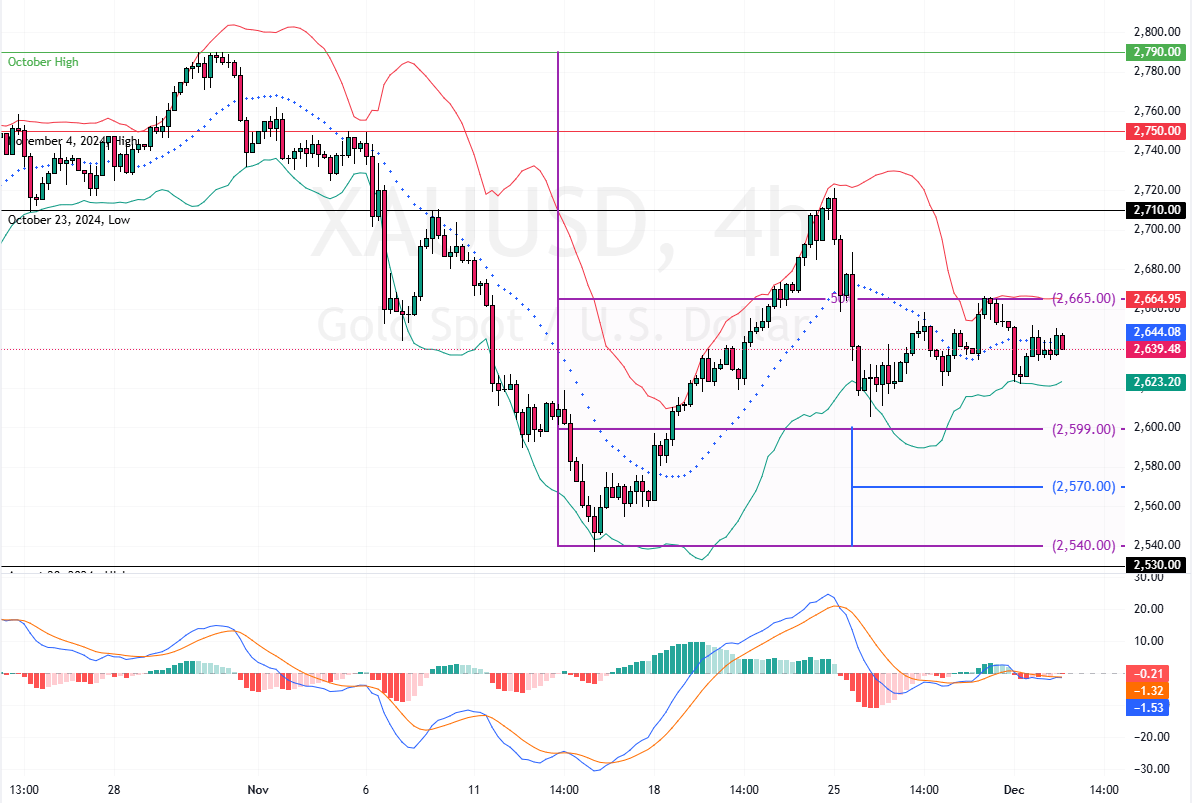

Gold prices remain steady above $2,640/oz as investors await US jobs data and Fed speeches. This fuels rate-cut expectations and boosts appeal amidst Middle East tensions.

- Gold holds steady above the $2,600 resistance

- Investors await key US jobs data

- Federal Reserve speeches anticipated

- Insights into monetary policy expected

- Fed Officials Signal Possible Rate Cut This Month

Gold Prices Steady at $2630 Ahead of Crucial US Jobs Data

On Tuesday, gold prices remained stable above $2,600 per ounce as investors focused on upcoming US employment data and speeches from Federal Reserve officials. These events are expected to provide insights into the central bank’s future monetary policy decisions.

Federal Reserve Governor Christopher Waller indicated support for another rate cut later this month. Similarly, New York Fed President John Williams suggested a gradual shift toward a neutral policy stance. These signals have led investors to increase the probability of a 25 basis point rate cut at the Fed’s December 17-18 meeting, with market expectations now at 75%.

Middle East Tensions Continue to Support Gold Prices

Geopolitical tensions in the Middle East also support gold prices. Despite a ceasefire agreement, ongoing clashes between Israel and Hezbollah are fueling market uncertainties on commodities.

This environment enhances gold’s appeal as a safe-haven asset for investors seeking to mitigate risk.