FxNews– In light of a series of policy actions, the Chinese economy is showing promising signs of recovery. Coupled with undervalued conditions, appealing valuations, and heightened pessimism, these factors suggest that Hong Kong/China equities, specifically the Hang Seng Index, might be on the brink of a bounce back.

Hang Seng Analysis – Signs of Recovery in The Chinese Economy

Interestingly, China’s recent macroeconomic data has outperformed expectations, as evidenced by the Economic Surprise Index (ESI). The ESI is approaching a neutral state from its mid-2020 lows in July. This improvement is further supported by the NBS manufacturing PMI last month, which hinted at a potential stabilization in manufacturing activity.

Moreover, credit growth, industrial production, and retail sales surpassed expectations in August. At the same time, deflationary pressures are subsiding. This combination increases the likelihood that growth may have reached its lowest point in Q3-2023 due to the momentum of support/stimulus measures. A closer look at the data also reveals potential bright spots in the economy.

The implementation of relief measures has picked up pace in recent months. These include reductions in key policy rates/lending rates, reserve requirement ratio cuts, measures for the property sector, and infrastructure spending. These early signs of a macroeconomic turnaround have prompted some analysts to revise their economic growth forecasts for the current year upwards. However, with ongoing FX outflows and falling home prices, additional fiscal and monetary measures may be necessary to revive the property sector.

Hang Seng Analysis

Meanwhile, based on specific market estimates, the risk barometer for Hong Kong/China equities is high. Historically, similar levels have been associated with positive equity returns over several weeks. However, timing the rebound can be challenging – there is no indication of a downtrend reversal on technical charts.

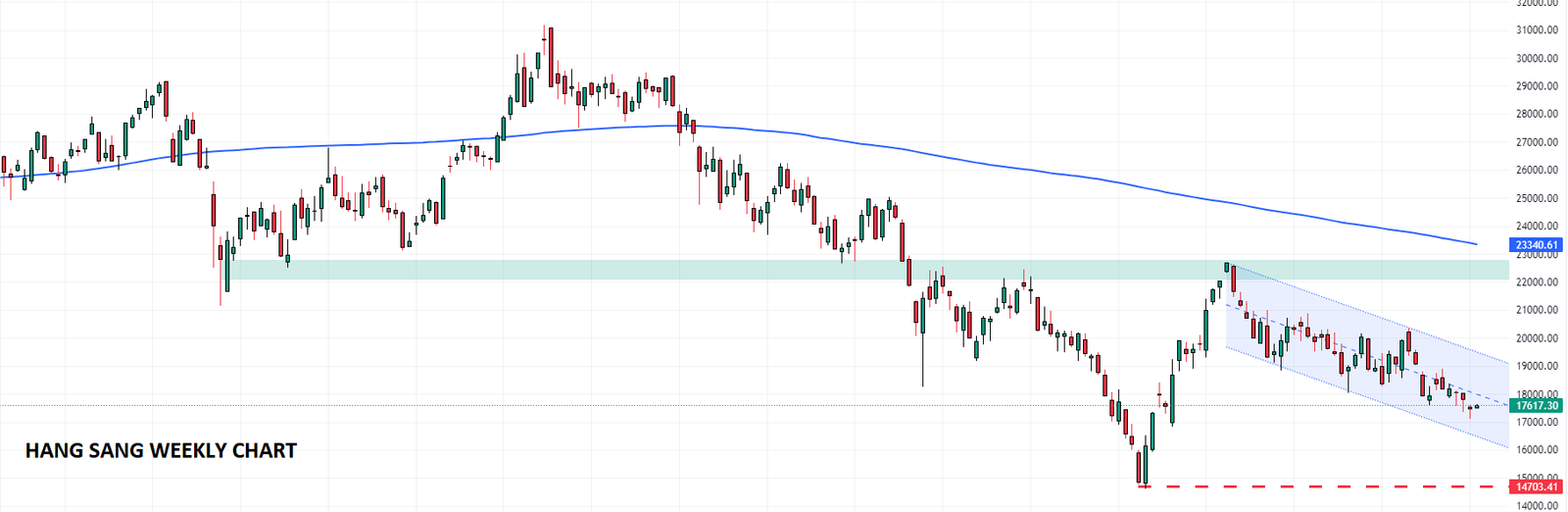

From a broader perspective, monthly charts reveal that since 2020, the index has been guided lower by a declining pitchfork channel. Despite a significant rebound in Q1-2023, the 14-month Relative Strength Index failed to surpass the 50-mark. This suggests that the early 2023 rebound was merely corrective.

On weekly charts, the index is at a critical support area. This includes the May low of approximately 18000 and the lower edge of a declining channel since early 2023 (around 17400). The next support level is at the 2022 low of 14600.

So far, the index has not shown any significant upward momentum. For immediate downside risks to diminish, the Hang Seng index must surpass the early August high of 20,300. Until then, risks are more likely to be on the downside.