FxNews—Natural gas prices in the U.S. have fallen below $2.6 (78.6% Fibonacci retracement level) per million British thermal units (MMBtu), easing after a 9% spike on Monday.

Traders are now looking forward to a report from the Energy Information Administration (EIA) due on Thursday. They expect utilities to add more gas to storage last week than usual. Currently, gas storage levels are about 6% higher than the average for this time of year. If this trend continues, it will be the fourth consecutive week of larger-than-normal storage increases—a pattern last seen in October 2022.

Expect Warmth Until November 20 Amid Heating Spike

Even though heating demand is expected to rise later in November as colder weather arrives, weather forecasts predict warmer-than-usual temperatures through November 20. From November 21 to 27, temperatures are anticipated to return to average levels.

U.S. Gas Production Hits 9-Month Low This November

At the same time, gas production has decreased. In November, the average gas output in the continental U.S. was 100 billion cubic feet per day (bcfd), down from 101.3 bcfd in October and below the record high of 105.3 bcfd set in December 2022.

Production dropped to 98.3 bcfd on Tuesday, marking a nine-month low. This decline was partly due to disruptions caused by Hurricane Rafael in the Gulf of Mexico.

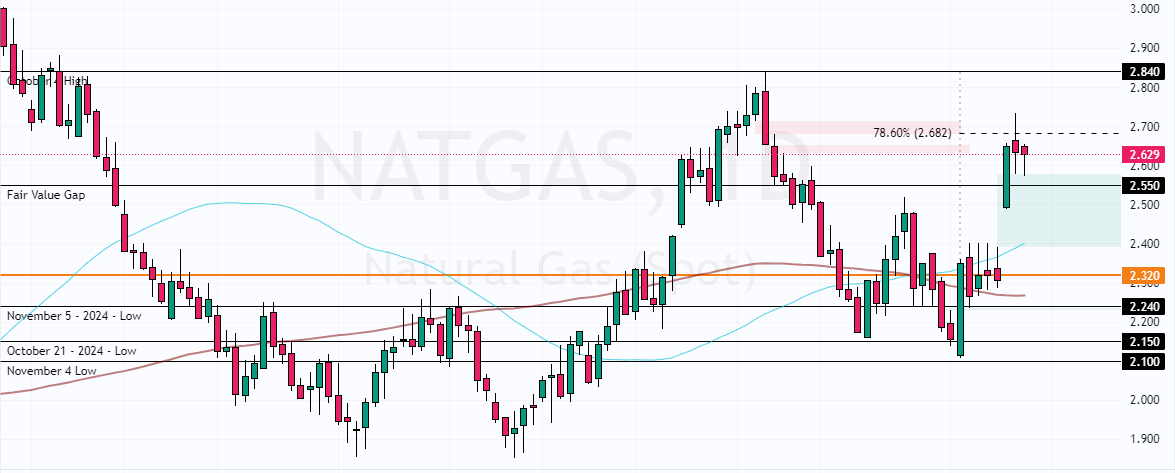

NATGAS Analysis – 13-November-2024

The primary trend is bullish because prices exceed the 100-period simple moving average. But, the uptrend eased when NATGAS hit the 78.6% Fibonacci retracement level at $2.68. Interestingly, today’s decline resulted in the prices filling the Fair Value Gap at approximately 2.55, providing new bids to NATGAS buyers.

As for the technical indicators, the Awesome Oscillator histogram is red, above zero, but declining. The same goes for the Stochastic Oscillator, which depicts 55 in the description after the indicator returns from overbought territory, meaning the bull market weakens.

On the other hand, the RSI 14 is above the median line, meaning the bull market should prevail.

Overall, the technical indicators suggest the primary trend is bullish, but the NATGAS prices have the potential to dip further.

- Good reads: Expect Lower Gasoline Rates Below $1.97

NATGAS Price Forecast – 13-November-2024

The immediate resistance is at $2.55. As long as the NATGAS prices are above this level, the trend outlook should remain bullish. That said, the immediate resistance rests at the 78.6% Fibonacci retracement level.

From a technical perspective, the uptrend should resume if NATGAS stabilizes above $2.68. In this scenario, the next bullish target could be the October high at $2.84.

Conversely, the bullish outlook should be invalidated if bears (sellers) push NATGAS below the immediate support ($2.55). If this scenario unfolds, a new consolidation phase could emerge, extending the downtick momentum to $2.4, the November 6 high.

- Support: 2.55 / 2.40

- Resistance: 2.68 / 2.84