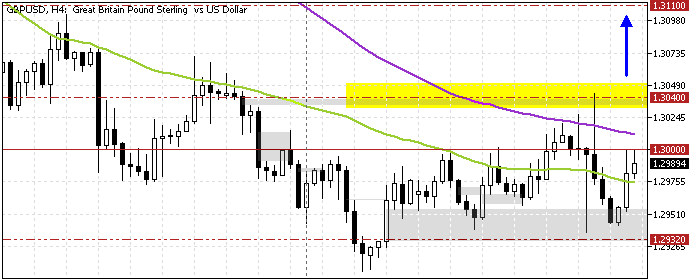

Bullish Scenario

The consolidation phase that began last week could extend to $1.311 if bulls close and stabilize the GBP/USD price above the 100-period SMA. In this scenario, the moving average will primarily support the bullish strategy.

- Next read: EUR/USD Nears Breakpoint as ECB Meets Goals

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.293 / 1.287

- Resistance: 1.3 / 1.304 / 1.311