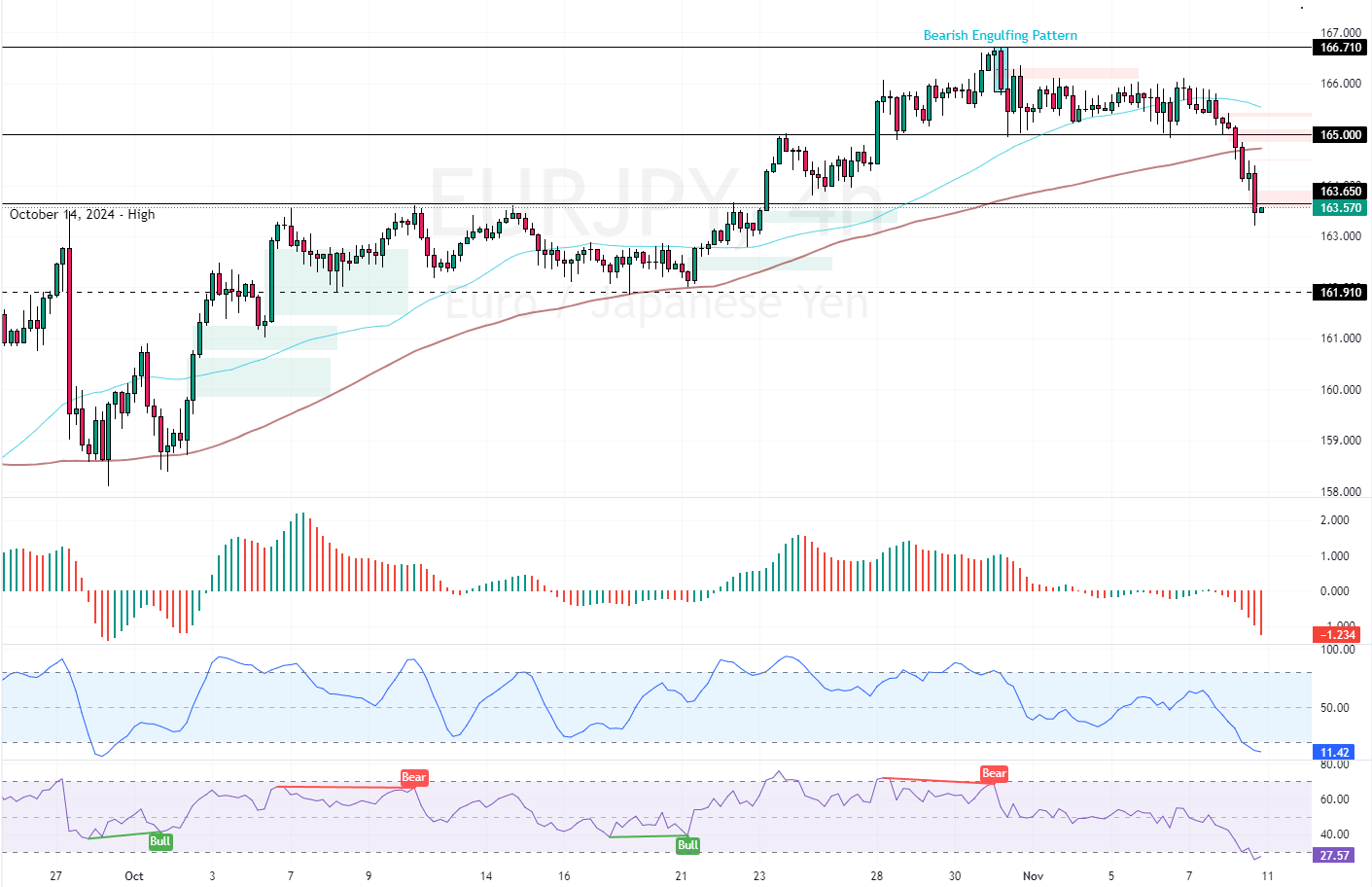

FxNews—The European currency lost its bullish momentum against the Japanese yen after it peaked at 166.7. Consequently, the currency pair consolidated in a narrow range (between the 166.7 resistance and 165.0 support) until today, when the bears pushed the price below the 165.0 critical support.

As of this writing, the EUR/JPY currency pair is trading at approximately 163.5, trying to stabilize below the October 14 high.

EURJPY Technical Analysis – 8-November-2024

The 4-hour chart shows that the momentum indicators signal that the Japanese yen is overpriced or that EUR/JPY is oversold. The Stochastic oscillator hovers below 20, suggesting an oversold market. This signal is supported by the RSI (14), which indicates a reading of 25, suggesting that the EUR/JPY could bounce from this level or begin a consolidation phase.

Overall, the technical indicators suggest a bearish primary trend since the price is below the 100-period simple moving average, but the EUR/JPY has the potential to consolidate or reverse.

EURJPY Forecast – 8-November-2024

As elaborated earlier in this technical analysis, the EUR/JPY is oversold. Therefore, going short at the current price is not advisable because the price could bounce at this stage.

That said, analysts at FxNews anticipate that EUR/JPY has the potential to rise and fill the fair value gap at approximately 163.9. This minor resistance level could provide a decent entry point for joining the bear market, with a target at the 78.6% Fibonacci level (162.9).

- Next read: EURUSD Drops to 1.066 After Bulls Lose Steam.

However, if EUR/JPY exceeds the minor resistance at 163.9, the 50% Fibonacci retracement level could be the next bullish target. Additionally, the bearish outlook should be invalidated if the EUR/JPY price exceeds 164.3 (50% Fibonacci).

- Support: 162.8 / 161.9

- Resistance: 163.9 / 164.3 / 165