FxNews—WTI crude oil futures dipped below $70 per barrel last Friday, marking the biggest weekly drop in over a month. Worries about the future demand and an expected excess supply drove this decline.

Recently, the International Energy Agency (IEA) revised its demand forecasts downward, suggesting a possible worldwide surplus. At the same time, OPEC has reduced its demand estimates for the third month, mainly attributing this to reduced demand from China.

China’s Economic Policies Affect Oil Demand

The Chinese government’s recent briefing on housing policies did not meet market expectations, further deepening concerns about demand in the world’s top oil-importing country. This has added to the downward pressure on oil prices.

Middle East Tensions Influence Oil Market

The situation in the Middle East also continues to influence the oil market. Last Thursday, it was confirmed that Yahya Sinwar, a prominent leader in Hamas, was killed in combat, which has heightened concerns about regional conflicts.

While Israel has indicated that it will not target Iranian oil facilities, the ongoing airstrikes add to the uncertainties in the region. Despite these challenges, oil prices were supported by an unexpected reduction in U.S. oil inventories.

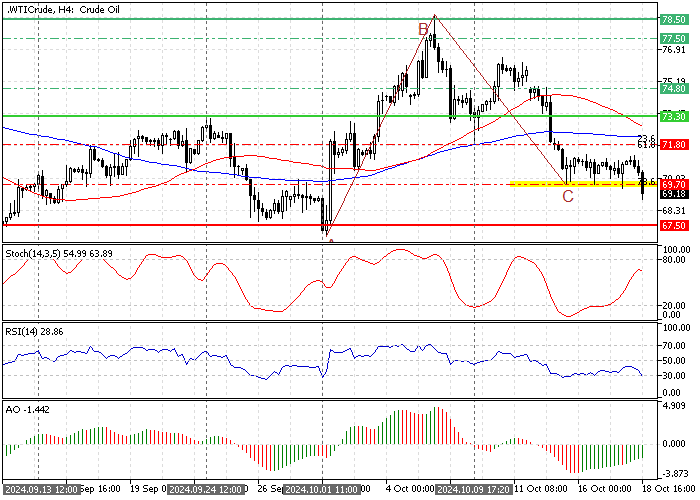

Crude Oil Technical Analysis – 18-October-2024

FxNews—Crude Oil bears broke the $69.7 critical resistance in the current trading session. This development in the price chart will likely result in the Oil price dipping further. In this scenario, the next bearish target will likely be the $67.5 resistance at $67.5.

Please note that the immediate resistance rests at $71.8, backed by the 100-period simple moving average. The bearish outlook should be invalidated if the price exceeds the 71.8$ mark.