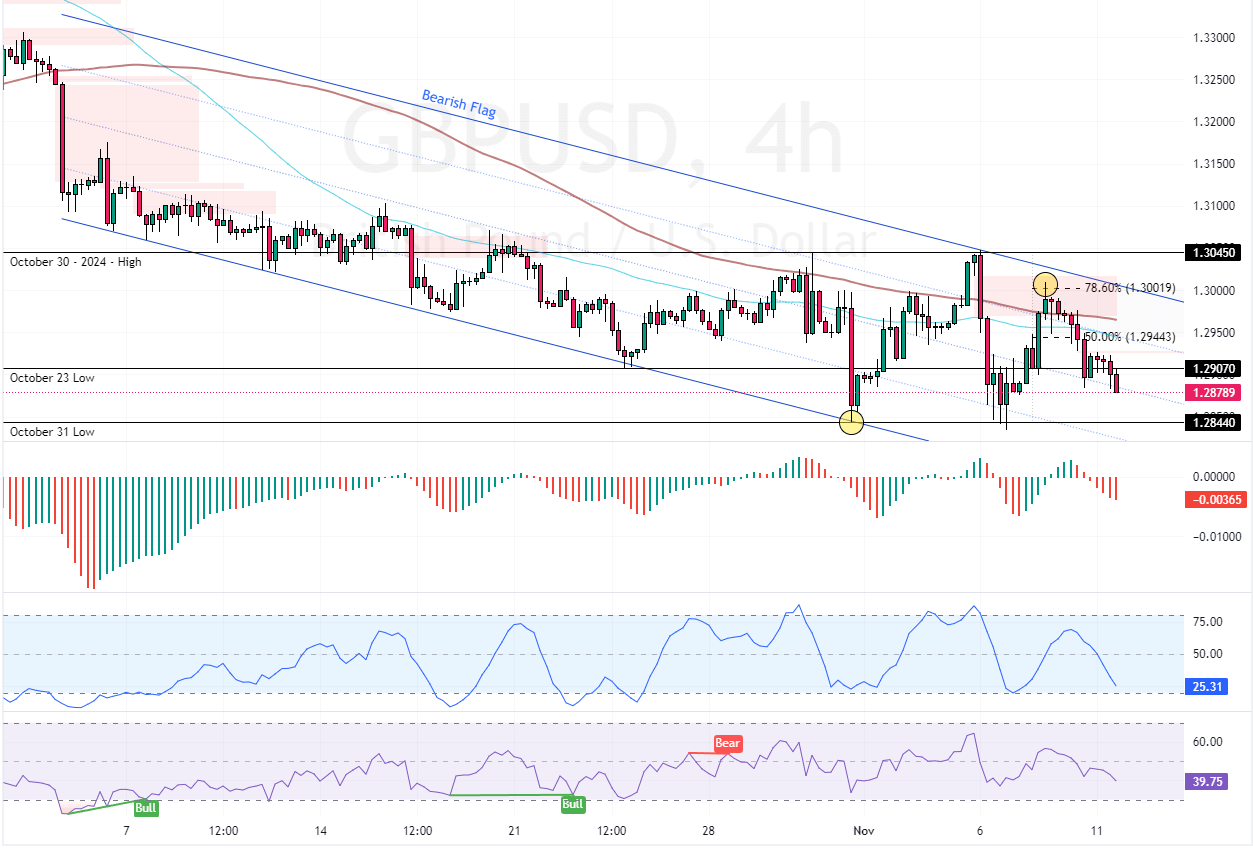

FxNews—As expected, the GBP/USD currency pair filled the bearish Fair Value Gap at approximately 1.30 on Thursday, November 7. Consequently, the downtrend was triggered again after the bears pushed the price below the %50 Fibonacci retracement level (1.294).

As of the writing, the pair trades bearish at approximately 1.288, aiming toward the October 31 low (1.284).

GBPUSD Technical Analysis – 11-November-2024

The Stochastic Oscillator depicts 25 in the description and is declining, which indicates that the market is not oversold and that the downtrend should resume. Furthermore, the RSI 14 supports the Stochastic’s bearish signal by showing 40 in the description.

Additionally, the Awesome Oscillator histogram is red and below zero, meaning the bear market prevails.

Overall, the technical indicators suggest the primary trend is bearish and should resume.

GBPUSD Forecast – 11-November-2024

The immediate resistance is at 1.30. The outlook of the GBP/USD trend remains bearish as long as the price is below the immediate resistance. In this scenario, the next bearish target would be 1.284, the October 31 low. Furthermore, if the selling pressure exceeds 1.284, the downtrend will likely extend to the August 8, 2024 low at 1.267.

Please note that the bearish outlook should be invalidated if GBP/USD exceeds the 1.300 mark or the upper line of the bearish flag, as the 4-hour chart shows.

- Support: 1.284 / 1.267

- Resistance: 1.294 / 1.30