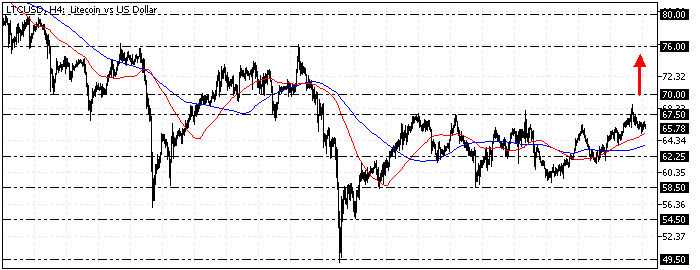

FxNews—Litecoin bulls are trying to stabilize the price above the descending trendline and the 100-period simple moving average. As of this writing, the LTC/USD price dipped below the moving average and the $67.5 immediate resistance.

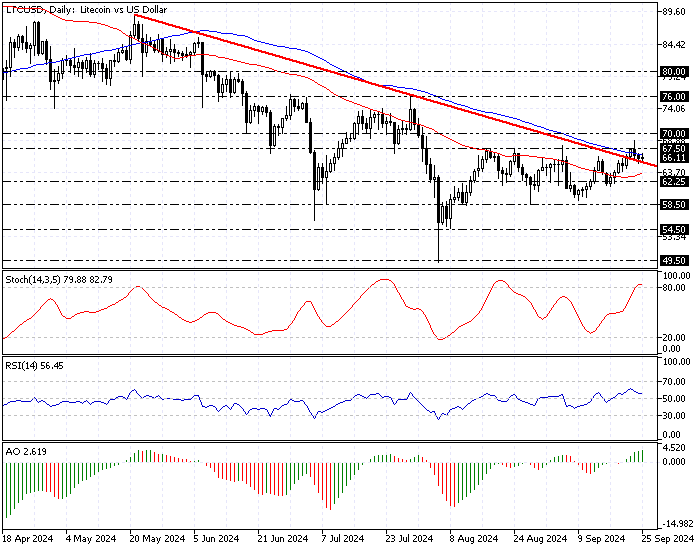

The daily chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

Litecoin Technical Analysis – 25-September-2024

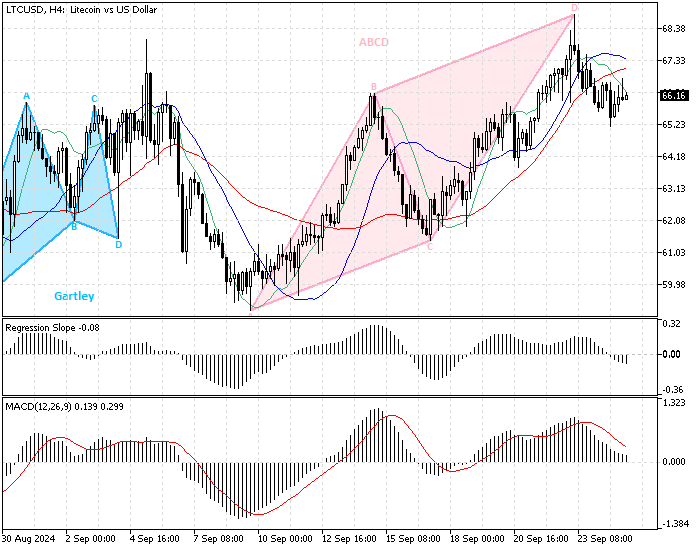

Zooming into the 4-hour chart, we notice it formed an ABCD harmonic pattern, as the image above shows. Additionally, the MACD indicator approaches the signal line from above, meaning the bear market is gaining strength.

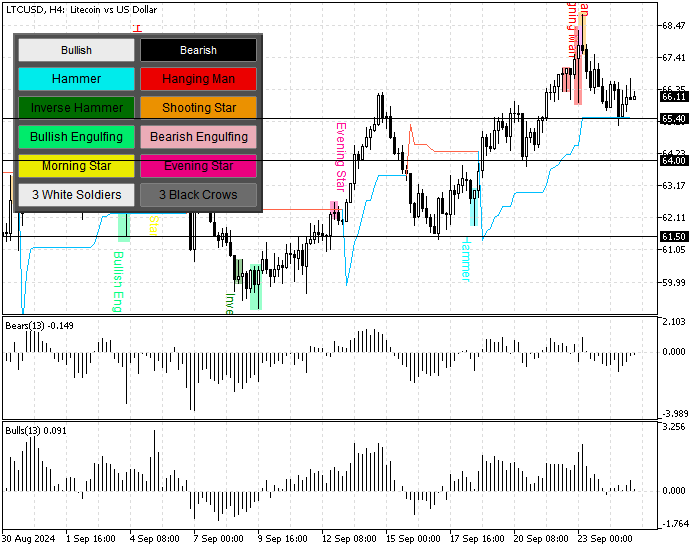

As for the candlestick pattern, the chart also formed another bearish signal: a bearish hanging man and a shooting star candlestick pattern, signaling that the downtrend will likely resume.

Overall, the technical indicators and the price action patterns suggest the Litecoin trend has the potential to reverse from a bull market to a bear market.

Litecoin Forecast – 25-September-2024

The immediate support is $65.4, which is a level that neighbors the September 20 high. If bears (sellers) close and stabilize the price below $65.4, the LTC/USD price will likely dip to the next support area at $64 (September 20 Low).

Furthermore, if the selling pressure drives the price below $64, the downtrend could extend to the September 17 low at $61.5.

Litecoin Bullish Scenario – 25-September-2024

If the bulls (buyers) close above the immediate resistance at $67.5, the uptick momentum that began this month could target $70, followed by the July 29 high at $76.0.

Please note that the bull market should be invalidated if the Litecoin price dips below the $65.4 support.

Litecoin Support and Resistance – 25-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $62.25 / $58.5 / $54.5

- Resistance: $67.5 / $70.0 / $76.0