FxNews—Gold climbed above $2,730 per ounce on Thursday, likely bouncing back after dropping more than 1% in the previous session from its record highs. The earlier decline was due to a stronger US dollar and higher Treasury yields, as there is a growing belief that the Federal Reserve will be cautious about easing monetary policies.

However, gold’s reputation as a safe asset still supports its rise, especially with ongoing conflicts in the Middle East raising fears of a larger crisis.

Additionally, the uncertainty around the upcoming US presidential election and potential monetary easing from major central banks continue to support gold’s rise.

Gold Technical Analysis – 24-October-2024

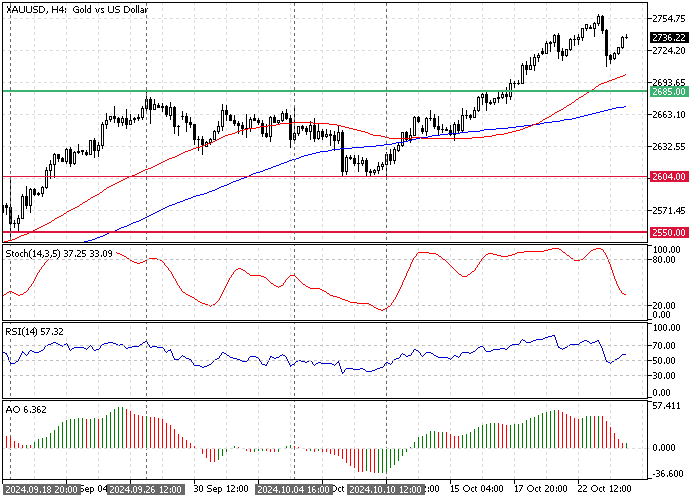

As of this writing, Gold trades at approximately $2,736, approaching the Fair Value Gap, the $2,737 resistance. The primary trend is bullish because the price is above the median line of the Bollinger Bands. On the other hand, the MACD indicators signaled an MA crossover, which could result in the Gold price dipping.

Overall, the technical indicators suggest the main trend is bullish and will likely resume.

Gold Price Forecast – 24-October-2024

Looking at the 4-hour chart, we notice intense buying pressure. Therefore, it is better to wait for XAU/USD to consolidate near $2,685. This supply zone can provide a decent entry point into the bull market with a smaller risk.

Therefore, traders and investors should monitor the $2,685 mark for bullish signals such as a hammer candlestick pattern or bullish engulfing candlestick. You may utilize the Basic Candlestick Patterns Indicator to automatically highlight the patterns on the chart.