FxNews—U.S. natural gas futures have risen toward $2.8 per million British thermal units (MMBtu). This uptick is due to expected higher demand as colder weather begins and production decreases. When temperatures drop, gas consumption usually increases, leading to higher prices.

Natural Gas Export Surge Signals Strong Demand

In addition, U.S. liquefied natural gas (LNG) export activity has increased. Last Friday, daily gas flows to export facilities reached a 10-month high. So far in November, natural gas exports to the seven major LNG plants averaged 13.3 billion cubic feet per day (bcfd), up from 13.1 bcfd in October. This rise indicates stronger international demand for U.S. natural gas.

Meanwhile, natural gas production in the Lower 48 states has declined. It decreased to 100.3 bcfd in November from 101.3 bcfd in October.

Furthermore, recent Energy Information Administration (EIA) data showed that U.S. utilities added 42 billion cubic feet of gas to storage in the week ending November 8. This addition leaves gas inventories 6.1% above the typical level for this time of year.

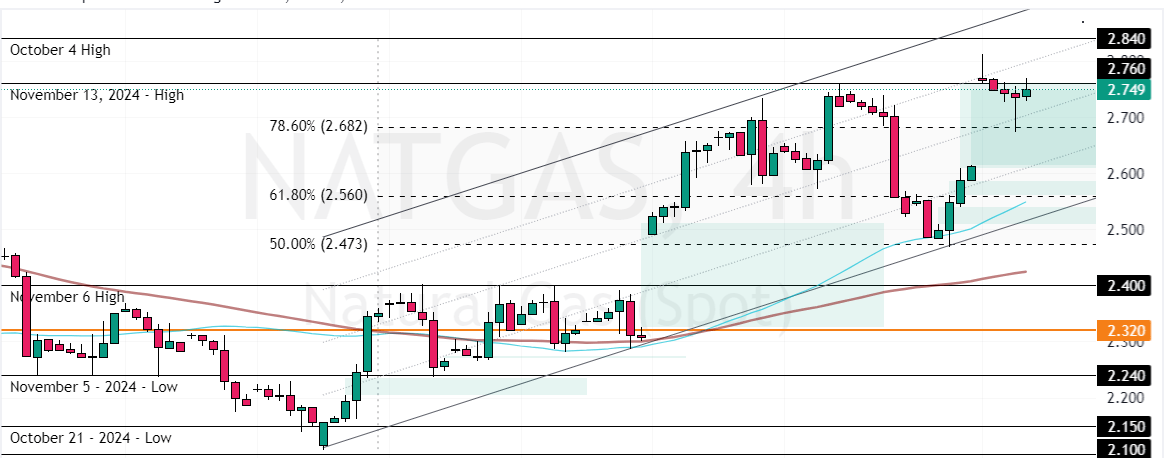

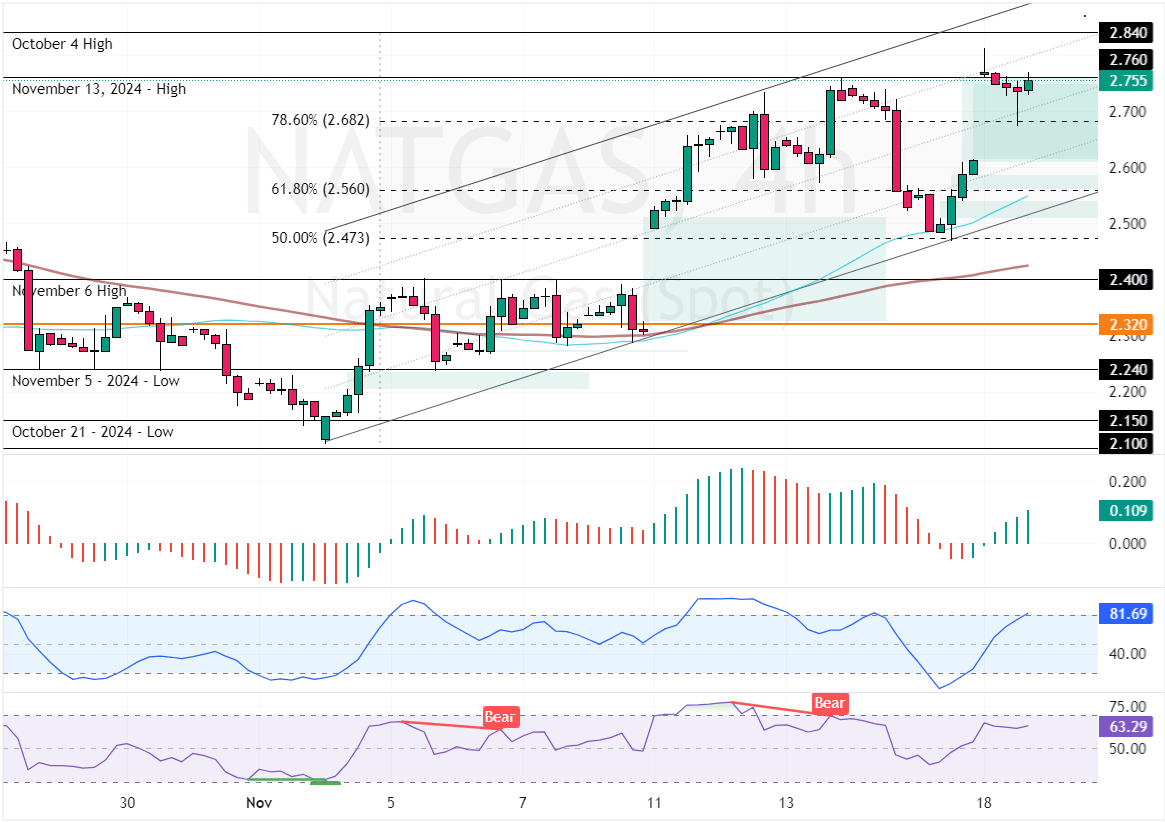

NATGAS Technical Analysis

As of this writing, NATGAS traded at approximately $2.75 and tested the November 13 high as resistance. The technical indicators show prices above the 50-period simple moving average, meaning the primary trend is bullish. However, the Stochastic Oscillator stepped above 80, depicting 81 in the description, indicating an overbought market.

Overall, the technical indicators suggest while the primary trend is bullish, the NATGAS prices could consolidate before the uptrend resumes.

U.S. Natural Gas Price Forecast

The immediate resistance is at $2.75. From a technical perspective, a new bullish wave will likely begin if buyers close and stabilize the price above the resistance. In this scenario, the NATGAS prices can rise toward $3.0.

On the other hand, a consolidation phase could be triggered in case bears (sellers) push the market below the immediate resistance ($2.68), the 78.6% Fibonacci level. If this scenario unfolds, the NATGAS prices might decline to $2.56, backed by the bullish fair value gap and the 61.8% Fibonacci level.

- Support: 2.68 / 2.56 / 2.47

- Resistance: 2.76 / 2.84 / 3.0