Gold tests $2640 resistance, giving back gains from the previous session amid thin holiday trading. Traders continued to await signals about the US economy under the incoming Trump administration. They assessed the Federal Reserve’s monetary policy outlook.

US PCE Data Hints at More Fed Rate Cuts

Recent US PCE inflation data challenged expectations of limited Fed rate cuts next year, suggesting more reductions could be possible, benefiting non-yielding gold.

Meanwhile, gold’s safe-haven appeal remained supported by rising geopolitical risks from the ongoing Russia-Ukraine conflict and tensions in the Middle East.

The commodity remained on track for a sharp 27% gain, its best annual performance since 2010. Central bank purchases, geopolitical tensions, and monetary easing by major central banks drove this.

Gold Technical Analysis – 27-December-2024

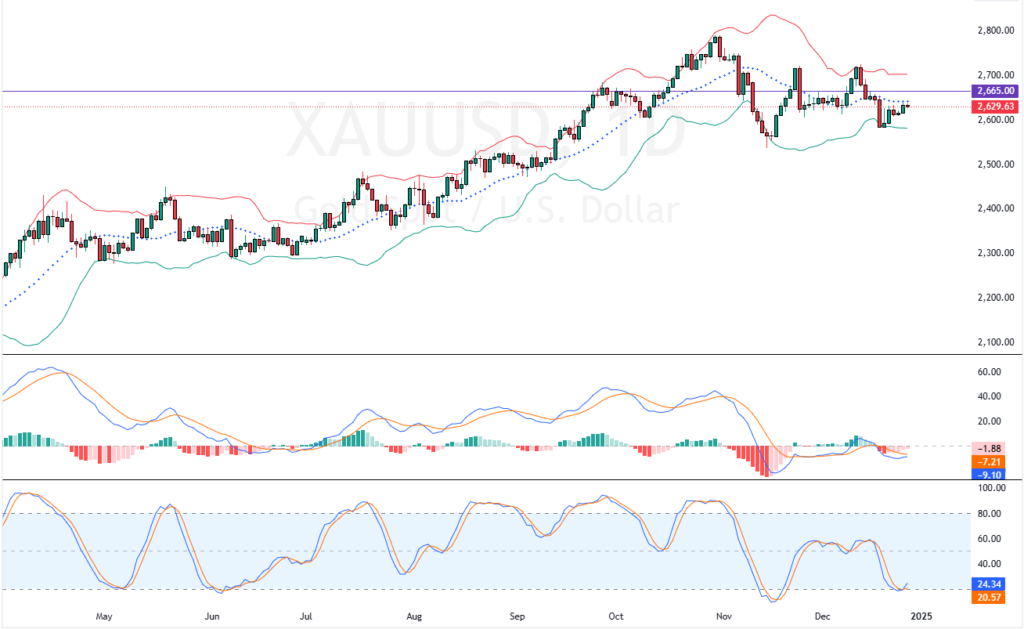

XAU/USD trades bearish, below the 75-period simple moving average and the $2,640 resistance leve. As for the technical indicators, the Stochastic Oscillator stepped down from the overbought territory, signaling the bear market strenghened.

Overall, the technical indicators suggest that the primary trend is bearish and should resume.

Gold tests $2640 resistance: What’s Next?

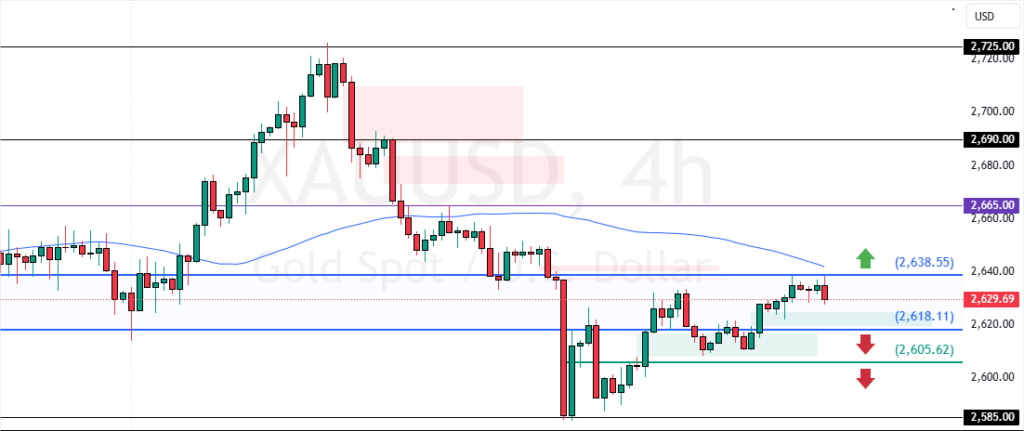

The immediate resistance is at $2,640. From a technical perspective the downtrend will likely extend to lower support levels if the immediate resistance holds firm.

In this scenario, XAU/USD could dip toward $2,618, followed by $2,605. Furthermore, if the selling pressure pushes the prices below $2,605, the bears’ path to $2,585 will likely be paved.

The Bullish Scenario

Please note that the downtrend should be invalidated if Gold’s value climb and stabilize above the $2,640 resistance. If this scenario unfolds, Gold can potentially test the $2,665 resistance.

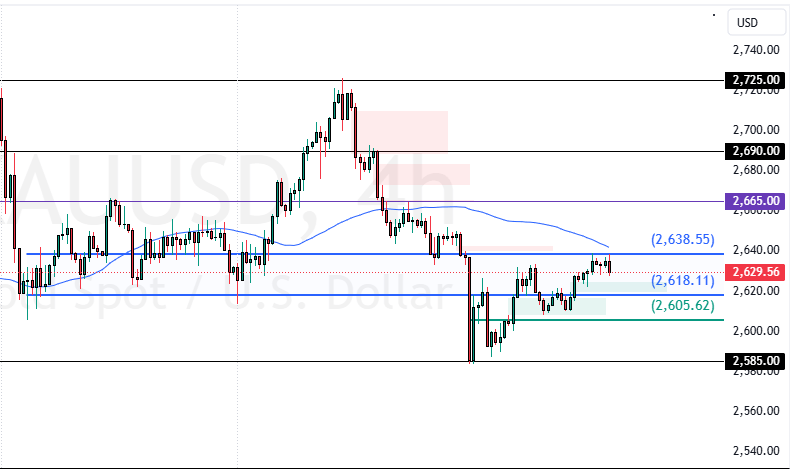

Gold Support and Resistance Levels – 27-December-2024

Traders and investors should closely monitor the below WTI Crude Oil key levels to make informed decisions and adjust their strategies accordingly as market conditions shift.

| Gold Support and Resistance Levels – 27-December-2024 | |||

|---|---|---|---|

| Support | $2,618 | $2,605 | $2,585 |

| Resistance | $2,640 | $2,665 | $2,690 |