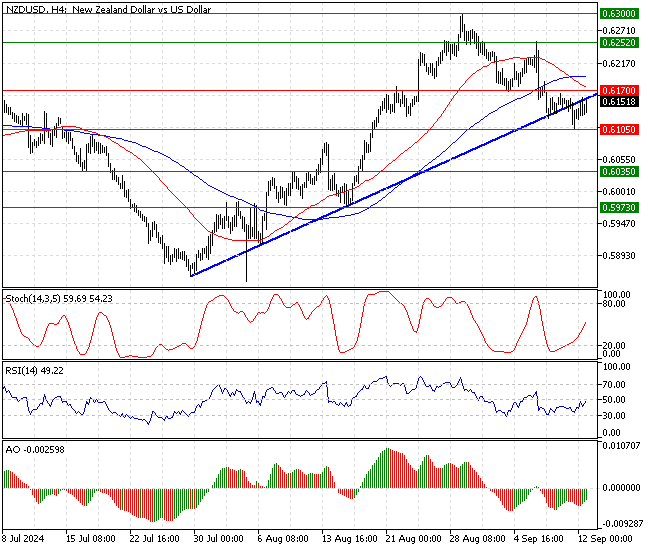

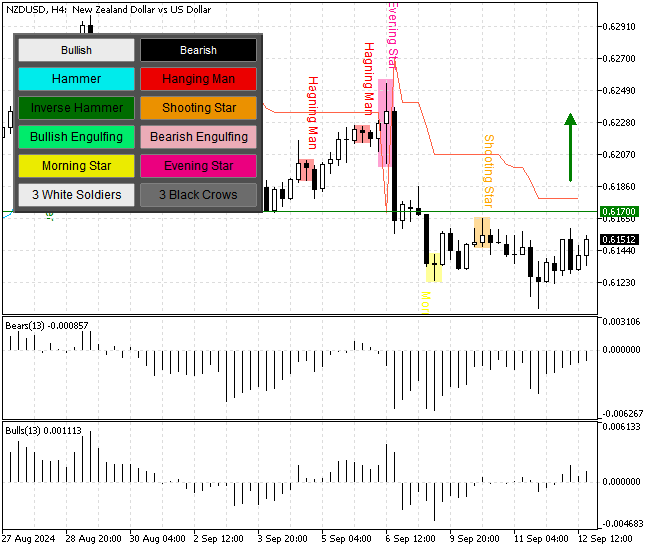

FxNews—The New Zealand dollar trades in a bear market at about $0.614 against the American currency. In today’s trading session, the pair tested the broken ascending trendline and the $0.616 resistance. As of this writing, the NZD/USD currency pair floats slightly below the September 10 High, the $0.616 immediate resistance.

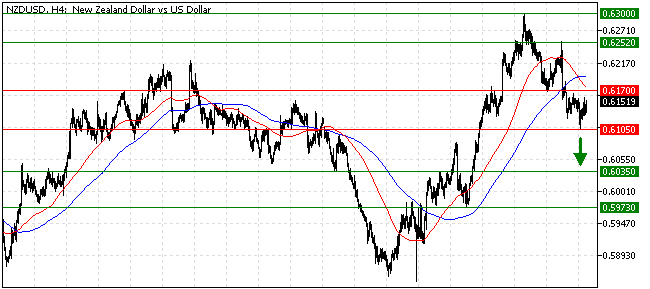

The 4-hour chart below demonstrates the price, key support and resistance levels, and indicators used in today’s analysis.

NZDUSD Technical Analysis – 12-September-2024

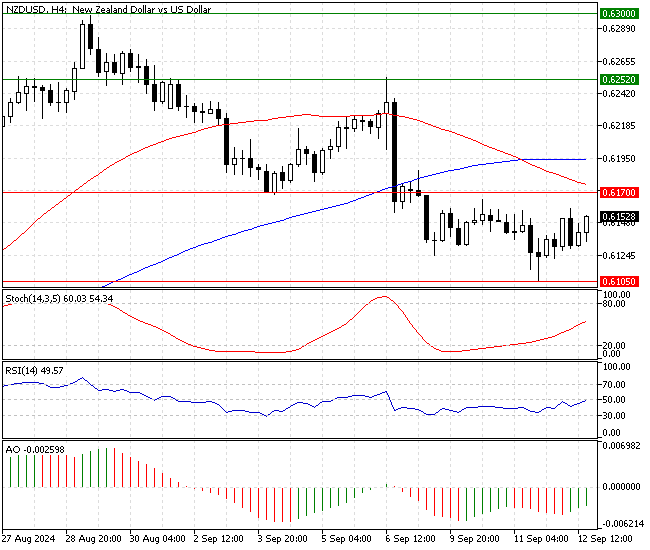

The currency pair’s price is below the 50- and 100-period simple moving averages, which suggests a bearish primary trend. However, the technical indicators indicate that the bear market is weakening.

- The Awesome oscillator formed a bullish twin peak pattern. The bars are green and approaching the signal line. This development in the Awesome oscillator histogram suggests the trend can potentially reverse.

- The stochastic oscillator shows 53 in the value and is increasing. This means the NZD/USD is not overbought, and the current uptick in momentum can resume.

- The relative strength index is below the median line, showing 48 in the description. Interestingly, a divergence signal in the RSI 14 in the 4-hour chart inclines a trend reversal pattern.

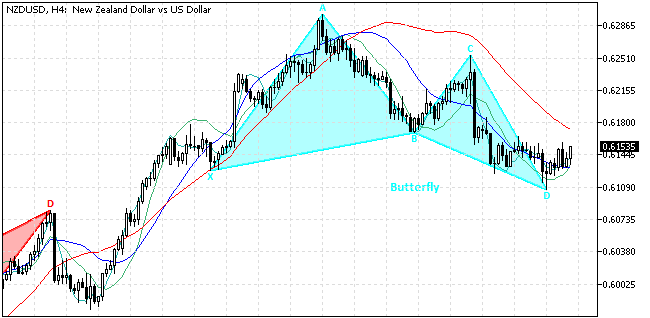

As for the harmonic pattern, the 4-hour chart formed a bullish butterfly pattern, signifying the market could shift from a downtrend to an uptrend.

Overall, the technical indicators suggest the primary trend is bearish, but New Zealand dollar buyers have the potential to shift the market from bearish to bullish.

NZDUSD Forecast – 12-September-2024

Despite the primary trend, which is bearish, multiple signals from the harmonic pattern and the technical indicators point to a trend reversal.

That said, the immediate resistance for the bulls lies at $0.617 (September 04 Low). The NZD/USD uptick momentum from yesterday’s $0.610 low will likely extend to $0.6252 (September 06 High) if the bulls (buyers) close and stabilize the price above $0.617. Furthermore, if the buying pressure exceeds $0.652, the next resistance area will be the August 2024 high at $0.6300.

Please note that the critical support for the current bullish wave rests at $0.610. The bullish scenario should be invalidated if the price falls below $0.610.

NZDUSD Bearish Scenario – 12-September-2024

The immediate support is the September 11 low at $0.610. The downtrend will likely resume if the bears (sellers) close and stabilize the price below $0.610.

If this scenario unfolds, the next bearish target will be ($0.603), the August 09 High. Furthermore, if the price dips below $0.603, the bear’s road to the August 15 low at $0.597 will be paved.

NZDUSD Support and Resistance Levels – 12-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.610 / $0.603 / $0.597

- Resistance: $0.617 / $0.625 / $0.630

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.