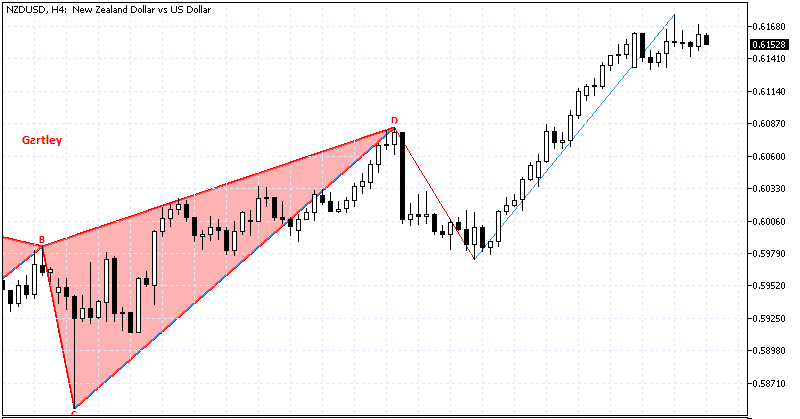

The New Zealand dollar struggles to stabilize above the July 8 high of $0.615 against the U.S. Dollar. The NZD/USD 4-hour chart below demonstrates the price, key support and resistance levels, and the technical indicators utilized in today’s analysis.

NZDUSD Technical Analysis – 22-August-2024

The primary trend is bullish because the price is above the 50 and 100-period simple moving averages. The technical indicators suggest a consolidation phase might be on the horizon.

- The awesome oscillator bars are red but above the signal line, meaning the bull market is losing momentum.

- The relative strength index value is 69, which is almost overbought, signaling that the New Zealand dollar is overpriced.

- The stochastic oscillator stepped outside the overbought territory, depicting 72 in the description, signifying sell.

Meanwhile, the NZD/USD 4-hour chart formed a shooting star candlestick, a bearish signal. Overall, the candlestick pattern and the technical indicators suggest the primary trend is bullish, but the currency pair’s price could dip to fill the gap between the August 18 high and July 18 high.

NZDUSD Forecast – 22-August-2024

The primary resistance rests at $0.615. From a technical perspective, if the price stabilizes itself above this level, the uptrend will likely resume, and the next bullish target could be the June 12 high at $0.622.

Please note that the bullish outlook will remain valid if the price remains above the August 18 high at $0.608. A dip below this support area will invalidate the bullish scenario,

- Also read: GBP/USD Technical Analysis – 22-August-2024

NZDUSD Bearish Scenario – 22-August-2024

The key resistance level for the bull market is at the August 18 high, the $0.608 mark. If the bears close and stabilize below $0.608, the next supply zone will be the August 9 high at $0.603.

Furthermore, if the selling pressure exceeds $0.603, the next support level will be the August 15 low at $0.597.

NZDUSD Support and Resistance Levels – 22-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.608 / 0.603 / 0.597

- Resistance: 0.622

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.