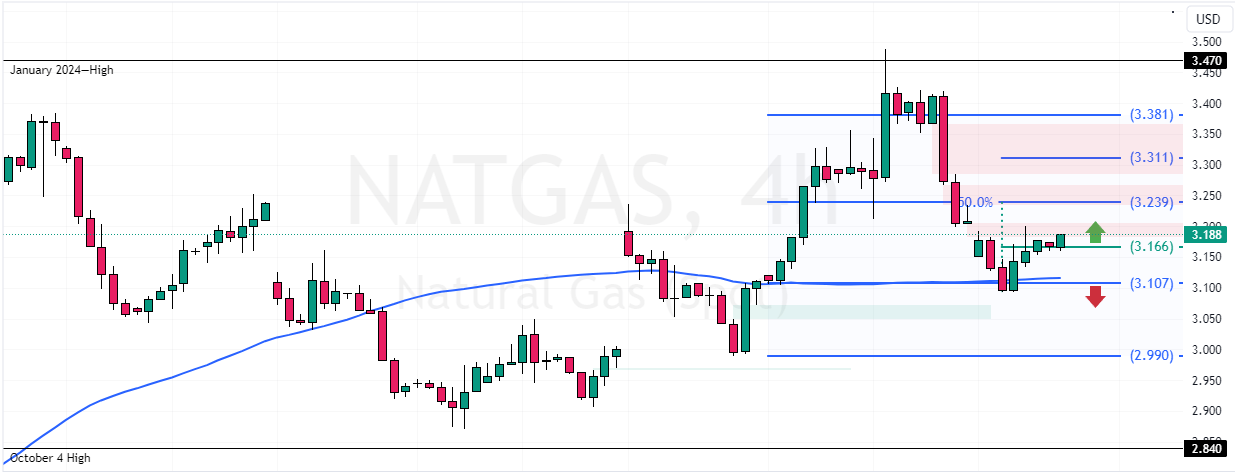

U.S. natural gas bounced from $3.1, hinted by Stochastic’s overbought signal. If prices hold above $3.1, the next bullish target could be $3.24.

Furthermore, the uptrend would escalate if NATGAS exceeds $3.24. In this scenario, $3.38 could be revisited. Please note that the bullish outlook should be invalidated if prices dip below $3.1.

NATGAS Analysis – 17-December-2024

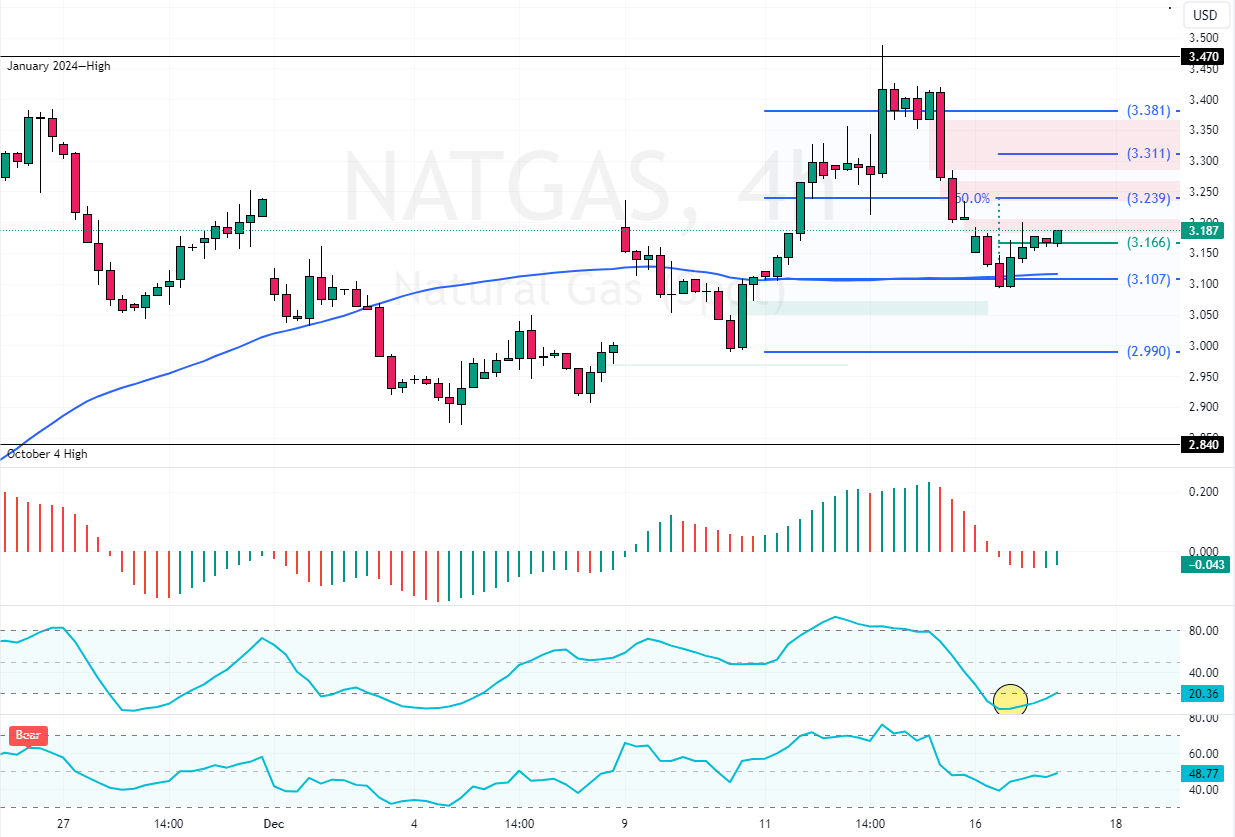

The primary trend should be considered bullish because the prices exceed the 75-period simple moving average. The current uptick in momentum was anticipated because Stochastic was hinting at an oversold market.

NATGAS trades at approximately $3.17 as of this writing, rising toward the 50.0% Fibonacci resistance level at $3.23.

As for the technical indicators, the Awesome Oscillator histogram is green but below zero, which means the bear market weakened. Additionally, the Stochastic and RSI 14 depict 19 and 47 in the description, respectively, and are rising.

Overall, the technical indicators suggest the primary trend is bullish and should resume.

Bullish Run to $3.38 Possible

The immediate support is at $3.16. From a technical perspective, the uptrend will likely resume if NATGAS prices remain above this level. In this scenario, the next bullish target could be the 50.0% Fibonacci resistance level at $3.23.

Furthermore, if the buying pressure exceeds $3.23, the bull’s path to $3.31 will likely be paved.

The Bearish Scenario

Please note that the bullish outlook should be invalidated if NATGAS prices dip below $3.10. If this scenario unfolds, the commodity in discussion can dip toward $2.99.