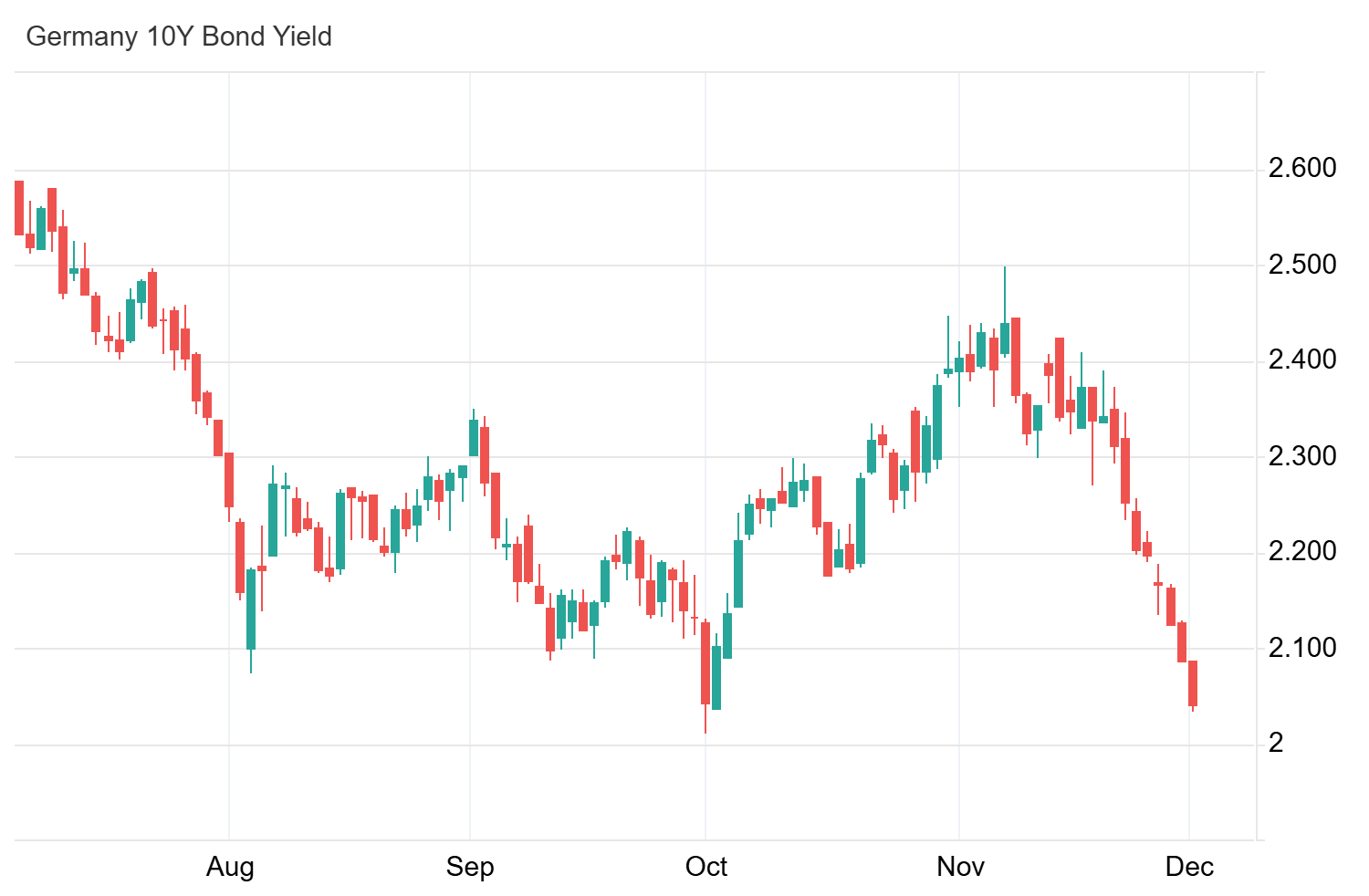

Germany’s 10-year government bond yield has decreased to 2.05%, the lowest in two months, due to rising political tensions in France.

The French government, led by Michel Barnier, is at risk of collapsing as the far-right National Rally party plans to support a no-confidence vote over the national budget. This budget standoff boosts the chance that the fragile coalition could be overthrown if far-right and left-wing opposition parties unite.

ECB May Reduce Rates Due to Slowing Inflation

Meanwhile, financial markets are increasingly expecting that the European Central Bank (ECB) may cut interest rates by 0.50% in December. This shift comes after reports of weak business activity and slowing inflation in the service sector.

Although a smaller 0.25% rate cut is still the main expectation, recent comments from ECB officials, including Governing Council member Martins Kazaks, have strengthened the belief that more significant monetary easing could be on the horizon.

Germany’s 10-year bond yield drops to a two-month low due to political turmoil in France, as markets anticipate possible ECB interest rate cuts in December.