The yield on U.K. 10-year government bonds is around 4.2%, nearly the highest in three months. This increase mirrors a rise in U.S. bond yields as traders adjust their expectations about future U.S. interest rate reductions.

Previously, experts expected the U.S. Federal Reserve to lower rates significantly, but now they believe these cuts won’t be as deep.

Bank of England’s Monetary Policy

In the U.K., investors are preparing for a potential shift in the Bank of England’s approach to interest rates. Following comments from Governor Andrew Bailey, there’s speculation that the Bank might forcefully reduce rates if the inflation trend slows.

Despite these expectations, the Bank maintained the interest rate at 5% in its last meeting in September after reducing it by 0.25% in August. Looking ahead, traders are predicting two additional rate cuts in 2024.

Economic Growth Insights

Regarding the U.K.’s economic performance, August data shows a 0.2% growth in GDP, aligning with what was anticipated. This indicates that the U.K.’s economy is likely to grow in the third quarter of the year, although the pace of this growth is expected to be modest compared to earlier. This suggests a steady yet cautious economic expansion under current conditions.

GBPUSD Technical Analysis 11-October-2024

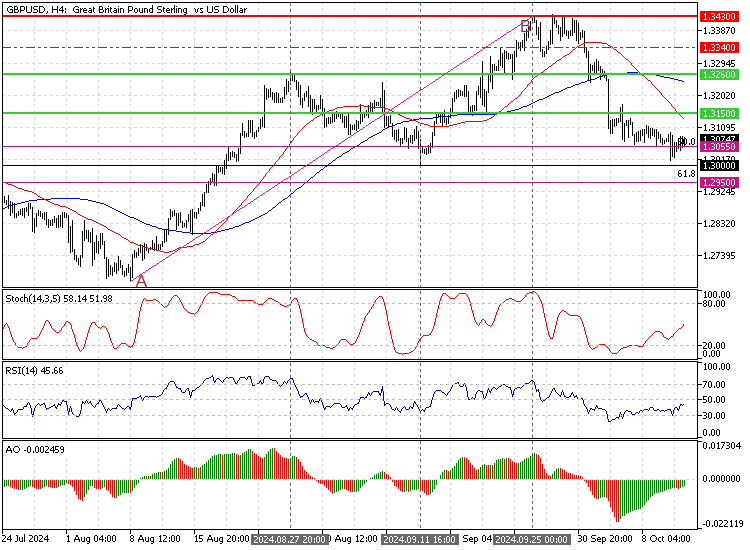

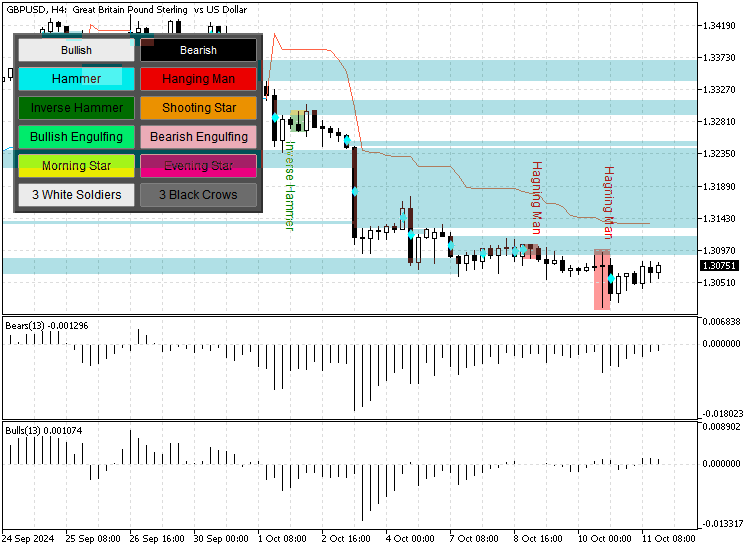

FxNews—The British Pound trades in a bear market against the U.S. dollar, below the SMA 50 and 100. The downtrend eased when the price neared the September 11 low at $1.30. Interestingly, the 4-hour chart formed a ‘hanging man’ candlestick pattern near the $1.30 critical resistance, justifying today’s uptick momentum.

Additionally, the Awesome Oscillator bars are green, approaching the signal line. Interestingly, the A.O.’s histogram signals divergence, which could soon impact the current trend direction.

Overall, the technical indicators suggest the primary trend is bearish, but the GBP/USD has the potential to erase some of its recent losses by aiming for upper resistance levels.

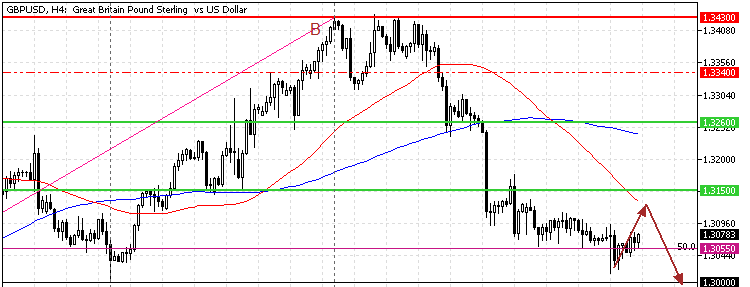

GBPUSD Forecast – 11-October-2024

Immediate resistance is at $1.30. From a technical perspective, the A.O.’s divergence could result in the GBP/USD’s current uptick momentum extending further. In this scenario, the bulls’ target could be the 1.315 resistance, neighboring the 50-period simple moving average.

It is worth noting that the $1.315 barrier offers a decent ask price for retail traders and investors to join the GBP/USD bear market. Hence, traders meticulously monitor this level for bearish signals, such as candlestick patterns.

GBP/USD Support and Resistance Levels – 11-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $1.30 / $1.295

- Resistance: $1.315 / $1.326