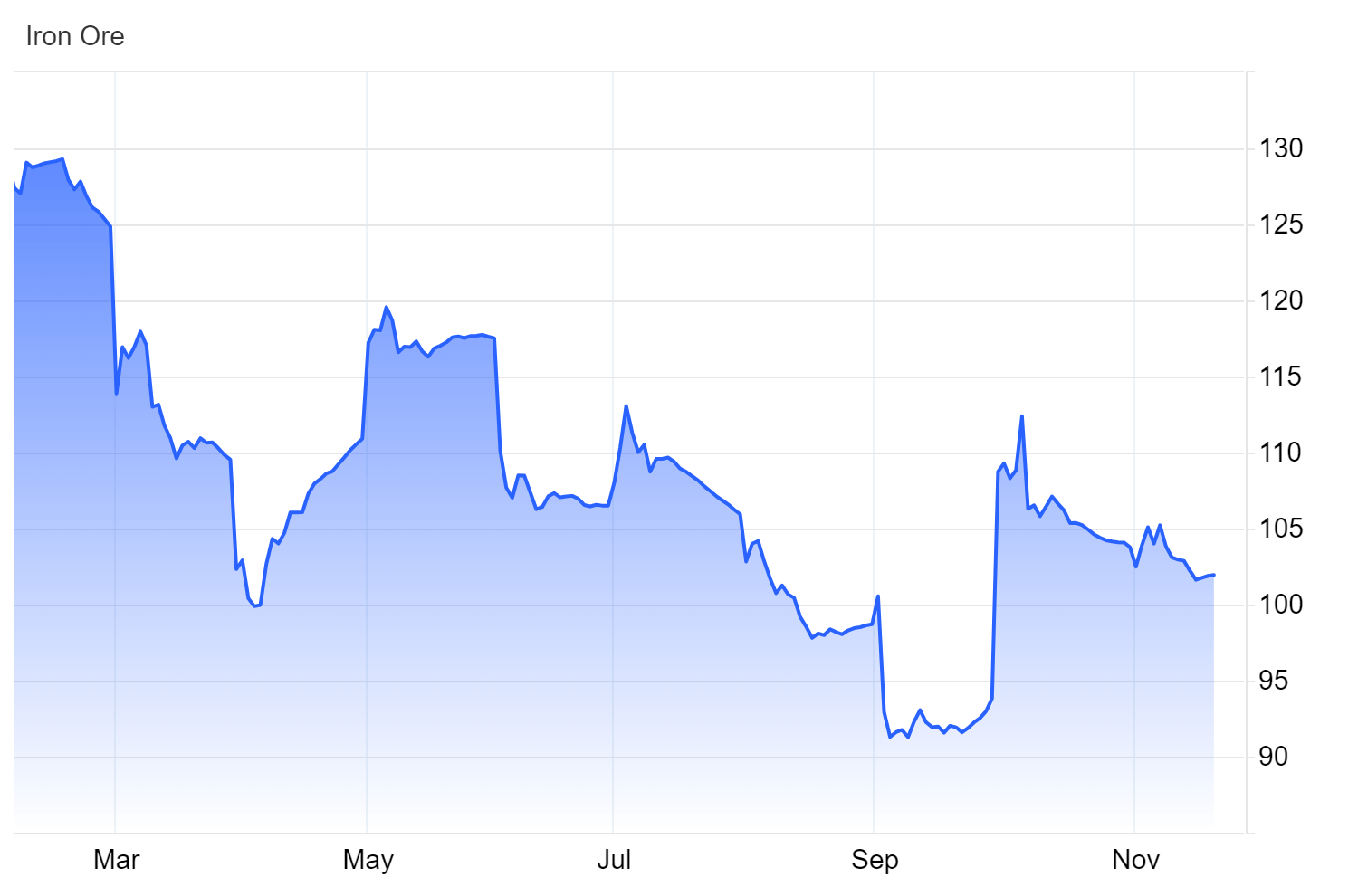

Iron ore prices for cargoes containing 62% iron have climbed to nearly $102 per tonne, reversing recent declines. This increase is fueled by renewed optimism for demand from China, the world’s leading commodity consumer.

In Guangzhou, for instance, the program for buying older apartments has been expanded. This expansion is likely to boost the need for construction materials such as iron ore.

China Maintains Lending Rates as Iron Ore Stocks Grow

Simultaneously, China’s central bank decided to keep its key lending rates the same this week. This move was anticipated and did not significantly alter the demand outlook for metals in China, the largest market for such products.

On the other hand, there is news of increased iron ore shipments from major suppliers like Australia. Additionally, the growth in iron ore stockpiles at Chinese ports still exerts downward pressure on prices.