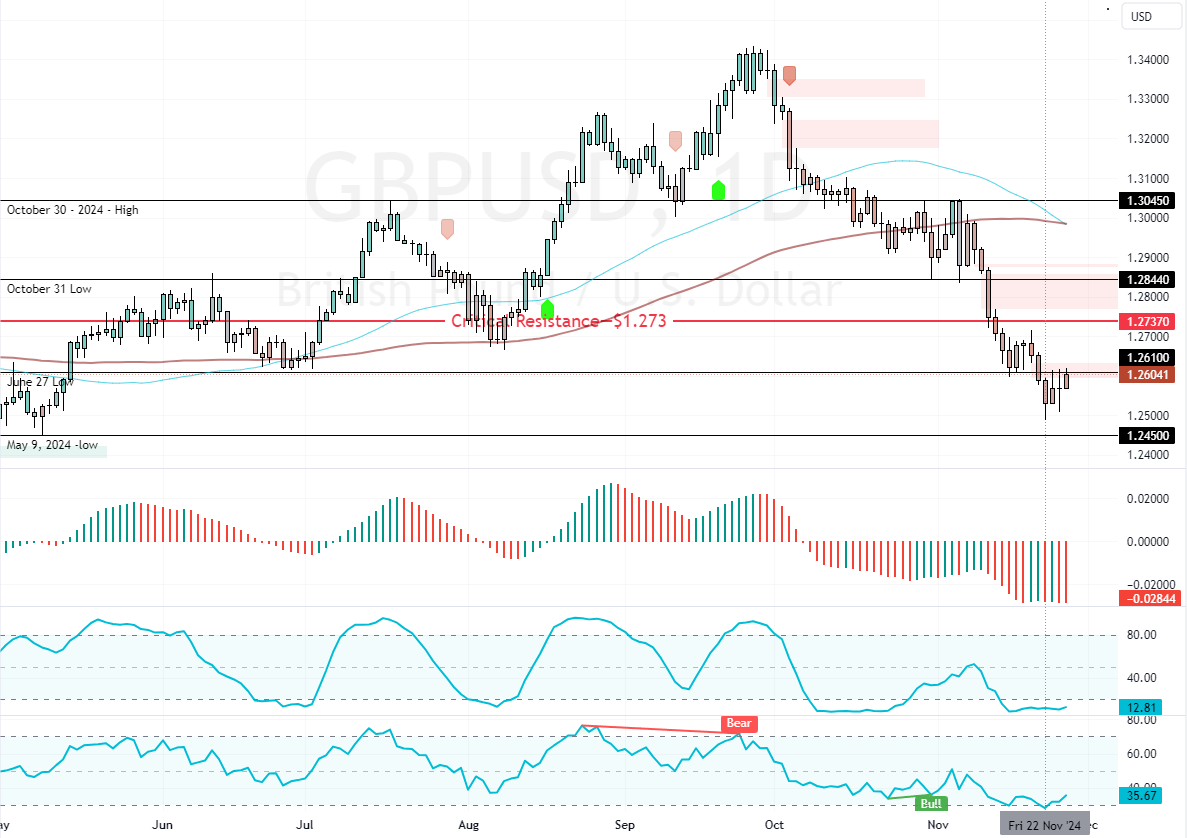

FxNews—The GBP/USD pair slipped below the June 27 low at $1.260, testing the level as resistance. Furthermore, the primary trend is bearish because the prices are below the 50-period simple moving average, as the daily chart below shows.

GBPUSD Shows Weak Bullish Signs

However, the currency pair has been experiencing an uptick in price momentum since Friday, November 22. The daily Stochastic Oscillator, which floats in oversold territory, hinted at this weak bullish momentum.

- Next good read: EURUSD Nears Prime Levels for Bearish Entries

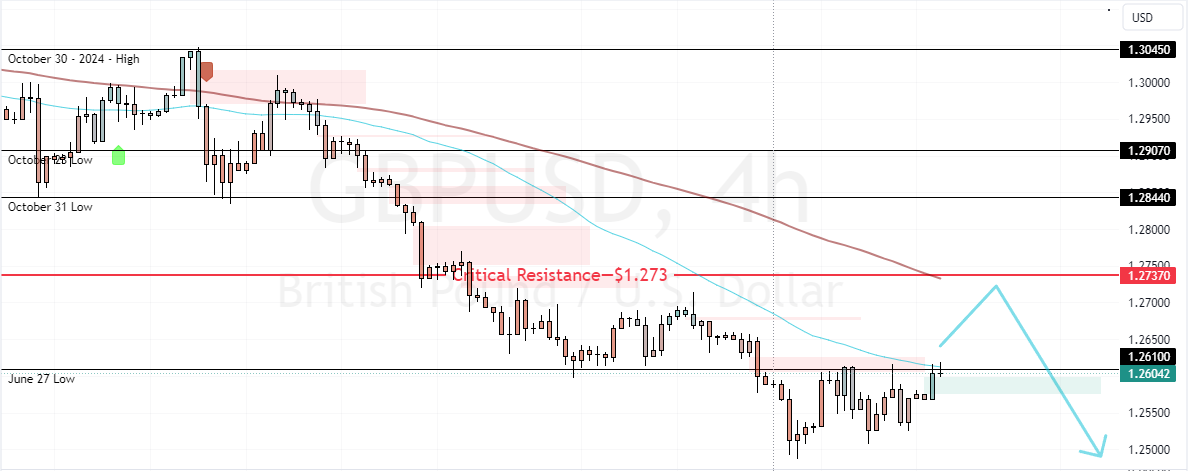

GBPUSD Hits Key Resistance as Sellers Flood the Market

Please note that the GBP/USD trend outlook remains bearish as long as the prices are below $1.273. But, if bulls pull the market above the immediate resistance at $1.261, the current bullish momentum could extend to the 1.273 mark, backed by the 100-period simple moving average (4-hour chart).

Please note that $1.273 provides a decent ask price for joining the bear market. Furthermore, if the resistance holds, the next bearish target could be $1.245.