FxNews—Inflation goals are becoming increasingly crucial as events in the Middle East develop. Government bonds, usually considered a safe place to put your money, are still playing this role.

Bunds, a type of bond, have seen a significant increase in value, and US markets are expected to do the same. However, the rise in oil prices is causing worry for those in charge of central banks, as it could slow down economic growth.

The Attraction of Bunds and Inflation Goals

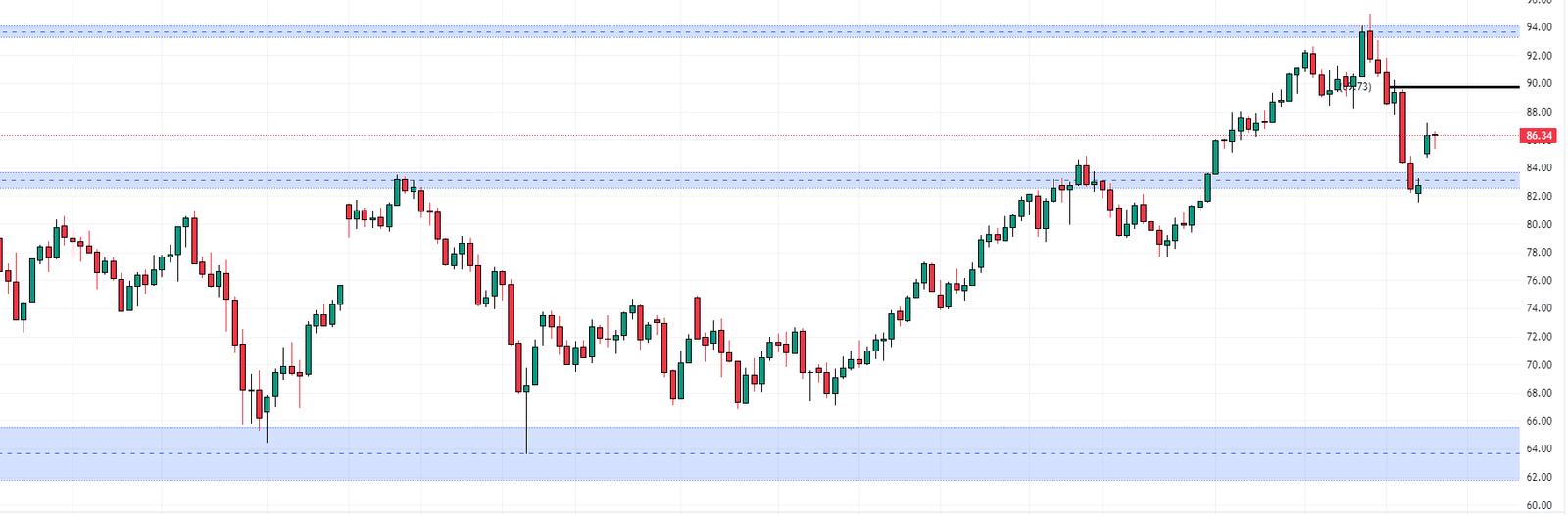

Even though there have been big selloffs recently, Bunds is still a safe place for investors to put their money. As events in the Middle East continue to develop, investors are looking for quality investments, leading to a drop in the yield on the 10-year Bund.

This happened even though oil prices went up by 4%. While energy prices stabilize at these higher levels, shorter-dated inflation swaps increase significantly. This suggests that achieving inflation goals is becoming more complex.

The Problem for Those in Charge of Central Banks

The European Central Bank (ECB) has highlighted that higher oil prices could make it harder to achieve its inflation goals. However, the risk-off tone and the potential slowdown in growth from higher energy prices seem to outweigh front-end pricing. The chance of another ECB hike is almost zero, suggesting that inflation goals are becoming more critical.

Interestingly, part of the yield rally has been attributed to more dovish comments from Federal Reserve’s Lorie Logan. She suggested that the Fed may see less need to raise rates further after the rise in yields as a higher term premium could help cool the economy.

Sovereign Spreads Widen

Sovereign spreads over Bonds have widened, with Italian bonds performing the worst. However, they were not alone in this general widening. By the end of the day, the critical 10-year spread for Italy had widened by 4bp, but Spain was not far behind, widening by 3bp. This points more to a general risk-off notion than an Italy-focused widening.

However, spread levels for 10-year Italy above 200bp have ECB officials taking a closer look and cooling on ending PEPP reinvestments early. A Reuters story cited officials suggesting that the widening was justified as a fair reaction to the government’s fiscal policies. Only one thought a discussion about TPI when levels were to reach 250bp would be more appropriate.

In conclusion, while there seems to be some reluctance by the ECB to step in actively, there is more potential for widespread widening due to lingering fiscal concerns. If the nature of further widening changes – i.e., driven more by general risk-off sentiment – then this may lead to a rethink on deploying the first line of defense.

J.J Edwards is a finance expert with 15+ years in forex, hedge funds, trading systems, and market analysis.