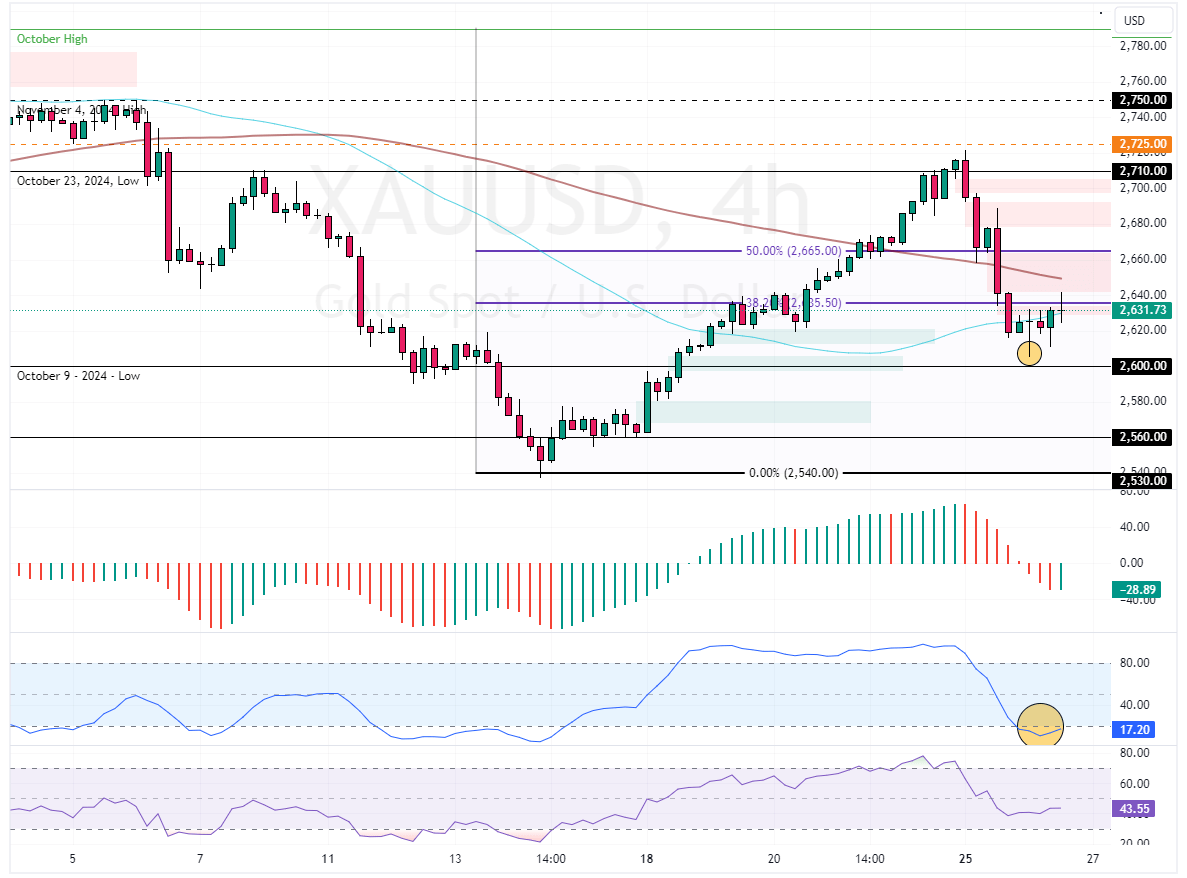

FxNews—Gold prices began a bearish trajectory after failing to surpass the $2,710 resistance. The decline happened because reports suggested that Israel and Hezbollah are close to a ceasefire agreement. This news reduced the demand for gold as a safe investment.

As of this writing, XAU/USD trades at approximately $2,630, stabilizing below the 38.2% Fibonacci support level.

Gold Prices Feel Heat from Trump’s Tariff Plans

Another factor affecting gold was the stronger U.S. dollar. The dollar gained strength after President-elect Donald Trump announced plans to impose a 25% tariff on all imports from Mexico and Canada starting his first day in office. He also proposed an extra 10% tariff on goods coming from China.

The nomination of Scott Bessent as the new Treasury Secretary also influenced gold prices. Bessent supports introducing trade restrictions gradually and is open to negotiating tariff levels with the incoming president.

- Also read: US Gasoline Futures Hit Two-Week High at $2

Investors are now paying attention to the Federal Reserve’s November meeting minutes, which will be released later today. These minutes could offer important insights into the central bank’s future monetary policy.

Gold Technical Analysis

The recent dip in gold prices resulted in the Stochastic Oscillator stepping into the oversold territory, meaning the market is saturated from sellers. The 4-hour chart also formed a bearish fair value gap area, which could absorb the prices like a magnet.

Despite the primary trend, which is bearish because the prices are below the 100-period simple moving average, XAU/USD could rise from this point.

Overall, the technical indicators and chart pattern suggest that while the bear market prevails, gold prices can potentially consolidate before the downtrend resumes.

Will Gold Hit $2,460 and Climb Higher?

The immediate resistance is at $2,460. From a technical perspective, if bulls pull gold prices above this level, they can potentially consolidate near upper resistance levels. In this scenario, the 50% Fibonacci resistance level will likely be revisited.

- Good read: Natural Gas Jumps 5% as Cold Snap Looms

On the other hand, a new bearish wave will likely emerge if bears push XAU/USD below the immediate resistance at $2,600. If this scenario unfolds, prices could dip toward the next supply area at $2,560.