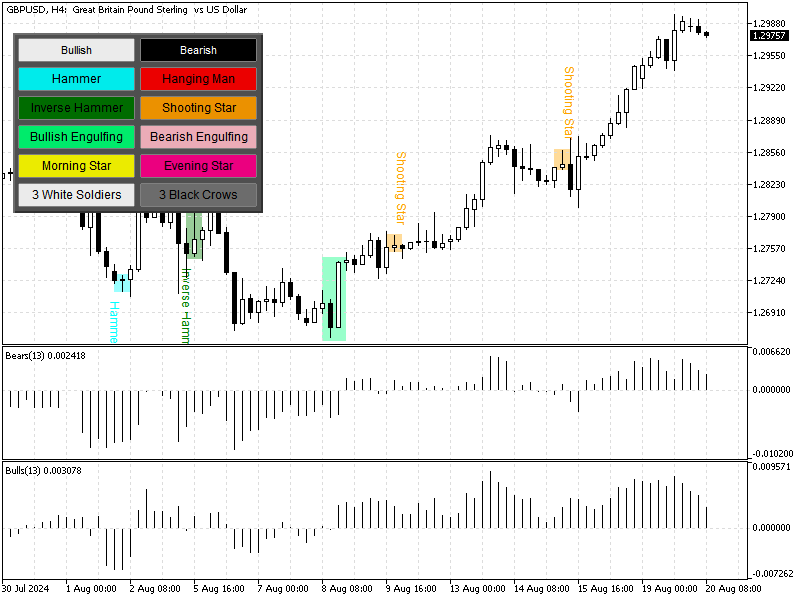

The British pound climbed above $1.297 (GBP/USD) to a one-month high, driven by economic strength and steady inflation. This led traders to believe the Bank of England might cut rates less aggressively than the Federal Reserve.

Market expectations show 44 basis points in rate cuts from the BoE this year, with a 39% likelihood of a 25-bps reduction in September. Meanwhile, a 25-bps cut from the Fed in September is fully anticipated, along with a 24.5% chance of a larger 50-bps cut.

Over 90 bps of easing is expected from the Fed by the end of the year. This week, key events include the Fed’s Jackson Hole meeting, where Chair Jerome Powell will speak on Friday. In the UK, investors are focusing on PMI data and GfK Consumer Confidence reports.