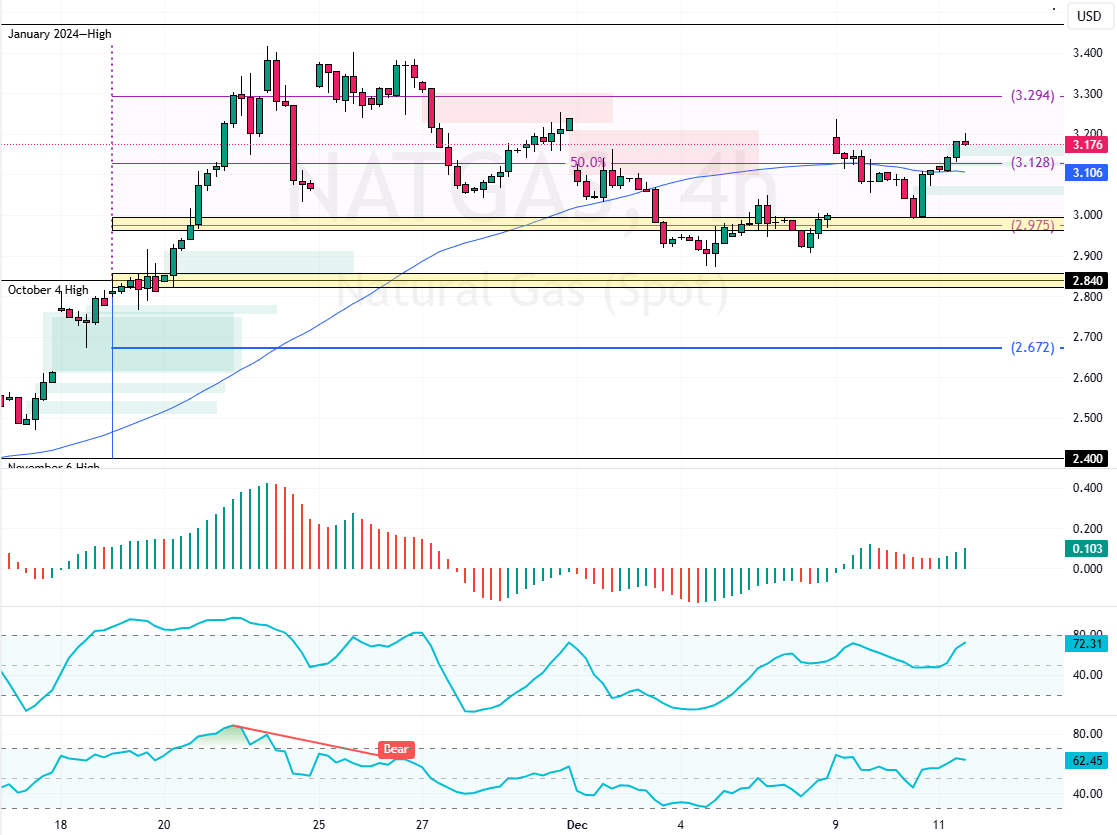

FxNews—U.S. natural gas began a bullish wave from $2.97, shifting prices above the 75-period simple moving average. As of this writing, NATGAS trades at approximately $3.18, stabilizing its recent gains. With critical support at $2.97, prices are likely to target the $3.29 resistance.

This recovery stems from stronger-than-expected domestic and export demand, helping prices surpass last week’s losses.

- Futures recover after a 7.8% drop.

- Stronger demand offsets warm-weather forecasts.

- Prices rise above $3.2/MMBtu.

Boosted by Rising LNG Feedgas Volumes

While milder temperatures may reduce heating needs, the market is supported by higher natural gas deliveries to major LNG export plants.

Feedgas volumes have climbed from November’s average of 13.6 billion cubic feet per day to nearly 14.2 billion cubic feet per day in early December. These strong flows are pushing LNG exports toward record highs.

Growing Supply and Adjusted Inventories

On the supply side, production in the Lower 48 states has reached over 102 billion cubic feet per day this December, up from last month’s output. Analysts predict even higher production rates in 2025, driven by global demand and resilient pricing.

Meanwhile, recent data from the Energy Information Administration show inventories at around 3,937 billion cubic feet, following a storage withdrawal of 30 billion cubic feet. Supply and inventory level shifts will likely shape pricing and market behavior in the coming months.