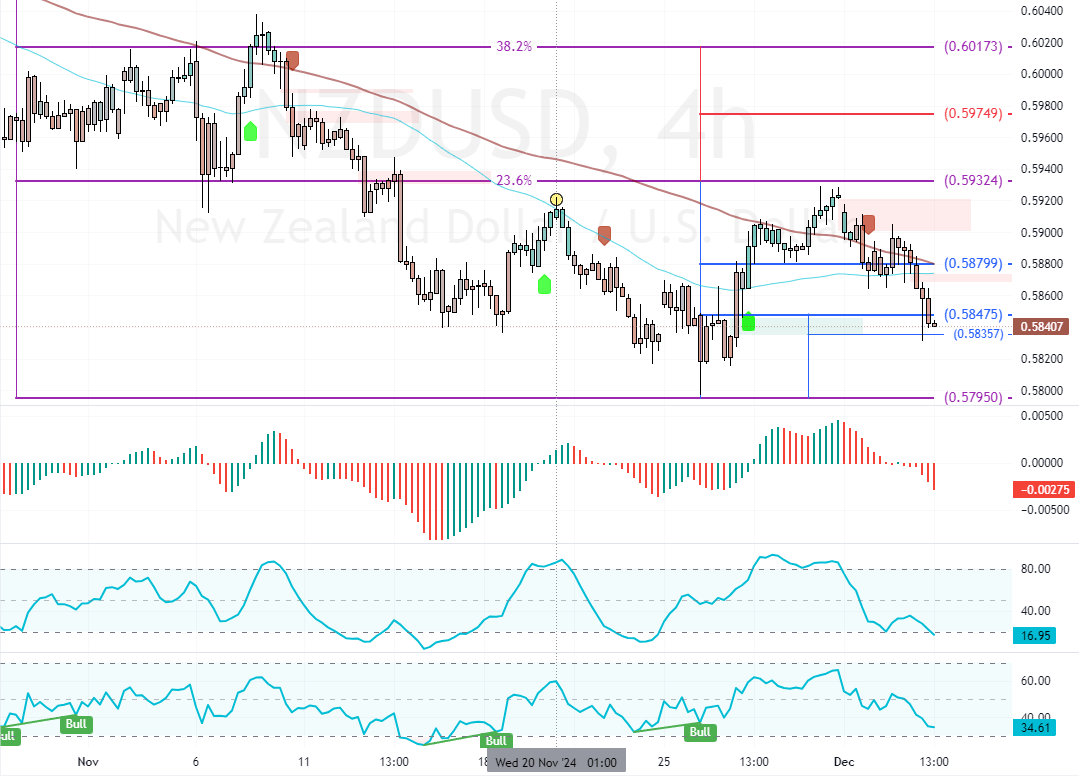

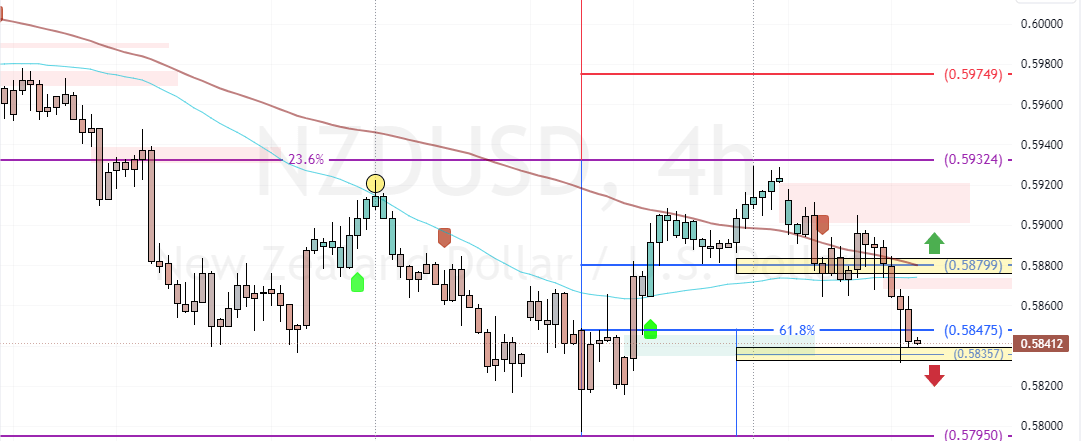

FxNews—The New Zealand dollar trades bearish against the American dollar. The current downtrend began from the 23.6% Fibonacci, hinted at by a long upper shadow candlestick pattern. Later, the Lorentzian Classification indicator signaled sell, adding credibility to the bear market.

As of this writing, NZD/USD trades at approximately 0.584, stabilizing below the 61.8% Fibonacci support level.

Dollar Overpriced as Stochastic Hits Oversold

As for the technical indicator, the Stochastic Oscillator stepped into the oversold territory, depicting 17 in the description. This means the US dollar is overpriced, at least in the short term. On the other hand, the Awesome Oscillator bars are red, below the signal line, indicating the downtrend should prevail.

Overall, the technical indicators suggest the primary trend is bearish and should resume after a minor consolidation.

NZDUSD Eyes November Low if Bears Break $0.583

The immediate support is at $0.583. If bears push the prices below this support, the downtrend will likely extend to a lower level. In this scenario, the next target could be the November low at $0.579.

- Also read: GBPJPY Up by %0.6 Amid Bearish Outlooks

Please note that the market outlook remains bearish as long as NZD/USD is below the 100-period simple moving average or the $0.587 mark.