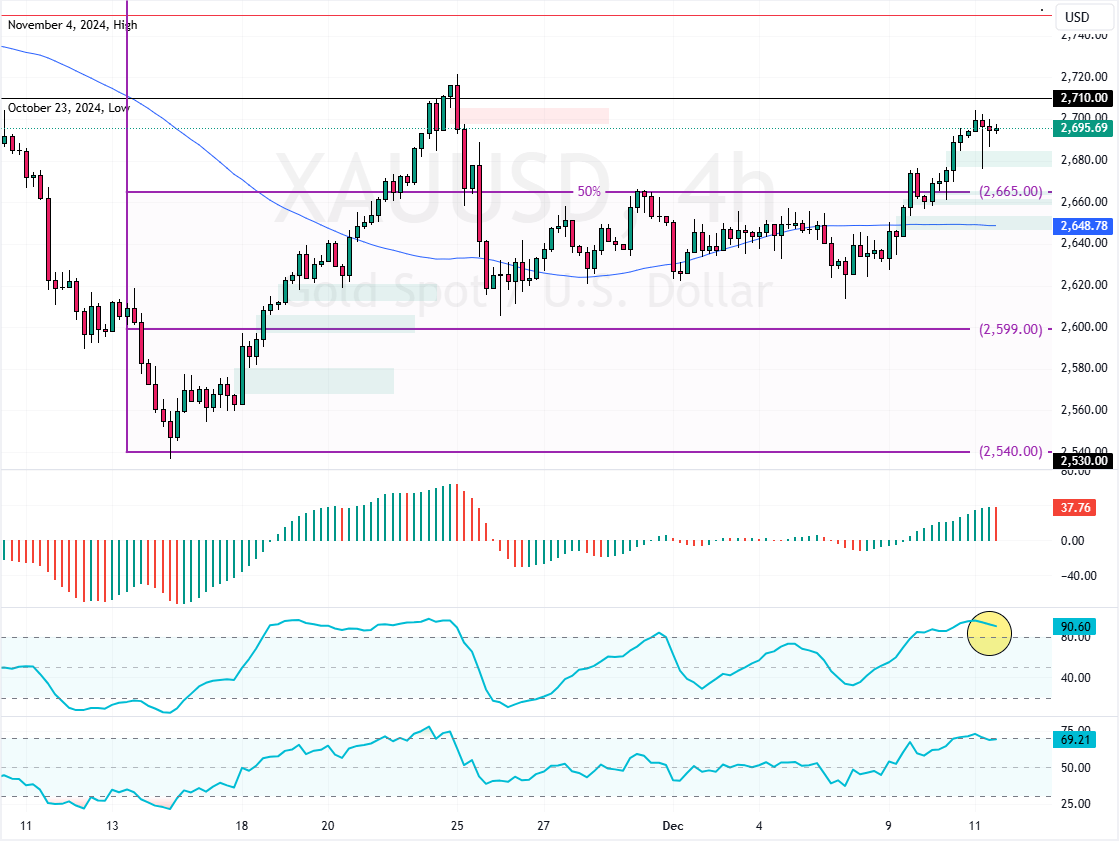

FxNews—Gold hovered near $2,690 per ounce on Wednesday, pausing after two days of gains. This pause came as traders watched closely for upcoming US inflation data. The report could influence the possibility of another Federal Reserve rate cut next week, boosting gold by lowering the cost of holding it.

- Gold hovers around $2,690 per ounce.

- US inflation data may guide the next Fed rate cut.

- Non-yielding assets benefit from lower interest rates.

Central Bank Rate Cuts Support Higher Gold Demand

Major central banks’ expectations of easier monetary policies helped keep the commodity‘s price near its recent highs. The European Central Bank (ECB), Swiss National Bank (SNB), and Bank of Canada (BoC) were all poised to reduce interest rates.

Meanwhile, China announced a more flexible financial approach plan, with the People’s Bank of China (PBoC) resuming gold purchases after a six-month break.

Geopolitical Tensions Boost Safe-Haven Appeal

Rising unrest tensions in the Middle East also strengthened gold’s position as a safe-haven asset. Reports of the Syrian regime’s instability and ongoing Israeli airstrikes increased investor caution.

This intense environment further encouraged traders to seek refuge in gold, reinforcing its status as a stable, long-term store of value.