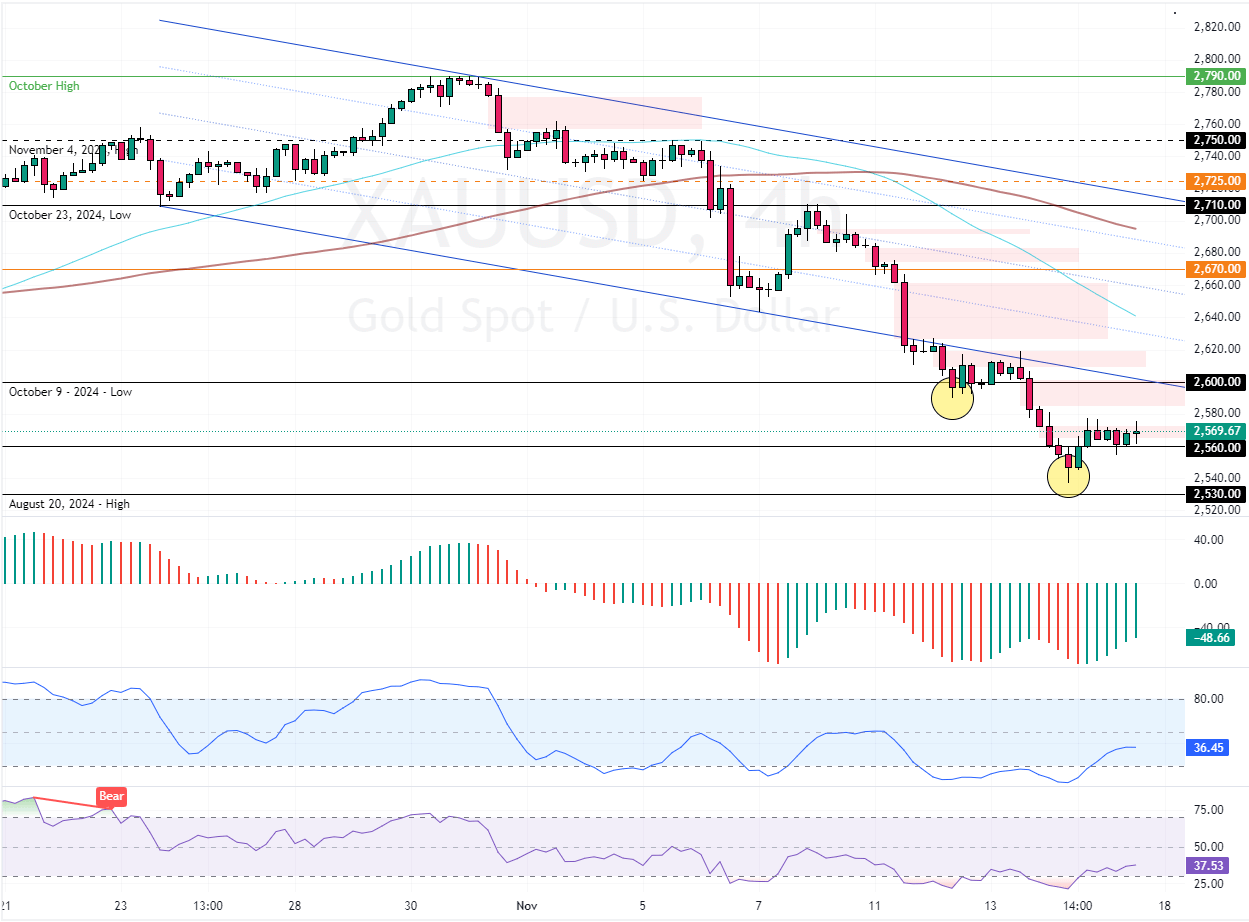

FxNews—Gold is experiencing a weak pullback from $2,530, heading to fill the bearish fair value gap at $2,600. The yellow metal has been trading bearish since the beginning of November, influenced by the stronger dollar and reduced expectations for Fed rate cuts. These events made the precious metals less attractive to investors.

No Rate Cuts Ahead Despite Inflation, Says Fed

Federal Reserve chairman Mr. Power stated earlier that the central bank doesn’t see a need to cut interest rates as the labor market is strong and inflation is persistent. Before Mr. Powel’s speech, investors speculated on rate cuts at 80%, but after his remarks, the expectation decreased to 50%, adding pressure to gold prices.

Furthermore, Trump’s administration aims to increase tariffs, lower taxes, and increase deficit spending, which can result in higher inflation. That said, higher inflation limits the Fed’s ability to reduce borrowing costs.

Gold Technical Analysis – 15-November-2024

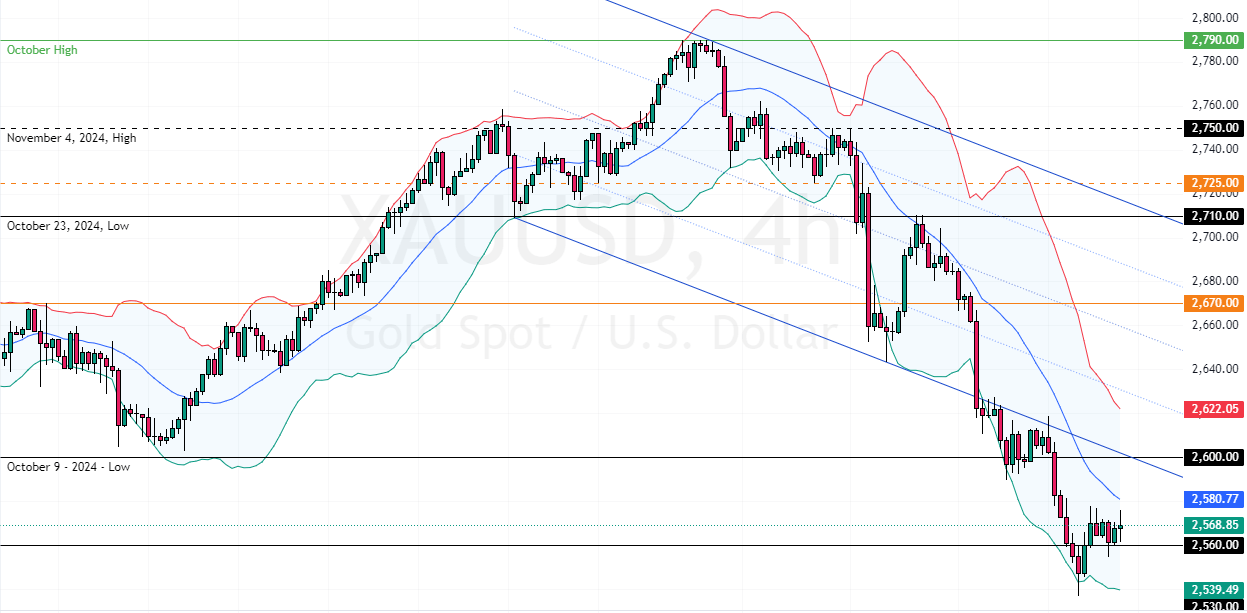

The XAU/USD is in a bear market, below the 50- and 100-period simple moving averages. The trend outlook remains bearish as long as the yellow metal trades below the October 9 low of $2,600.

As for the technical indicators, the momentum tools left the oversold territory today, which resulted in the prices showing some uptick in momentum. However, the market is still oversold, so joining the bears at the current price is not advisable.

We suggest traders and investors wait patiently for the XAU/USD to consolidate near the 2,600 mark, backed by the bearish fair value gap. In this scenario, investors should monitor this resistance area for bearish signals, such as candlestick patterns.

Please note that the bear market should be invalidated if prices exceed $2,600.

- Support: 2,530 / 2,480

- Resistance: 2,600 / 2,670

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.