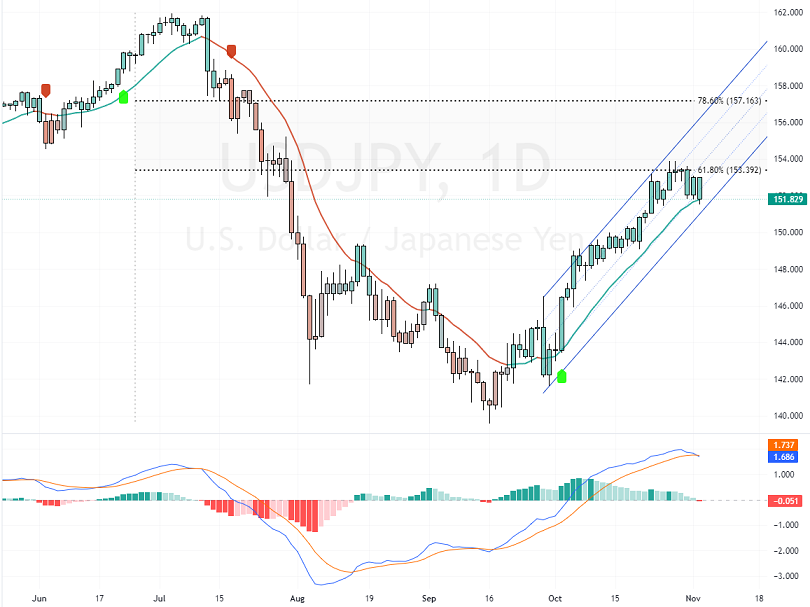

FxNews—The U.S. dollar trades bullish against the Japanese yen, but the uptrend eased when the price reached the daily 61.8% Fibonacci retracement level at 153.3. As of this writing, the currency pair trades at approximately 151.9, testing the ascending trendline as support.

The USD/JPY daily chart below demonstrates the key support and resistance levels, as well as the technical indicators utilized in today’s analysis.

USDJPY Technical Analysis 4-October-2024

Zooming into the 4-hour chart, we notice the price is above the 100-period simple moving average, indicating the primary trend is bullish. Furthermore, the Stochastic Oscillator record shows 15, meaning the Japanese yen is overpriced in the short term.

That said, the Awesome Oscillator histogram is red, below the signal line, which indicates that the bear market should prevail.

Overall, the technical indicators suggest that while the primary trend is bullish, the USD/JPY price is in an oversold condition, which could cause the market to turn bullish from this point.

USDJPY Forecast – 4-November-2024

The immediate support level is the 23.6% Fibonacci retracement level of the 4-hour chart, the 151.0 mark. The market outlook remains bullish as long as USD/JPY exceeds that support, backed by the 100-SMA and the ascending trendline.

Furthermore, the immediate resistance level is at the November 1 high, 153.0. The uptrend should resume if bulls pull USD/JPY above this mark. In this scenario, the uptrend will likely resume, and the next bullish target could be the 78.6% Fibonacci retracement level at 157.1.

Please note that the bullish strategy should be invalidated if the USD/JPY price falls below the 151.0 support.

Bearish Scenario

If bears (sellers) close and stabilize USD/JPY below the immediate support 151.0, the current downtick momentum would extend to the next Fibo level, at 149.2.

USDJPY Support and Resistance Levels – 4-November-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 151.0 / 149.2

- Resistance: 153.0 / 153.9 / 157.1