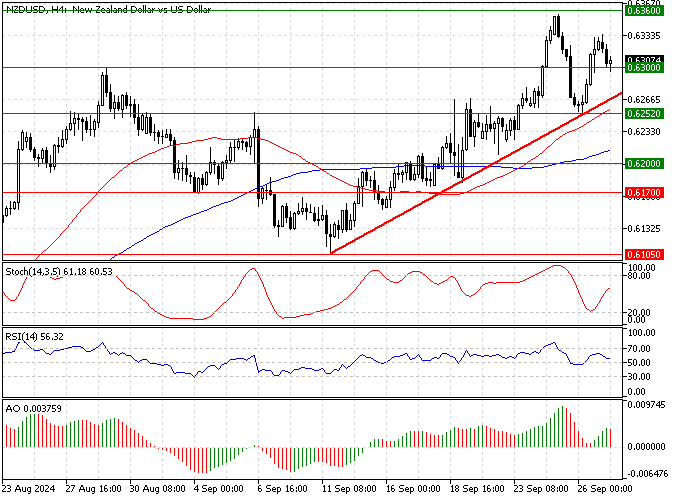

FxNews—The New Zealand dollar is in an uptrend against the U.S. dollar, trading above the 50- and 100-period simple moving averages. As of this writing, the NZD/USD pair trades at approximately $0.63, testing the September 29 high.

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

NZDUSD Technical Analysis – 27-September-2024

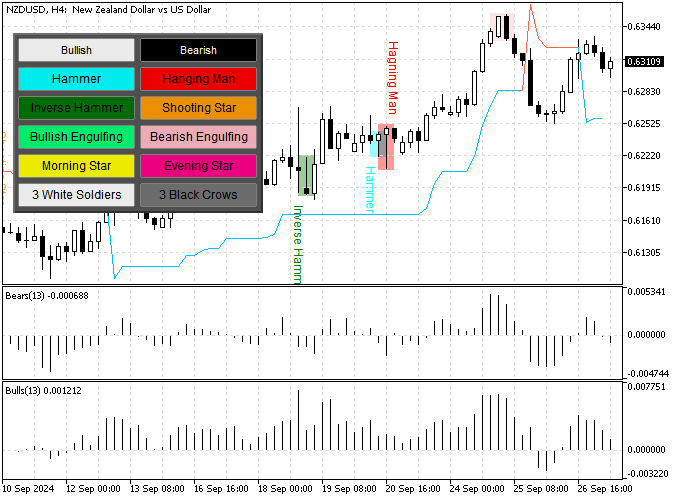

The currency pair returned above the Supertrend indicator yesterday’s trading session and started a minor consolidation phase today.

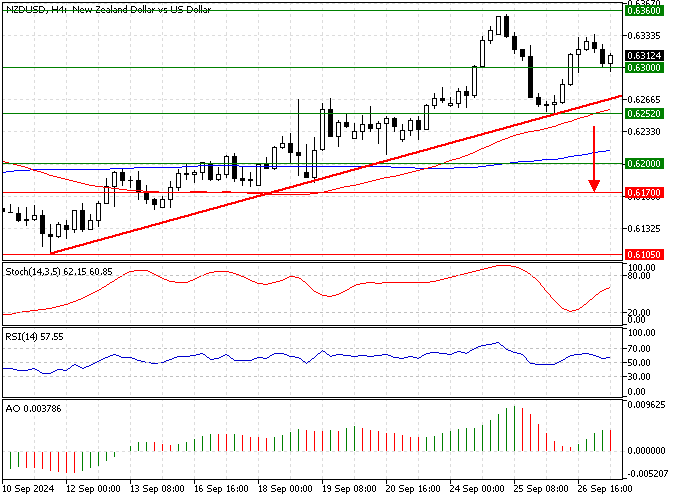

The ascending trendline, which coincides with the $0.625 support, the September 26 low, is the primary support for the current bull market.

NZD/USD Forecast

From a technical perspective, if the NZD/USD price holds above the $0.625 support, the uptrend will likely resume. If this scenario unfolds, the bull’s initial target could be the September 25 high at $0.636.

Furthermore, if the buying pressure results in the price exceeding $0.636, the next bullish target could be the July 14 high at $0.641.

NZD/USD Bearish Scenario

If the bears (sellers) push the NZD/USD price below $0.625, the consolidation phase that began at $0.636 can potentially spread to $0.620, a supply zone neighboring the 100-period simple moving average.

Furthermore, if the decline drives the market price below $0.620, the next support level will be $0.617, followed by the September 11 low.

Please note that the bull market should be invalidated if the NZD/USD price falls below the 100-period SMA.

NZDUSD Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.63 / $0.625 / $0.62 / $0.610

- Resistance: $0.636 / $0.641