On Wednesday, the price of gold stayed below the immediate resistance of $2,620, backed by the bearish fair value gap.

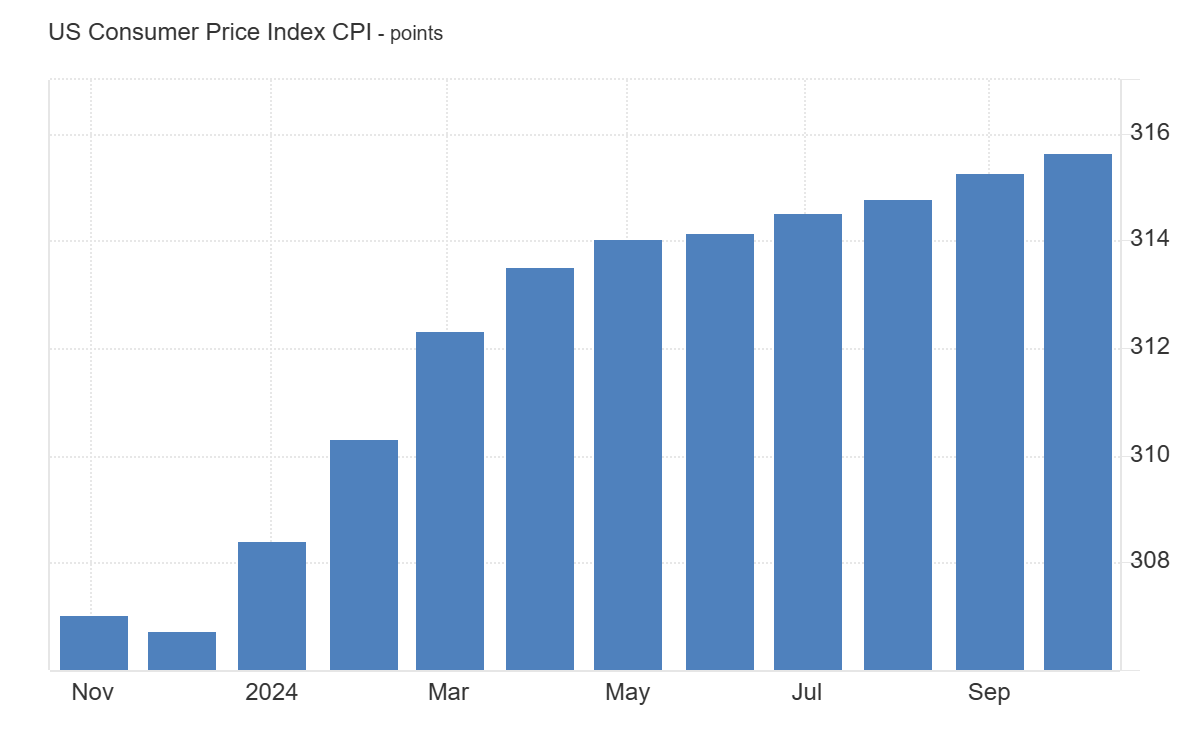

This weak uptick momentum from $2,590 occurred after a key report indicated that inflation pressures persist but remain within expected levels. Specifically, the annual inflation rate in the U.S. increased to 2.6% in October from 2.4% in September.

Inflation Holds Steady with Monthly 0.2% CPI Increase

The Consumer Price Index (CPI) increased by 0.2% monthly, matching the increase of the previous three months. Core inflation also stayed steady at 3.3% annually and 0.3% monthly.

However, gold is still near a two-month low. This is because expectations have grown that the Federal Reserve might delay its easing cycle next year due to certain fiscal strategies and inflationary policies.

Gold ETFs Shed $809 Million in Early November

As a result, traders now see a 60% chance of another rate cut in December, down from about 80% before the recent election.

Meanwhile, the World Gold Council reported that global gold exchange-traded funds (ETFs) experienced outflows of around $809 million (12 tonnes) in early November. These outflows were mainly from North America but were partially offset by inflows in Asia.

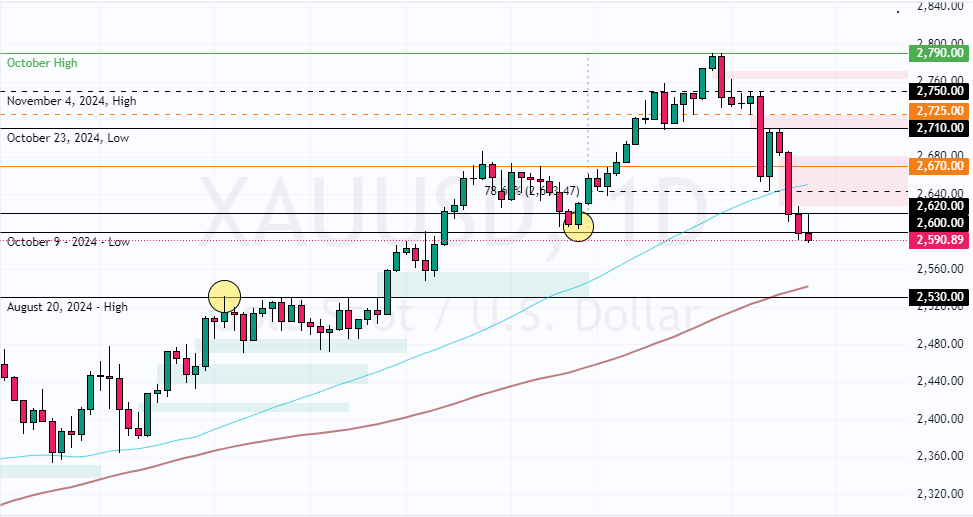

Gold Technical Analysis – 13-November-2024

As of this writing, XAU/USD broke below the $2,600 immediate resistance while the Stochastic Oscillator depicts 16 in the description, meaning an oversold market. The Stochastic’s oversold signal is backed by RSI 14, where the indicator stepped below 30. On the other hand, the Awesome Oscillator histogram changed color to green, but the bars are below the signal line.

These developments in the technical indicators suggest that while the primary trend is bearish, yellow metal can potentially erase some of its recent losses.

Gold Price Forecast – 13-November-2024

From a technical perspective, the downtrend should resume now that gold has broken below the immediate support of $2,600. In this scenario, the next bearish target could be the August 20 high at $2,530.

Please note that the bearish outlook should be invalidated if the XAU/USD price exceeds $2,460 (November 7 Low).

- Support: 2,560 / 2,530

- Resistance: 2,620 / 2,640 / 2,670