FxNews—The Litecoin market is bearish, testing the October 25 low at $67 as support, backed by the 61.8% Fibonacci retracement level. As of this writing, LTC/USD trades bearish at approximately $67,8, forming a double bottom pattern.

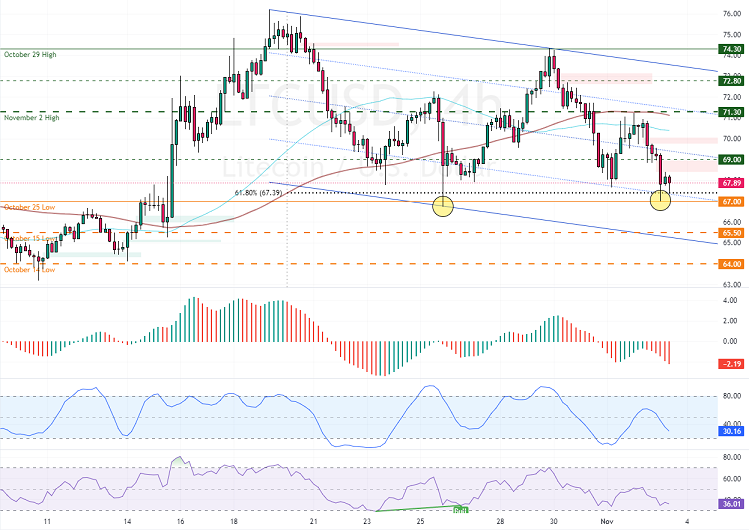

The Litecoin 4-hour price chart below demonstrates the price, support, and resistance levels, as well as the technical indicators utilized in today’s analysis.

Litecoin Technical Analysis – 3-October-2024

From a technical perspective, the primary trend should be considered bearish because LTC/USD is below the 50- and 100-period simple moving averages. In addition to the moving averages, the Awesome Oscillator hovers below the signal line with a red histogram, meaning the bearish trend should prevail.

Furthermore, the Stochastic Oscillator and RSI 14 declined but were not oversold, suggesting the downtrend could resume.

Overall, the technical indicators suggest the primary trend is bearish and should resume.

Litecoin Forecast – 3-October-2024

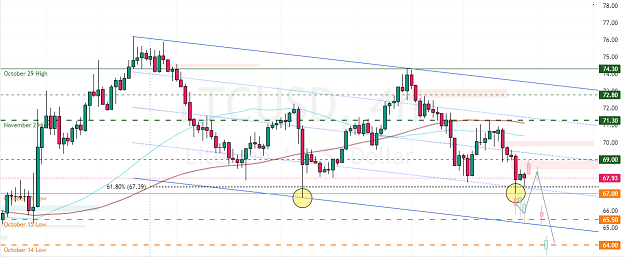

The downtrend that began on October 29 will likely resume if bears close and stabilize the Litecoin price below the critical $67.0 support. In this scenario, the next bearish target could be $65.5, followed by the October 14 low, $64.0.

Please note the downtrend trigger depends on whether bears push the price below the immediate support at $67.00. That said, the bearish outlook should be invalidated if LTC/USD exceeds $69.0, the Fair Value Gap resistance area.

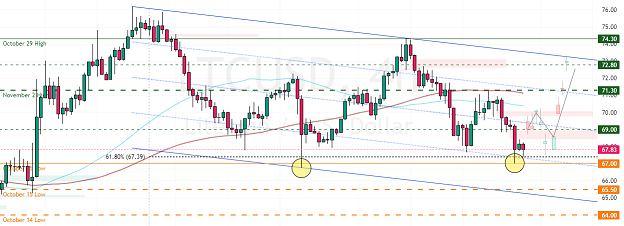

Litecoin Bullish Scenario

If Litecoin’s value exceeds $69.0, the bullish double-bottom pattern will likely come into play. If this scenario unfolds, the current pullback could extend to the November 2 high at $71.3. Furthermore, if the buying pressure exceeds $71.3, the bulls’ path to $72,8 will likely be paved.

Litecoin Support and Resistance Levels – 3-November-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 67.0 / 65.5 / 64.0

- Resistance: 69.0 / 71.3 / 72.8