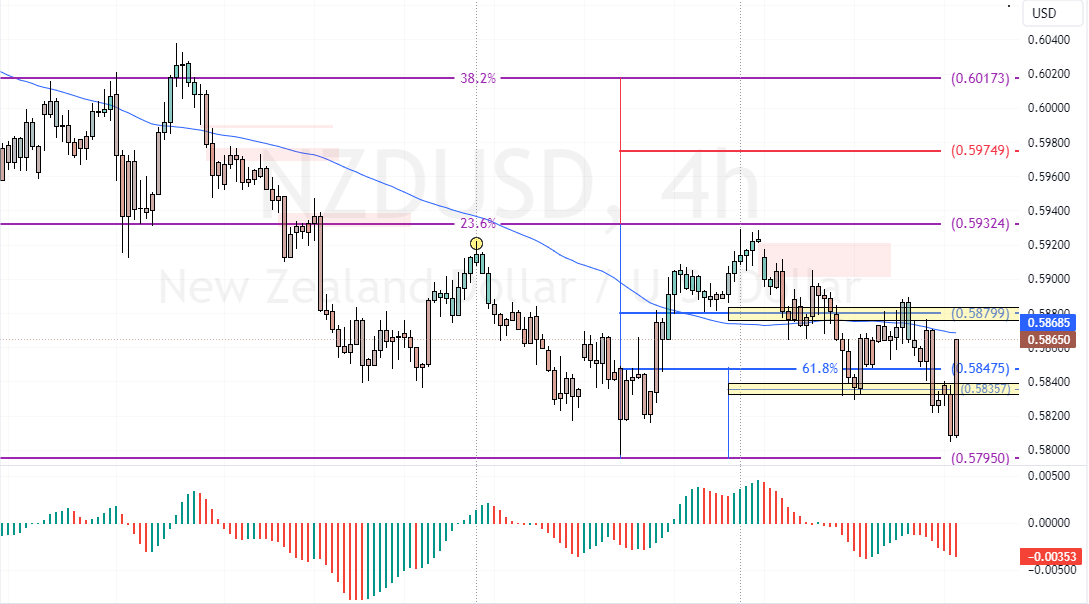

The NZD/USD currency pair remained below the 50-period simple moving average at approximately $0.586. This followed a sharp drop in the previous session, reflecting pessimistic market sentiment and ongoing policy adjustments.

- NZ dollar trading near $0.586

- Nearly 1% drop in the previous session

- Investors watching for growth signals

Prime Minister’s Plan to Ease Pressure

New Zealand’s Prime Minister has promised to reduce inflation and interest rates. This promise aligns with the Reserve Bank’s recent moves to cut its benchmark rate. Policymakers hope that these steps will steady the economy and reassure businesses.

- Also read: EURUSD Near 1.056 as Macron Plans Budgets

Global Factors Add More Uncertainty

Beyond local policies, external parties also weigh on the Kiwi. China’s lingering deflationary pressures raise worries since it is New Zealand’s top trading partner. Meanwhile, upcoming U.S. inflation data may explain the Federal Reserve’s next steps, influencing global sentiment and currency markets.