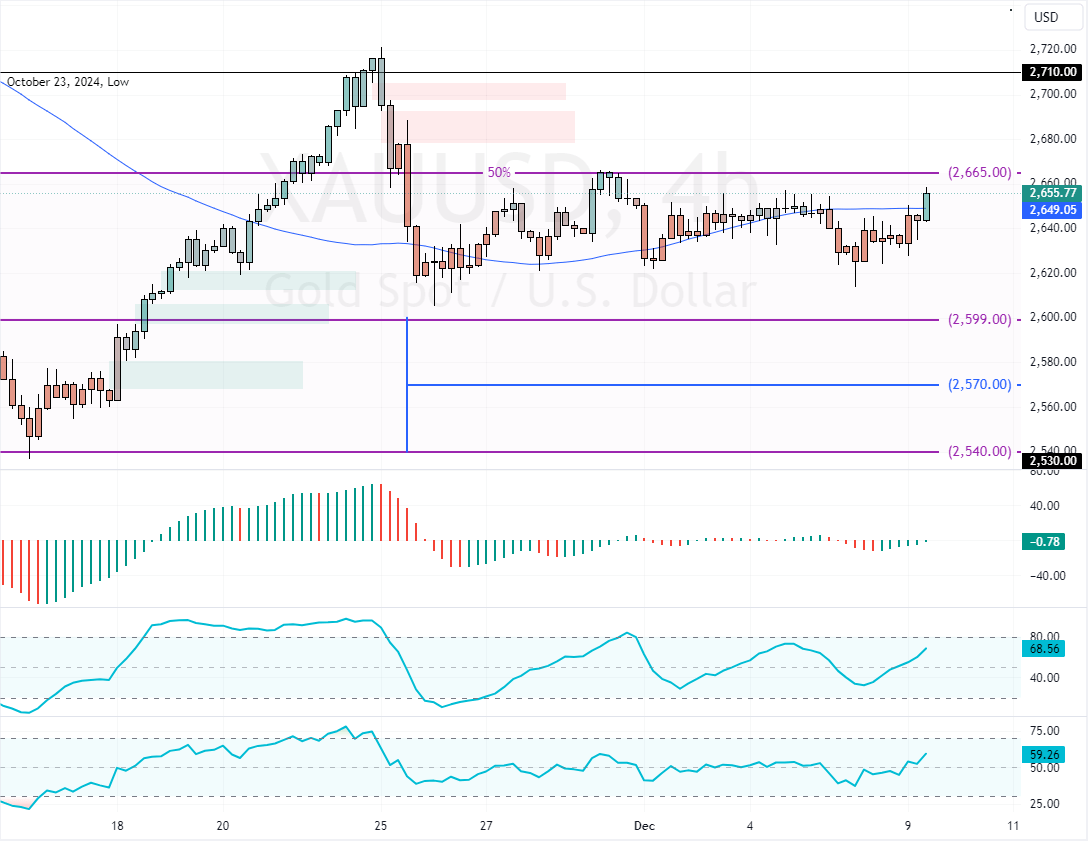

Gold has climbed above $2,640 per ounce, reflecting its role as a safe haven during uncertain times. The Middle East tensions and China’s return to gold buying contributed to this surge. Investors are seeking security, driving the price even higher.

- Gold surpasses $2,640 per ounce

- Increased demand due to Middle East instability

- China resumes purchasing after six-month pause

Middle Eastern Unrest and Chinese Buying Drive Demand

In Syria, rebels recently ended the power of a decades-long ruling family, sparking fears of greater regional instability. Uncertainty in the Middle East tends to push investors toward gold, as it remains a trusted store of value.

Meanwhile, China’s central bank, returning as a gold buyer, has added another layer of support for the rising value of this commodity.

- Also read: Why U.S. Natural Gas Futures Are Rising

US Interest Rate Cuts Further Enhance Gold’s Prices

Recent US job data suggests softer labor conditions, making a Federal Reserve interest rate cut more likely. Lower rates mean holding gold becomes relatively cheaper compared to interest-paying assets.

This shift has drawn even more investors into gold markets, fueling its record-breaking climb.