FxNews—On Thursday, WTI crude oil futures increased toward $72 per barrel. This rise comes after the price fell by more than 1% the day before. The focus has returned to the ongoing unrest in the Middle East.

Despite peace efforts, persistent heavy fighting has kept investors cautious. Investors are keeping an eye on possible interruptions in oil supply from the Middle East and are waiting to see how Israel will react to Iran’s recent missile strike.

Oil Faces Pressure from Rising Dollar and U.S. Stockpiles

At the same time, oil prices faced downward pressure due to a significant and unexpected increase in U.S. oil inventories. The Energy Information Administration reported a rise of 5.5 million barrels, much higher than the expected 0.7 million barrel increase.

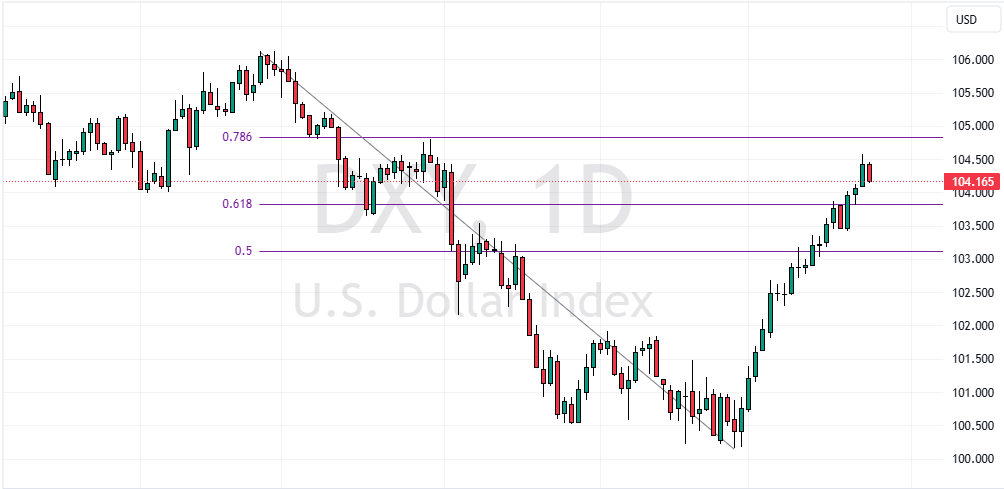

Moreover, the dollar index, which measures the dollar’s strength against a basket of currencies, reached its highest point since late July on Wednesday, making Oil priced in dollars less attractive.

- Editor’s pick: Gasoline Prices Steady Amid Global Oil Turmoil

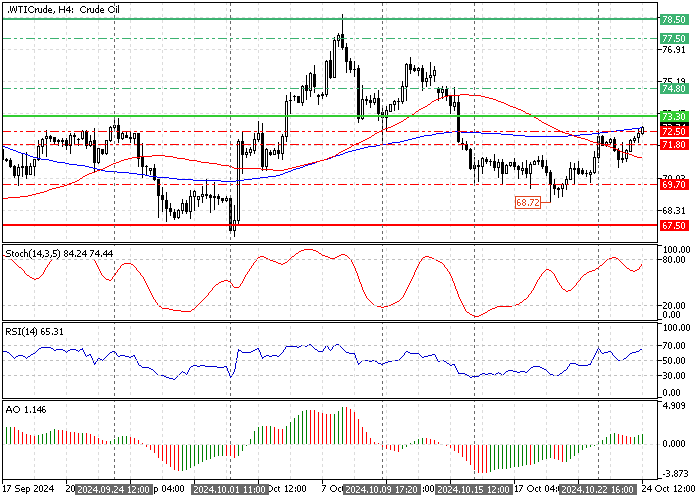

Crude Oil Technical Analysis – 24-October-2024

Oil trades slightly Above the October 22 high at $72.5, aiming toward the critical resistance of $73.3 (September 24 High). The Awesome Oscillator histogram is green, above the signal line, meaning the bull market strengthens.

Additionally, the AO’s signal is backed by the Relative Strength Index (RSI 14), where the indicator depicts 65 in the description, signaling the price could rise further. That being said, the Oil price is below the 100-period simple moving average, making the outlook market bearish.

Overall, the technical indicators suggest the primary trend is bearish, but the price can rise toward the critical resistance level at $73.3.

Crude Oil Price Forecast – 24-October-2024

From a technical perspective, the primary trend remains bearish as long as the price is below the 100-period SMA and the $73.3 resistance. But, we have bullish signals from both fundamental and technical indicators.

Therefore, the bullish wave from $68.7 could extend to the $74.8 resistance if buyers close and stabilize the Oil price above the 100-SMA or the $73.3 mark. If this scenario unfolds, the immediate support for the bullish scenario will be the 100-period SMA.

Crude Oil Bearish Scenario

Conversely, if bulls fail to surpass the $73.3 resistance, a new bearish wave will likely form. In this scenario, the market outlook will remain bearish, and Oil could dip and revisit the October 15 low at $69.7.

Crude Oil Support and Resistance Levels – 24-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $71.8 / $69.7 / 67.5

- Resistance: $73.3 / $74.8 / $77.5